Ethereum price prediction is gaining renewed attention as ETH holds steady near the $3,030 level. After posting a modest 1.42% gain over the past 24 hours, market participants are closely analyzing its next move. Technical indicators are flashing mixed signals, with short-term moving averages showing slight bullishness, while longer-term trends remain weak.

Traders are paying particular attention to resistance zones between $3,047 and $3,085, which could determine whether ETH continues climbing or stalls out again. Meanwhile, interest is shifting toward high-upside alternatives like Bitcoin Hyper, a presale token attracting early momentum.

With ETH’s upside appearing limited for now, some investors are rotating capital into lower-priced assets offering more aggressive short-term potential.

ETH Holds $3,000, But Trend Signals Conflict

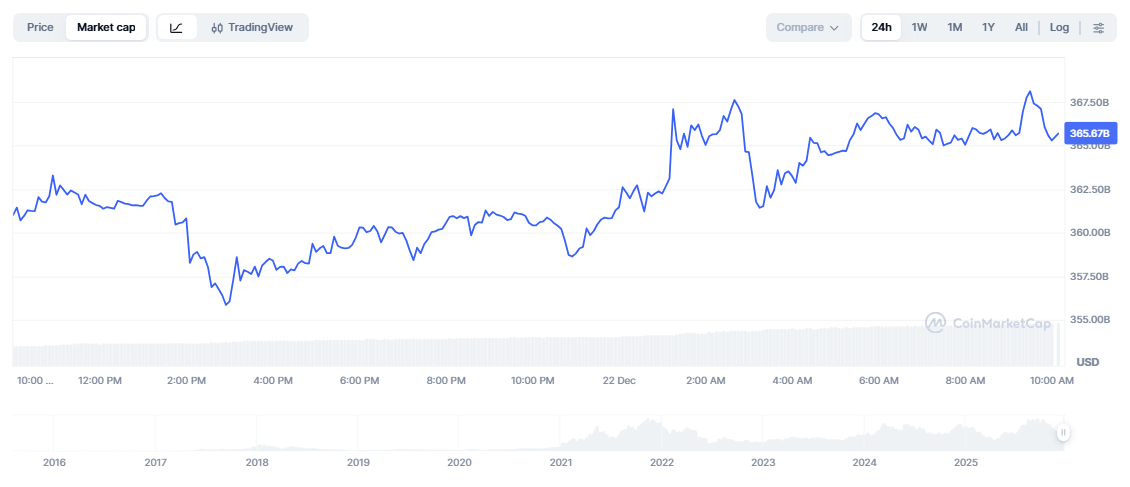

Ethereum has once again crossed the $3,000 threshold, currently trading at $3,031.04 with a market cap of over $365 billion. The 24-hour volume surged more than 113%, reflecting renewed interest – but the volatility vs market cap ratio (4.24%) still raises questions about stability.

Short-term moving averages like the 50-day SMA show a bullish slope, but the broader 200-day moving average remains bearish since December 17, 2025. This divergence highlights a fragile uptrend – a pattern that may limit Ethereum’s ability to sustain rallies unless macro tailwinds intervene.

Resistance Levels Near-Term: $3,047 and $3,085

Looking at classical pivot analysis, Ethereum faces resistance at $3,024.84, $3,047.85, and $3,085.81, with strong support observed around $2,902.90. The forecast for December 23 and 29 projects ETH to hover between $3,030 and $3,032, suggesting limited breakout momentum in the immediate term.

Most moving averages, including SMA 50 ($3,094.22) and EMA 50 ($3,875.19), are currently flashing sell signals, reinforcing the lack of bullish conviction. Notably, all simple and exponential moving averages across short, mid, and long timeframes are uniformly red – a rare occurrence and historically a signal for caution.

The Relative Strength Index (RSI) remains within the 30–70 neutral zone, which typically signals consolidation. However, a bearish divergence over the last 14 candles points to potential downside pressure despite price stability.

This divergence often precedes short-term pullbacks or failed breakout attempts – particularly when combined with weak macro support.

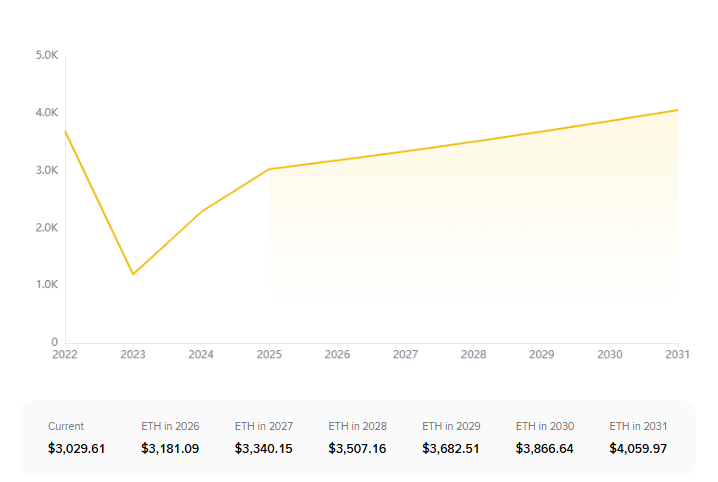

Ethereum Price Prediction Through Early 2026

Looking forward, Ethereum’s projected price shows only marginal gains. Forecasts estimate ETH to close 2025 around $3,345.79, with a minimum of $2,980.12 and a potential high near $3,162.96. That implies a 7.7% ROI from current levels – modest by crypto standards.

While this paints ETH as a steady large-cap hold, it lacks the explosive upside many traders seek heading into 2026. This helps explain the rotation into high-potential presales like Bitcoin Hyper, which is closing in on its $30M raise target and is set for a price increase in just over 24 hours.

With an entry price of $0.013465, some traders are viewing it as a better speculative bet with a lower risk/reward ratio than chasing blue chips at local highs.

If Ethereum holds above $3,030 and breaks $3,085 this week, it could test the $3,100–$3,150 zone. But current resistance levels, weak long-term moving averages, and divergence signals suggest this range might cap further gains unless fresh catalysts emerge – such as ETF news, scaling upgrades, or macro Bitcoin movement.

Until then, the Ethereum price prediction favors a sideways to slightly bullish bias through year-end. Traders watching risk-adjusted upside may continue favoring smaller-cap or presale plays as ETH consolidates.

Bitcoin Hyper Gaining Momentum as ETH Stalls

With Ethereum’s momentum fading and macro uncertainty rising, new capital is shifting to alternative opportunities like Bitcoin Hyper. The project has already raised over $29.67 million, with less than 36 hours left until its next price increase.

Early-stage interest in $HYPER is driven by:

Low entry price compared to ETH

Presale growth mechanics

A clear funnel for onboarding via crypto or card

This narrative is familiar: traders using ETH as a liquidity base, then rotating into presale coins before launching into broader markets.