Merlin Chain [MERL], the Bitcoin [BTC] layer-2 solution, has recorded a notable increase in on-chain activity over the past day, even as Bitcoin’s price remains largely range-bound.

The asset rallied sharply, gaining 16%, at press time, while the number of token holders climbed to 173,800. Although performance appears decisively bullish, signs of a potential price pullback still loom within the broader market structure.

Liquidity boom lifts price

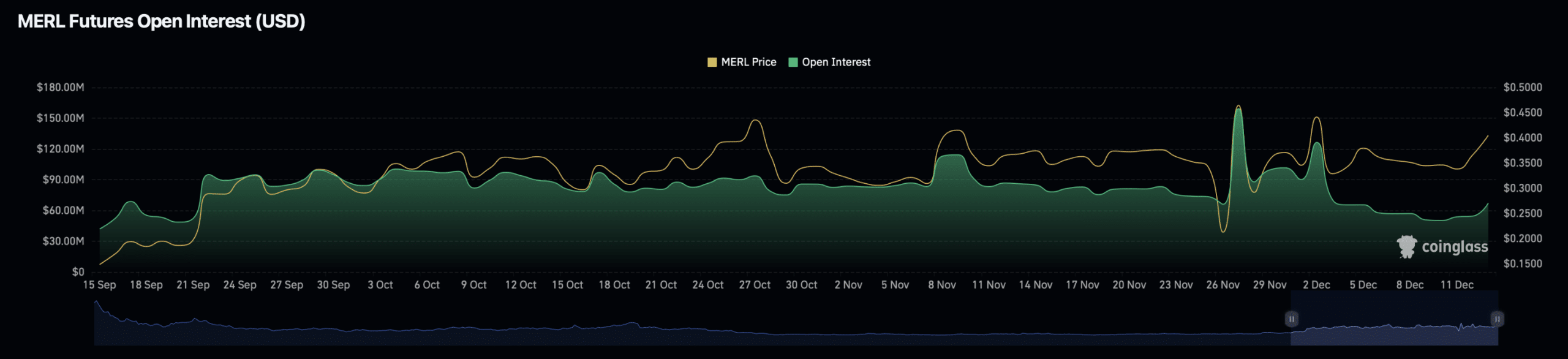

The recent surge in MERL price can be largely attributed to a sharp liquidity inflow across the derivatives market.

MERL perpetual Open Interest (OI), a metric that reflects the total value of outstanding derivative contracts and overall market liquidity, has climbed to a new all-time high of $75.79 million, as of writing.

Notably, this spike highlights the bullish sentiment currently circulating in the market. OI reached this level after expanding by approximately $27 million within a single day.

Source: CoinGlass

Such a large one-day inflow typically includes positions from both long and short traders. In this instance, trading data indicates that long positions dominate market activity.

Trading volume has also turned decisively positive, with the taker Buy/Sell Ratio reaching 1.05. This reading suggests that taker buy orders are leading cumulative volume, reinforcing short-term bullish pressure.

