Uphold is an all-in-one, multi-asset trading platform that offers more than just cryptocurrency trading. Users can easily trade not only cryptocurrencies but also stocks, commodities, and fiat currencies. With features like instant conversions, a clean and intuitive interface, and unique offerings such as a crypto debit card, Uphold provides flexibility and convenience for both casual traders and serious investors. Whether you’re buying Bitcoin, trading precious metals, or diversifying into forex, Uphold’s simple yet powerful tools make it easy to manage all your investments in one place.

In this review, we’ll explore its features, fees, security, and overall user experience, while comparing it with major exchanges like Coinbase and Binance to help you decide if it’s the right platform for you.

Uphold Overview – What Is Uphold?

Founded in 2014 by Halsey Minor, Uphold is one of the oldest crypto platforms in the market. Initially named Bitreserve, it focused on providing a Bitcoin storage solution with an evolving API. In 2025, Bitreserve rebranded to Uphold, marking the transition to a more robust digital asset platform. Uphold is a global cryptocurrency ecosystem serving over 10 million users across 140+ countries, offering 300+ cryptocurrencies, forex, and precious metals like gold and silver. It supports fiat payments in USD, EUR, and GBP, making it beginner-friendly while also catering to institutional investors.

The platform provides staking rewards with APYs up to 14%, 4.4% interest on USD balances (2% on balances under $1,000), and early access to cryptocurrencies that are new to the market. Uphold ensures security with real-time proof of reserves and a commitment to never loan client funds, offering a transparent and compliant trading experience. The platform is also very accessible, with investors being able to trade via web and a mobile app.

Recently, Uphold has made some changes to its staking oservice. Users can now stake several different Proof-of-Stake assets, and rewards are paid out weekly. The rates vary depending on the specific asset and the demand on the network, but the process remains simple and beginner-friendly. You choose the coin, commit it to staking, and Uphold handles the technical side while passing the rewards back to you.

Uphold Products and Services

Trading

As we mentioned earlier in our Uphold review, the platform provides early access to new tokens by connecting to 30 trading venues, including centralized and decentralized exchanges and Layer 2 networks, while enabling one-step trading between any two assets. The platform also offers retail traders essential features like automatic recurring trades, built-in wallet storage, limited stop orders, and fast deposits with 0% deposit and withdrawal fees.

Uphold’s tools such as take-profit and trailing stop-loss features help manage risk by automatically selling assets at predefined thresholds. Additionally, Uphold’s AutoPilot feature uses dollar-cost averaging (DCA) to reduce volatility, supported by a DCA calculator and automatic recurring trades, making it a practical and versatile choice for traders.

Uphold Vault

The Vault is Uphold’s new assisted self-custody solution, providing enhanced security for digital assets through a multi-signature framework. Your crypto can only be moved using your personal Vault key and a backup key, with Uphold offering assisted key replacement services and 24/7 instant trading access.

In simple terms, you hold two keys, while Uphold keeps one, which means you stay in control but still have a safety net if you ever lose access.

Currently, the Vault supports only Bitcoin and XRP, but they plan to expand to other networks in 2025. For now, other assets can be stored in Uphold’s full custody or traditional self-custody wallets.

This secure self-custody solution uses a 2/3 multi-signature wallet, where you control two keys, and Uphold holds one. It ensures your crypto remains safe, accessible, and protected by a key replacement service, offering Bitcoin and XRP holders peace of mind.

At the moment, Vault works with Bitcoin, XRP, Hedera (HBAR), and a few XRPL tokens like CORE, SOLO, and RLUSD. It comes with a subscription cost of $4.99 per month or $49.99 a year, and as with any blockchain transaction, network fees apply when you move funds in or out.Alongside Vault, Uphold now also offers the UPHODL wallet, a non-custodial Web3 wallet that puts the private keys in your hands. It supports multiple blockchains, including Bitcoin, Ethereum, ERC-20 tokens, and even NFTs, giving you a lot more flexibility if you want to explore the Web3 space.

Staking

Uphold is an excellent choice for long-term investors looking to earn passive income through cryptocurrency staking, offering competitive annual percentage yields (APYs) on a variety of top-staking coins. High-yield options include Cosmos (13.8%), Polkadot (10.4%), and Casper (10%), while Solana and Tezos provide solid returns at 8% and 4.8%, respectively. On the other hand, Ethereum staking rewards align with the market average at 3.55%, though Cardano yields are lower at 1.96%.

