Fidelity’s top markets strategist has warned that Bitcoin’s October high of $126,000 could mark the top of the current cycle, and investors should be ready for a rough ride in 2026.

According to Jurrien Timmer, a notable pullback is possible next year with key support seen in a range of $65,000 to $75,000. That view sits alongside data points and trader commentary that recall past big drops after sharp peaks.

Cycle Warning From Fidelity

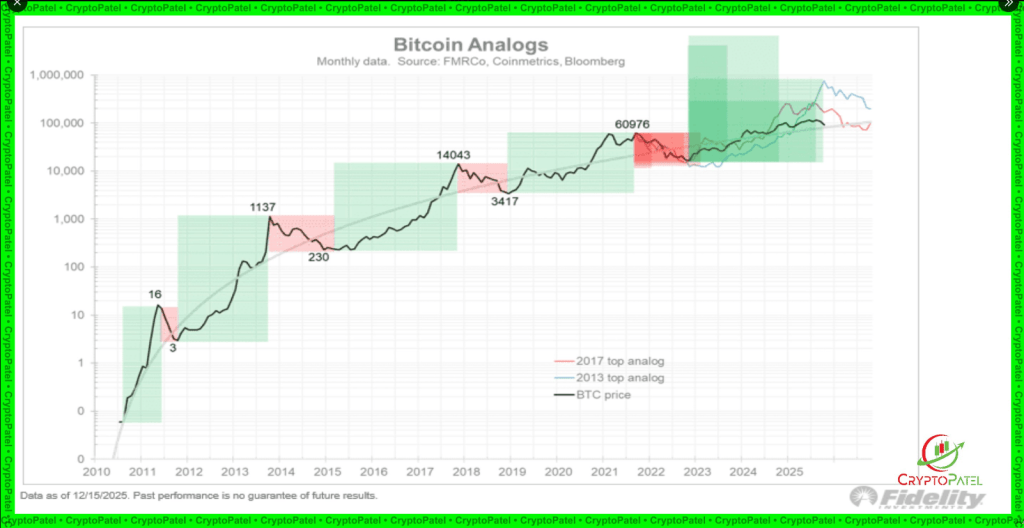

According to Timmer, Bitcoin’s price history follows a roughly four-year rhythm tied to halvings. Past peaks have been followed by steep corrections of about 70 to 85%.

For example, after a high of $1,137 in 2013 the price slipped to roughly $230, and the 2017 peak near $14,050 later traded down toward $3,415. Prices surged again after 2021, and that pattern of parabolic advance then sharp retreat has been repeated. Some traders say those falls are tests of patience rather than a sign the story is broken.

Historical Charts Show Parabolic Moves

Reports have disclosed that long-term log charts help put these swings in perspective by showing percentage growth across cycles, which can make big-dollar moves easier to read.

Market action often looks like a rapid climb to a peak, a quick drop, and a long period where prices move sideways and gains feel slow. Those sideways stretches are where many long-term holders are rewarded, though it can take years.

Galaxy Research has flagged overlapping macro and market risks that make forecasting harder for 2026, and options and volatility trends suggest Bitcoin is behaving more like a macro asset than a pure growth gamble. Galaxy Research is still bullish on a multi-year view and projects a path toward $250,000 by the end of 2027.

Based on reports from traders, the first quarter has in past cycles been a period that often supports price stability, although recent years have shown less regularity. Large inflows and treasury buys that could arrive in 2025 might be offset by early-cycle selling from big holders.

The balance between institutional demand and whale supply will likely show itself in the first half of 2026, making that stretch important for whether historical four-year rhythms hold firm.

2026 Could Provide Clues

If prices pull back into the $65,000–$75,000 area, it would fit the historical correction range and offer a test of market structure. Traders and investors will be watching liquidity, derivatives flows, and how quickly spot buyers step in after any sharp declines. Patience has paid off before; the largest gains came after extended calm, not right after the low was printed.

Featured image from Unsplash, chart from TradingView