Hyperliquid has moved to calm growing speculation around recent HYPE token selling, after community members raised concerns that a wallet engaging in aggressive trades might be linked to the project’s internal team.

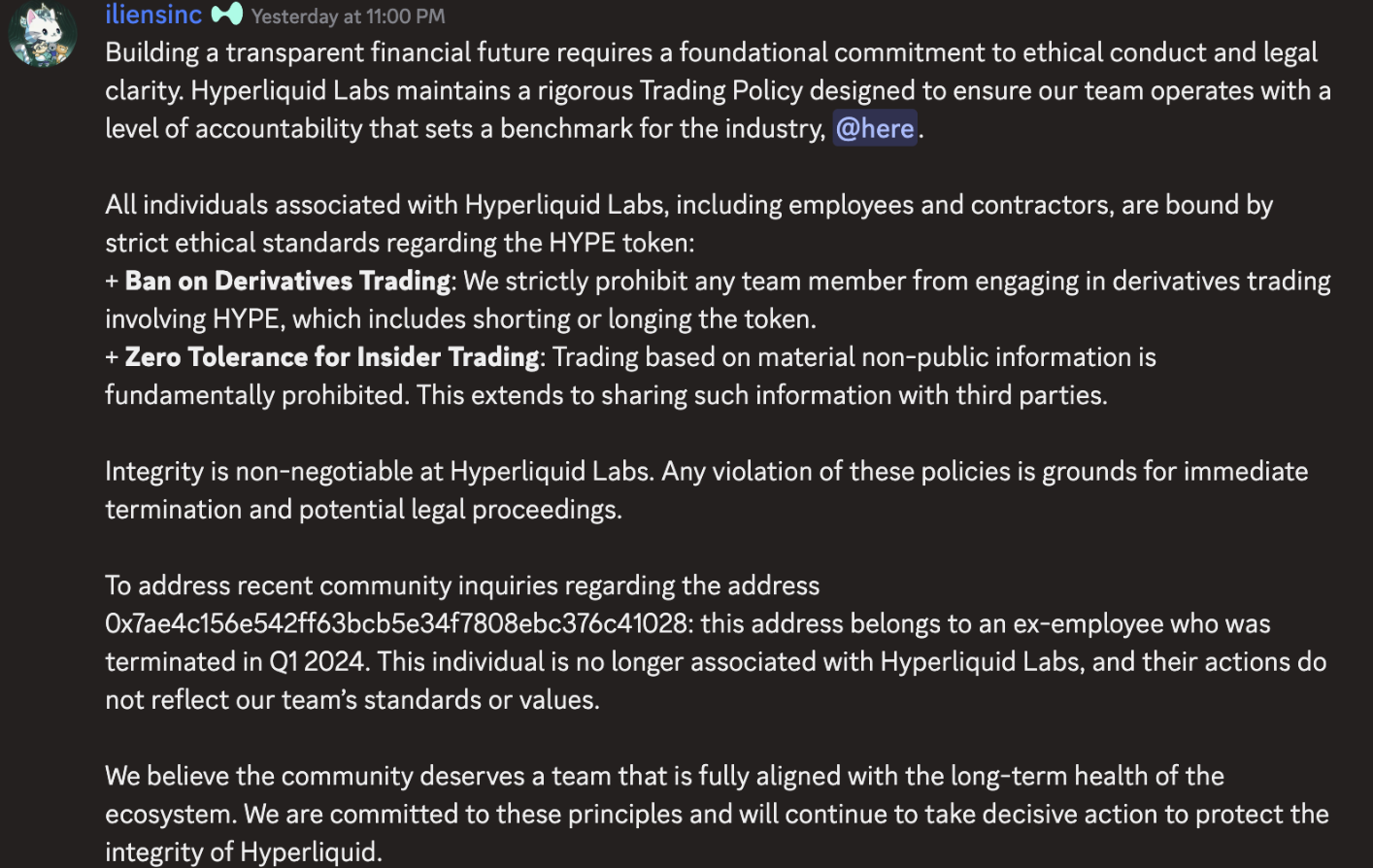

According to a statement shared by Hyperliquid co-founder Iliensinc in the project’s Discord, the wallet in question does not belong to any current team member. Instead, it is controlled by a former employee who was dismissed in early 2024 and has had no affiliation with Hyperliquid Labs since.

Key takeaways:

The wallet accused of shorting or selling HYPE is linked to a former employee, not the current Hyperliquid team.

Hyperliquid says the individual was terminated in early 2024 and no longer represents the project.

Leadership denies any insider trading by current employees or contractors.

The clarification aims to address community concerns around transparency and governance.

Wallet Activity Sparked Community Scrutiny

The issue surfaced after onchain observers noticed a wallet executing sizeable HYPE trades, including a notable sell-off in November that coincided with heightened market volatility. Some community members speculated that the activity reflected insider behavior, fueling debate around transparency and internal controls.

Hyperliquid’s leadership pushed back on that narrative, stressing that the address was wrongly assumed to be tied to the active team. Iliensinc stated that the individual behind the wallet no longer represents the project and that their actions should not be interpreted as reflecting Hyperliquid’s internal practices or values.

Strict Trading Rules for Team Members

In the same message, Hyperliquid outlined its internal policies around token trading. Current employees and contractors are prohibited from trading HYPE derivatives entirely, including both long and short positions. The rules are designed to eliminate conflicts of interest and ensure no one with privileged access can profit from non-public information.

The platform also enforces a blanket ban on the use or disclosure of material non-public information for trading purposes, whether directly or through third parties. According to the team, these standards are intended to set a higher bar for accountability in decentralized trading environments.

Market Context: Growth, Volatility, and Attention

Hyperliquid has emerged as one of the most dominant players in decentralized perpetuals, capturing a significant share of global perp DEX volume throughout 2025. Its rapid growth has made both the platform and its native token a focal point for traders and analysts.

Despite recent price weakness, HYPE remains far above its launch levels and continues to attract attention from high-profile market participants. Arthur Hayes, for example, has previously described Hyperliquid as one of the most compelling narratives of the current crypto cycle, citing its market share and execution.

Reaffirming Trust Amid Scrutiny

By addressing the wallet controversy directly, Hyperliquid appears intent on drawing a clear line between historical individuals and its current governance framework. The episode highlights the level of scrutiny faced by fast-growing decentralized platforms, where onchain transparency can quickly turn speculation into reputational risk.

For Hyperliquid, the message is straightforward: questionable trading activity tied to former insiders does not reflect the project’s current operations, and internal safeguards remain firmly in place as the platform continues to scale.