Based on our and many other Uphold reviews, the process is straightforward and user-friendly, whether using the desktop or mobile platform. Investors simply select the desired staking coin and confirm their choice, and rewards are automatically distributed to their Uphold Vault wallet in the respective cryptocurrency.

Interest on USD Balances

Uphold offers a competitive USD Interest Account, paying a 4.40% APY on balances of

$1,000 or more ($21,000), with no monthly fees or lock-up terms. This feature is ideal for those who sell cryptocurrency and want to hold proceeds in an interest-bearing account before reinvesting. USD balances are held in FDIC-insured bank accounts, providing security and flexibility for seamless fund allocation. The account is also accessible to everyone, requiring only a $1 minimum deposit and charging no monthly fees.

The USD Interest Account is a brokerage account offered by Atomic Brokerage LLC, a member of FINRA/SIPC, and is part of the Atomic Brokerage Cash Sweep Program. While SIPC does not protect cash deposited solely for the Cash Sweep Program, funds swept to participating banks are FDIC-insured up to $2,500,000 ($250,000 per depositor, per insured bank). Note that rates are subject to change, and funds held directly in the Atomic Brokerage account are not FDIC-insured.

Uphold Card

Uphold provides clients with a Mastercard-issued debit card that connects directly to a user’s Uphold account, allowing them to spend cryptocurrency seamlessly in the real world. When purchasing, funds are automatically converted from crypto to the local currency and settled instantly with the retailer—without the merchant even knowing crypto was used. The card is especially useful for travelers, as it supports multiple global currencies with no foreign transaction fees and can also be used at ATMs.

Users can also create a virtual card, which is ideal for online shopping, especially with unfamiliar merchants. The Uphold card app is available on both Android and iOS, making digital payments even more convenient. While applying for the card is free, shipping fees apply. However, one downside is that, unlike some competing Bitcoin debit cards, Uphold does not offer cashback rewards.

Business Account

Uphold’s Business Account enables companies to securely and instantly transfer assets to employees and partners worldwide. It offers free asset storage, robust data protection, and low-cost conversions between currencies and precious metals, making it a practical solution for global transactions.

The account also includes know-your-customer (KYC) verification, anti-money laundering (AML) measures, and financial risk controls, ensuring compliance and security for every transaction.

Educational Materials

The Uphold Academy provides access to a comprehensive suite of educational resources designed to help users navigate the complexities of cryptocurrency and blockchain technology. The curriculum is divided into Beginner, Intermediate, and Advanced courses, covering topics such as blockchain fundamentals, consensus mechanisms, and sophisticated trading strategies. Each course is divided into concise lessons, making it easier for users to grasp complex concepts at their own pace.

Beyond the core courses, Uphold Academy provides specialized content on Uphold’s proprietary tools and services, such as Topper, a fiat-to-crypto onramp, and insights into Uphold Institutional, which supports institutions in the digital asset economy.

Uphold Fees & Commissions – Is Uphold Good for Pricing?

Almost every Uphold exchange review closely examines trading and non-trading fees, so let’s see whether the platform offers competitive pricing.

Trading Fees

Uphold’s trading commissions vary based on market conditions, but the platform provides estimated rates depending on the asset. Bitcoin and Ethereum trades typically incur a commission of 1.4% to 1.6%, which is comparable to major exchanges like Coinbase and Gemini. While this pricing is higher than some non-US platforms, many of those alternatives lack regulation and do not accept US customers. For other altcoins (excluding stablecoins), trading commissions range from 1.9% to 2.95%. These fees are not separately displayed but are instead built into the quoted exchange rate, which remains valid for 18 seconds before refreshing.

Stablecoins are the most cost-effective asset to trade on Uphold, with commissions averaging just 0.25%, the same rate applied to major currency trades. However, precious metals carry higher fees, typically ranging from 1.9% to 2.95%. Additionally, a $0.99 fee applies to trades under $500, which is important for users considering smaller transactions.

| Traded Asset | Average Trading Fee |

| Bitcoin and Ethereum | 1.4% – 1.6% |

| Stablecoins | 0.25% |

| Other Altcoins | 1.9% – 2.95% |

| Forex | 0.25% |

| Precious Metals | 1.9% – 2.95% |

Non-Trading Fees

Deposit and withdrawal fees on Uphold vary by country and payment method, similar to many cryptocurrency exchanges. US clients benefit from fee-free ACH deposits, while standard ACH withdrawals are also free—though instant payouts come with a 1.75% fee. Deposits made via debit cards and Google/Apple Pay are free for US users, while credit card deposits incur a 3.99% fee. In the UK and Europe, local bank transfers, debit cards, and Apple/Google Pay deposits are also fee-free, and unlike in the US, credit card surcharges are waived.