Spot investors step in

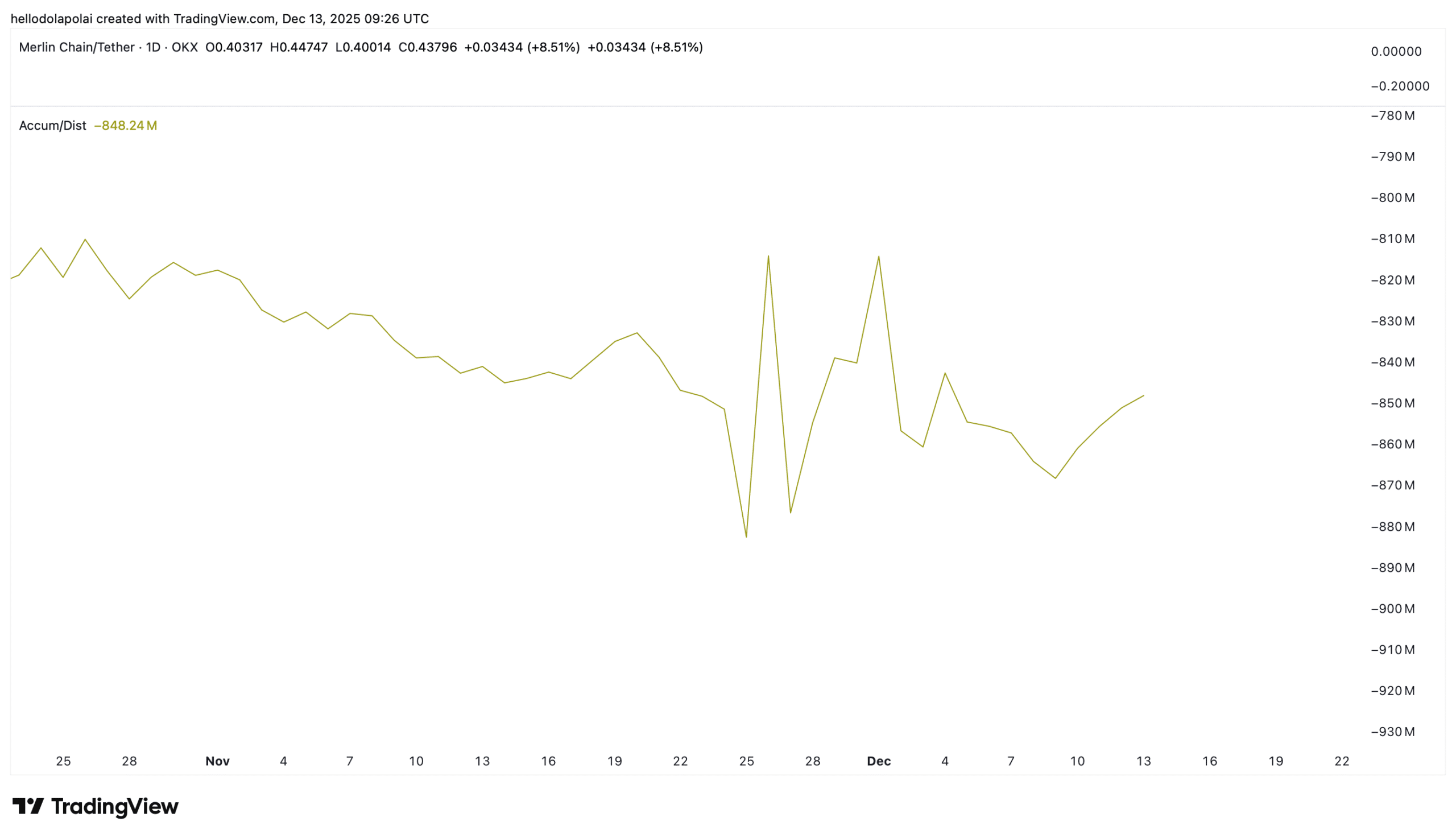

Spot market participants have also continued to accumulate MERL, helping to restrict available supply.

In context, exchange outflows remain relatively modest, with roughly $700,000 worth of MERL withdrawn from centralized platforms over the past day.

On its own, this level of outflow does not strongly confirm a bullish market structure, as the amount remains comparatively small.

However, sustained accumulation alongside consistent net outflows increases the likelihood that MERL maintains its upward trajectory, as bullish investors view current levels as an attractive entry point.

Source: TradingView

Notably, the accumulation/distribution indicator has ticked higher, pointing to stronger buying pressure relative to selling. That said, the indicator remains in negative territory.

This negative reading suggests that recent buying has yet to fully offset the heavier selling pressure observed over the past week, which contributed to the prior decline.

Risk of a pullback?

