Michael Saylor’s brief post on X that showed “green dots” ahead of orange dots has stirred fresh talk in markets. According to traders who track his public messages, the pattern is being read as a possible hint that more Bitcoin buying could be on the way.

Bitcoin is trading just below a heavy resistance band around $90,000, a level where selling pressure has built up and where traders and market desks are closely watching for either a breakout or another rejection.

Market Reaction And Signals

Prices moved on the rumor alone. Short-term traders bought into the idea that a large buyer may be shifting action back toward accumulation. Based on reports, some market participants compared the signal to earlier Saylor posts that preceded corporate purchases.

No official company filing or treasury update has been released to confirm any new acquisition. The message was posted without any accompanying press release, and that lack of confirmation kept some desks cautious.

Institutional Demand And On-Chain Clues

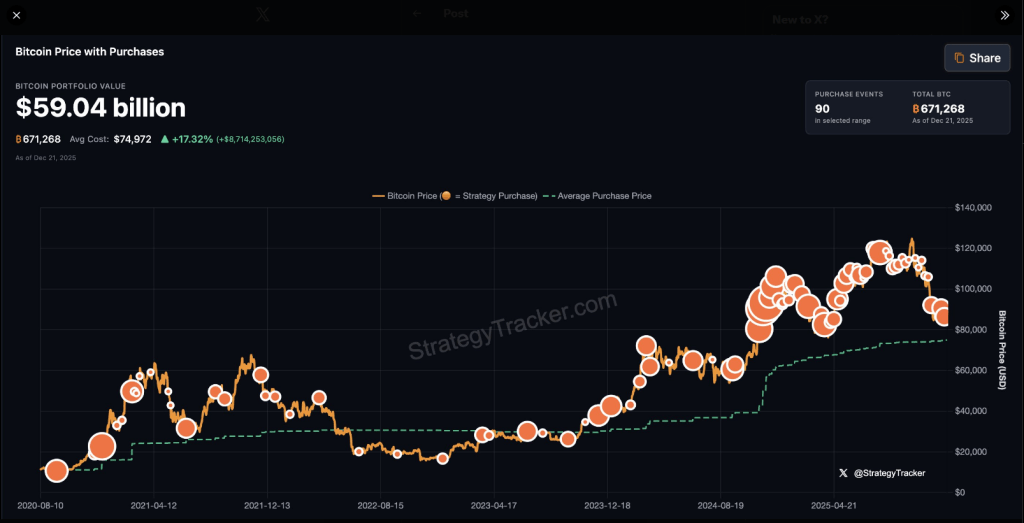

Reports have disclosed that institutional flows still matter to Bitcoin’s price path. Large spot Bitcoin ETFs and corporate treasuries are part of the backdrop that traders cite when interpreting a high-profile hint from a corporate figure.

On-chain metrics, where available, are being scanned for coin movements into custody accounts. One key piece of evidence that would change market conviction is a clear transfer into an exchange or ETF custody wallet, followed by a public disclosure; absent that, the green-dot post remains a market signal more than a proof point.

Liquidity sits near $90,000. Many orders cluster around that level, and that makes it a psychological and technical barrier. If a big buyer steps in under the wall, sellers may be cleared and price could push higher.

If selling stays firm, BTC could stall and move sideways for several sessions. Traders are also watching order books, funding rates, and ETF balances for shifts. Volume spikes paired with visible custody inflows would be a stronger signal than a social post alone.

History And Context

Michael Saylor is a visible buyer historically, and his public comments have affected sentiment before. Reports linking his posts to later buys have circulated in market media, and traders use that history to give the current message weight.

Featured image from Unsplash, chart from TradingView