For cryptocurrency transactions, Uphold does not charge deposit fees, but withdrawals incur network-based costs that vary by asset. For example, withdrawing Bitcoin costs 0.000075 BTC, while Litecoin withdrawals require 0.0008 LTC. Ethereum withdrawals, on the other hand, are subject to the real-time gas fee, which fluctuates based on network activity.

Supported Cryptocurrencies

Uphold is one of the first platforms to support Ethereum and Litecoin. Uphold supports over 300 cryptocurrencies, including major best coins like Bitcoin, and Solana, as well as 9 stablecoins, highly-rated meme coins like Dogecoin and Shiba Inu, and frequently adds new projects early—such as Magic, which was listed at $0.26 and rose to $0.54 on other exchanges within 35 days. This makes Uphold a strong choice for diversifying across crypto markets and other asset classes to reduce risk.

Other Assets Available on Uphold

Uphold lists the following assets in addition to cryptocurrencies:

Forex

Forex, the largest trading marketplace globally, can be accessed directly on Uphold. Twenty domestic currencies, including majors like USD, GBP, EUR, CAD, and CHF, are supported. Less popular currencies include SGD, PLN, NOK, and MXN.

Precious Metals

Uphold also supports three precious metals: gold, silver, and platinum. These assets are particularly popular during economic turmoil, so it’s convenient that Uphold provides access to them at the click of a button.

Uphold Security – Is Uphold Safe To Use?

Uphold is highly committed to security, making it an excellent choice for users concerned about the safety of their funds. It is registered with FinCEN as a Money Service Business in the US and operates under the UK’s FCA regulations as an Agent of an Electronic Money Issuer. Uphold complies with KYC (Know Your Customer) and anti-money laundering (AML) regulations, ensuring full adherence to important legislation like the Bank Secrecy Act. The platform also employs 24/7 risk management teams to monitor transactions, and users are strongly advised to enable two-factor authentication (2FA) for extra protection.

With these security measures in place, many users ask, “Is Uphold a good exchange for security?” The platform sets itself apart with real-time proof of reserves, updating every 30 seconds to confirm that all client funds are backed 1:1 by live assets. Uphold’s reserves currently total nearly $2.7 billion, spread across fiat currencies, precious metals, and cryptocurrencies, ensuring financial stability. Thanks to its strict regulatory compliance, transparency, and advanced security protocols, Uphold remains a trusted platform for those prioritizing safety.

Uphold Customer Support

As reported by other Uphold reviews, customer support could be approved. This is because neither live chat nor telephone assistance is offered. Instead, users must create a support ticket and wait for a reply.

That said, I found most account queries, such as payments and technical issues, can be resolved from the ‘Help’ section. Simply search for the keyword and a help document should appear.

Uphold Exchange Availability

While Uphold isn’t very favorable for fees, it does offer a user-friendly experience. Beginners will find the platform simple to use, even when buying cryptocurrency for the first time.

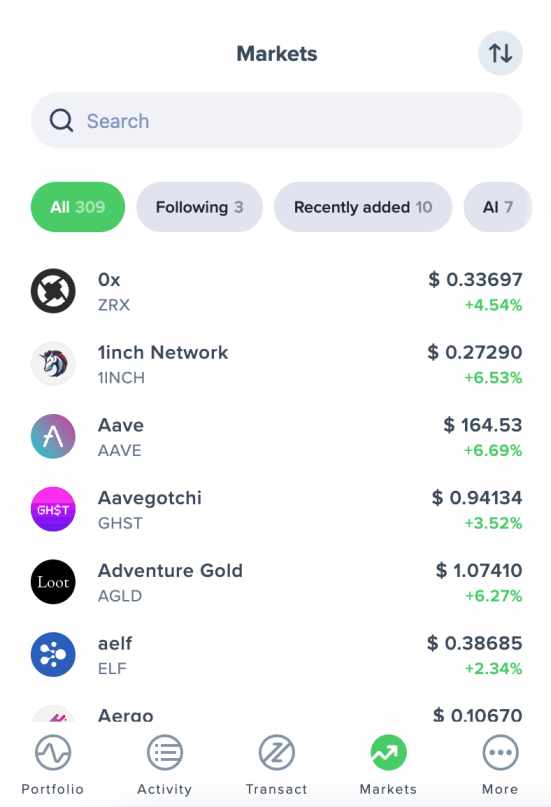

Uphold Mobile App Experience – Is Uphold User-Friendly?

