Altcoin investors may close 2025 without seeing profits in their portfolios. However, many analysts remain optimistic despite the altcoin market capitalization (TOTAL2) dropping 30% from this year’s peak.

What makes analysts believe the altcoin bear market may be entering its final phase? The following points highlight the key reasons.

Why Altcoins Are in a Phase of Opportunity

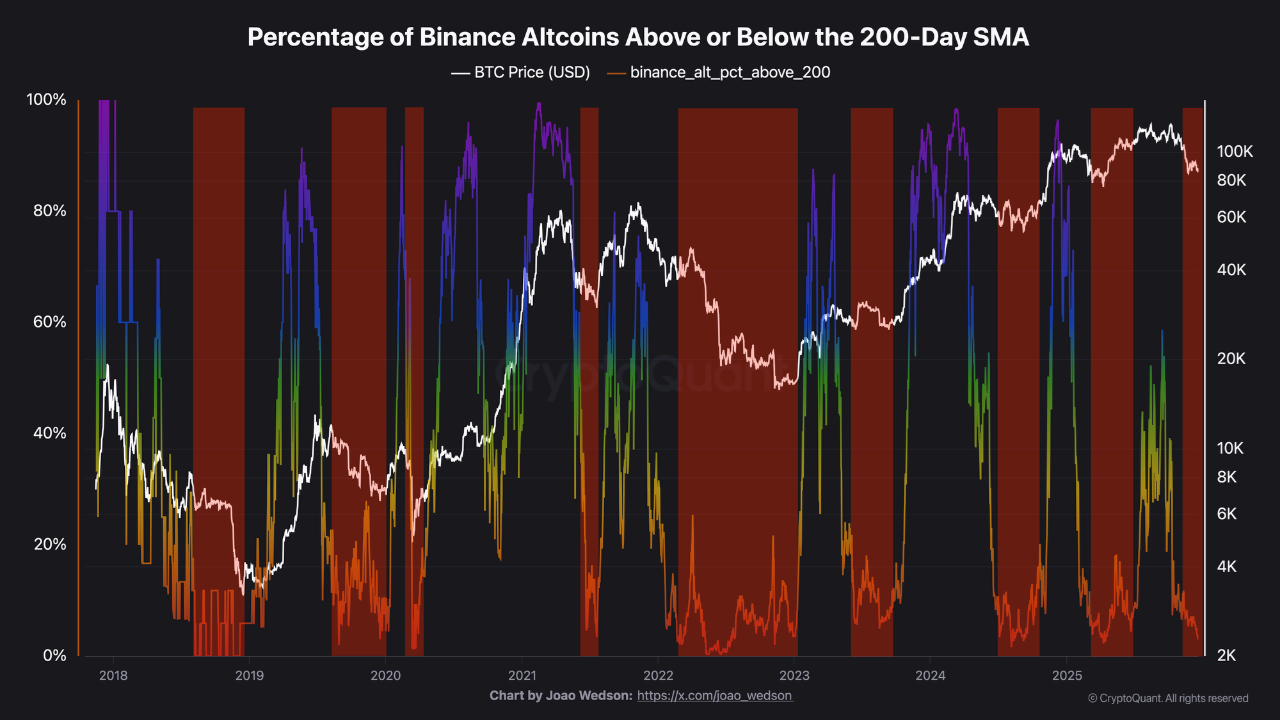

First, CryptoQuant data shows that only about 3% of altcoins on Binance trade above the 200-day moving average. This level marks a historical low.

CryptoQuant analyst Darkfost attributes a lack of liquidity and defensive investor sentiment as the primary causes. Investors currently prioritize capital preservation over exposure to risky assets.

Percentage of Binance Altcoins Above or Below the 200-Day SMA. Source: CryptoQuant

The fact that most altcoins trade well below their long-term averages reflects widespread undervaluation driven by negative sentiment. Recent BeInCrypto analysis reveals that altcoins such as XRP, TON, and ADA possess strong fundamentals, yet their prices have failed to recover.

Despite the bleak outlook, historical comparisons suggest that such weak periods often create attractive opportunities for patient investors.

“Even though it may seem counterintuitive, these types of periods often offer the best opportunities. This phase may last for some time, especially if the market enters a prolonged bear phase,” Darkfost said.

Second, fear and a lack of interest from retail investors often unlock the best price zones. Large investors tend to seize these moments to accumulate.

Well-known X analyst CrediBULL Crypto highlighted this factor as a key signal for identifying market bottoms. A recent post argued that attention, not capital, moves first.

When retail investors lose interest, large players step in to buy. As early green candles appear, retail attention gradually returns. Retail participation then accelerates the next phase of the move.

Technical Signals Point to a Potential Bottom

Third, multiple technical indicators suggest that the altcoin bear market is nearing its end. Renowned market analyst Michaël van de Poppe stated that current altcoin market capitalization levels act as strong support. He described the zone as an “area to hold.”

Altcoins Market Cap Excluding BTC and ETH. Source: Michaël van de Poppe

“Ultimately, it looks like we’re on a crucial level of support. It seems worthwhile to stay positioned at this level. Solid bounces suggest that green candles may appear from here,” Michaël van de Poppe predicted.

Additional signals reinforce this outlook:

The altcoin market cap ratio, excluding the top 10, versus Bitcoin sits at its strongest support since 2017.

Altcoin dominance currently stands at levels comparable to those during the COVID crisis period, which previously preceded a strong recovery.

These factors suggest that altcoins may be in the final stage of decline. Recent BeInCrypto analysis indicates that a DCA strategy could prove effective if started from December.

However, some analysts continue to warn of risks. They argue that an altcoin season may not arrive even in 2026. Venture capital inflows remain weak, and market sentiment may take a considerable amount of time to recover.