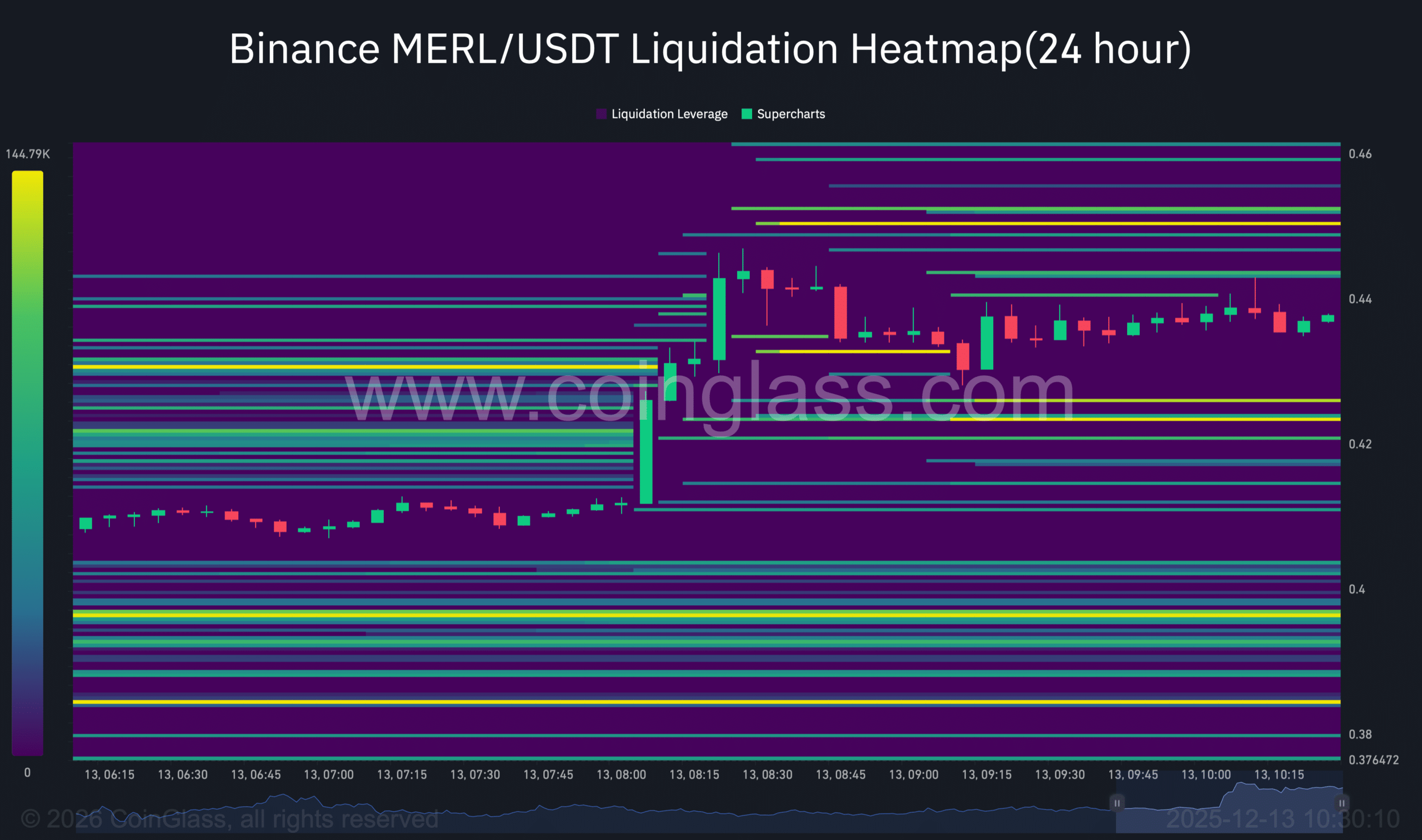

Despite recent gains, MERL still shows downside risk, as indicated by the liquidation heatmap.

This tool highlights liquidity concentrations above and below the current price to signal potential moves. Liquidity positioned above often draws prices upward, while clusters below suggest possible declines as the market moves to fill those levels.

Source: CoinGlass

Currently, MERL’s rally has pushed the price higher, clearing major liquidity zones above. As a result, most liquidity clusters now sit below the current trading range.

Based on classical market behaviour, this setup increases the possibility of a short-term pullback. However, such outcomes are not guaranteed.

One key exception emerges when bullish momentum continues to strengthen, allowing price to defy typical liquidity-driven retracements.