Uphold’s app is free to download on Android and iOS. A QR code is displayed on the desktop website, taking users straight to the download link. Opening the app immediately asks the user to open an account or log in. New customers will find the sign-up process seamless.

As a regulated platform, Uphold requires basic personal details, including name, nationality, and date of birth, along with a government-issued ID—though this step can be completed later. However, deposits are only available after KYC verification. If you are looking for exchanges that don’t require KYC, it’s best to check other options.

Once set up, users can browse categorized markets, such as DeFi, DAO, Gaming, Smart Contracts, and Metaverse, or use the search function for specific assets. Buying assets is straightforward—simply enter an amount in local currency and confirm, and the crypto is instantly added to the account balance.

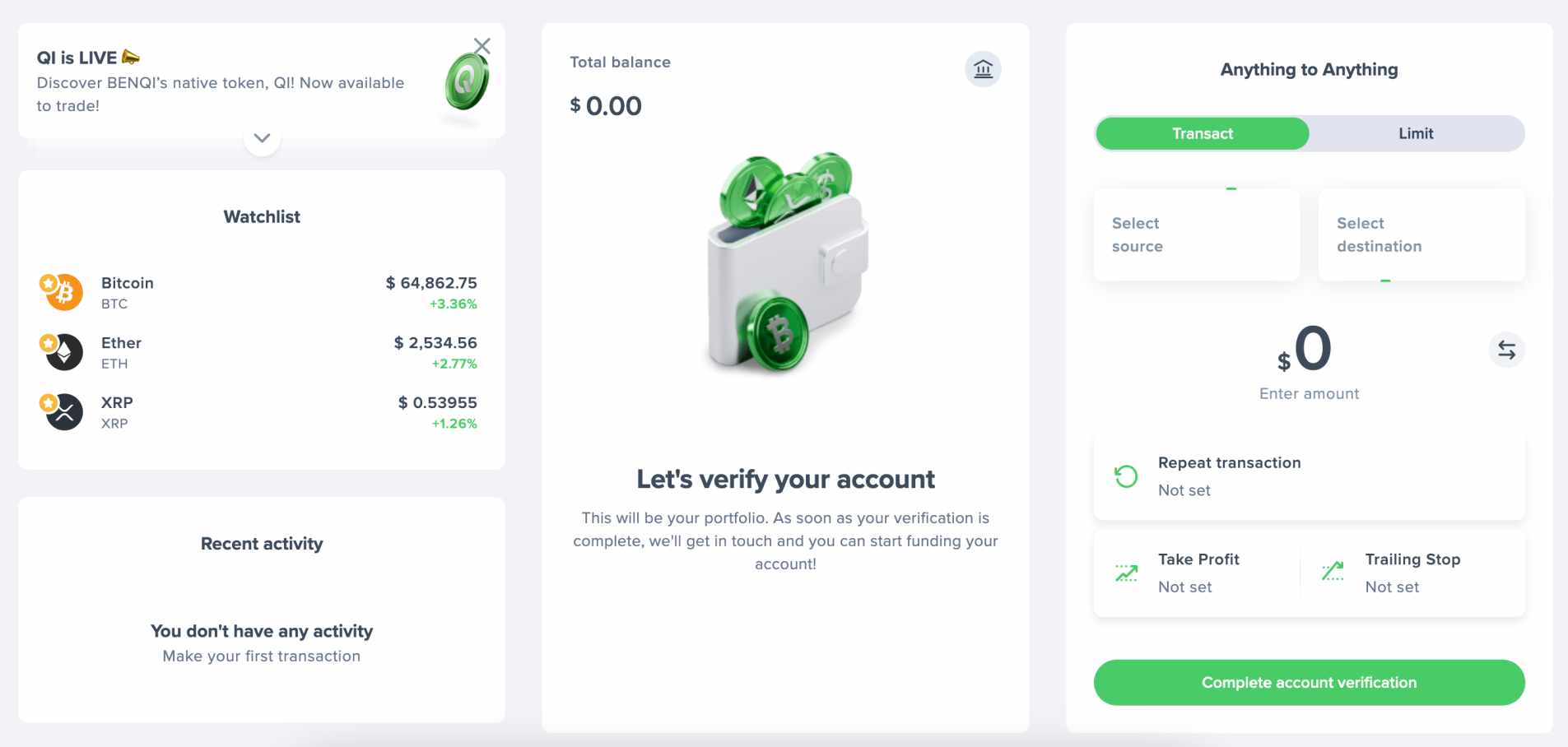

Desktop Experience

The desktop experience is even smoother. Users can access their accounts by visiting the Uphold website and logging in. The desktop dashboard is split into three segments. To the left is the markets tab. This enables users to find cryptocurrencies and other assets.

The portfolio balance is shown in the middle, while the trading box is on the right. There’s also a side panel for additional features, including earning tools and security preferences.

User Reviews and Common Issues

Many of the Uphold reviews that users give out present a mixed picture. Some of them praise the platform for its user-friendly interface, a wide range of supported assets, and efficient transaction processes. They appreciate the ability to trade various assets, including cryptocurrencies, stocks, and precious metals, all in one place. Additionally, positive feedback highlights the transparency of fees and the real-time proof of reserves, which provide confidence in the platform’s financial stability.

However, users have reported common issues. Some express concerns about account verification delays, which can hinder timely access to trading features. Others mention experiencing slow customer support response times, leading to frustration when urgent assistance is needed. A few users have reported unexpected account restrictions or closures, sometimes without clear explanations, affecting their ability to manage their assets effectively. These concerns suggest that while Uphold offers a robust platform, there is room for improvement in customer service and communication.

Uphold vs. Competing Trading Platforms

Uphold is a leading crypto exchange, but it’s not the only option. This analysis compares Uphold, Coinbase, Binance, and Kraken, evaluating fees, features, availability, and ease of use to determine how they measure up.

Regulation and Compliance

Uphold crypto exchange and ensure it operates according to the guidelines and compliance requirements. It holds licenses from four tier-one regulators, as it is regulated by the FinCen and other state regulators in the USA, as well as the UK’s FCA. On top of that, the exchange is also registered and regulated in Canada by FINTRAC. As for the European market, the Uphold Exchange is registered and licensed in Lithuania by the Financial Crime Investigation Service under the Ministry of the Interior. It also complies with global anti-money laundering regulations while maintaining data protection protocols according to the EU data protection requirements, the Gramm-Leach-Bliley Act, and the regulations imposed by the People’s Republic of China.

Uphold Pros and Cons

My research shows that Uphold comes with the following pros and cons:

Pros

Offers a beginner-friendly way to invest in cryptocurrency

Supports over 300 cryptocurrencies, plus metals and forex

Convenient payment types include debit/credit cards and Google/Apple Pay

Local bank payments are fee-free

Available as a desktop platform or a mobile app

Robust security and 100% proof of reserves updated every 30 seconds

Earn interest on USD balances

Connected to 30+ underlying exchanges (liquidity providers)

No hidden fees

Cons

Trading commissions in line with other insured platforms, but slightly higher than non-US-regulated platforms

Seasoned traders might find the platform too basic for advanced trading

US credit card deposits are charged 3.99%

Doesn’t offer margin trading accounts

How to Get Started With Uphold

Follow the steps below to get started with Uphold in under five minutes:

Step 1: Choose Device Type – First, decide whether you want to use Uphold on the desktop website or mobile app. Both offer a user-friendly experience.

Step 2: Open an Account – Now open an account, providing personal information and contact details when prompted. The provided mobile number and email address must be verified.

Step 3: Complete KYC – Uphold users must complete the KYC process before depositing funds. A government-issued document is needed; hold it to your device camera when prompted. The ID will also need to be placed next to your face. These two steps will verify the account almost instantly.

Step 4: Deposit Funds – You can now make a deposit; choose from a debit/credit card, local bank transfer, or Google/Apple Pay.

Step 5: Search for Asset – Use the search bar to find your preferred asset. This could be a cryptocurrency like Bitcoin or Ethereum. Or an alternative asset class like precious metals or forex.

Step 6: Trade – Finally, type in the investment amount and confirm the market order. You can also deploy limit, stop-loss, and take-profit orders for increased flexibility.

Conclusion: Is Uphold Legit and Should You Trade on It?

After spending some time using Uphold, I can confidently say it has become one of my go-to platforms for trading and managing my investments. I truly appreciate the user-friendly interface as it makes it easy to trade everything from cryptocurrencies to precious metals in one convenient place. The transparent fees and instant conversions are significant advantages, especially when you want to move between different asset types. Also, the ability to earn staking rewards and interest on USD balances adds even more value to the platform.

While customer support could be improved, you should feel secure using Uphold due to its strong security measures and regulatory compliance. It’s a fantastic platform for anyone looking for a comprehensive solution to invest, trade, and diversify. If you’re seeking a straightforward, reliable platform with plenty of features and an easy-to-use mobile app, I would definitely recommend giving Uphold a try.