Ethereum is attempting to reclaim the $3,000 level after showing pockets of bullish strength over the weekend. Buyers briefly managed to push the price higher, but momentum has struggled to build, and ETH remains vulnerable below a key psychological threshold. As volatility compresses, market conviction appears fragile. Many analysts are increasingly calling for lower prices, arguing that recent rebounds lack the follow-through required to shift the broader structure back into a sustained uptrend.

On-chain data helps explain this hesitation. According to a recent CryptoQuant report, Ethereum’s Net Unrealized Profit/Loss (NUPL) indicator remains in positive territory, with the latest reading hovering around 0.22. This suggests that the average ETH holder is still sitting on unrealized gains, but those profits are relatively modest.

Historically, this zone is associated with a “belief” or cautious optimism phase, rather than euphoria. In other words, the market is neither in panic nor in an overheated state.

This positioning places Ethereum at an inflection point. Investors are no longer capitulating, but they are also not aggressively chasing upside. With profits still on the table and sentiment mixed, ETH’s next move will likely depend on whether buyers can regain confidence and absorb lingering sell pressure. Until then, the market remains caught between hope and hesitation.

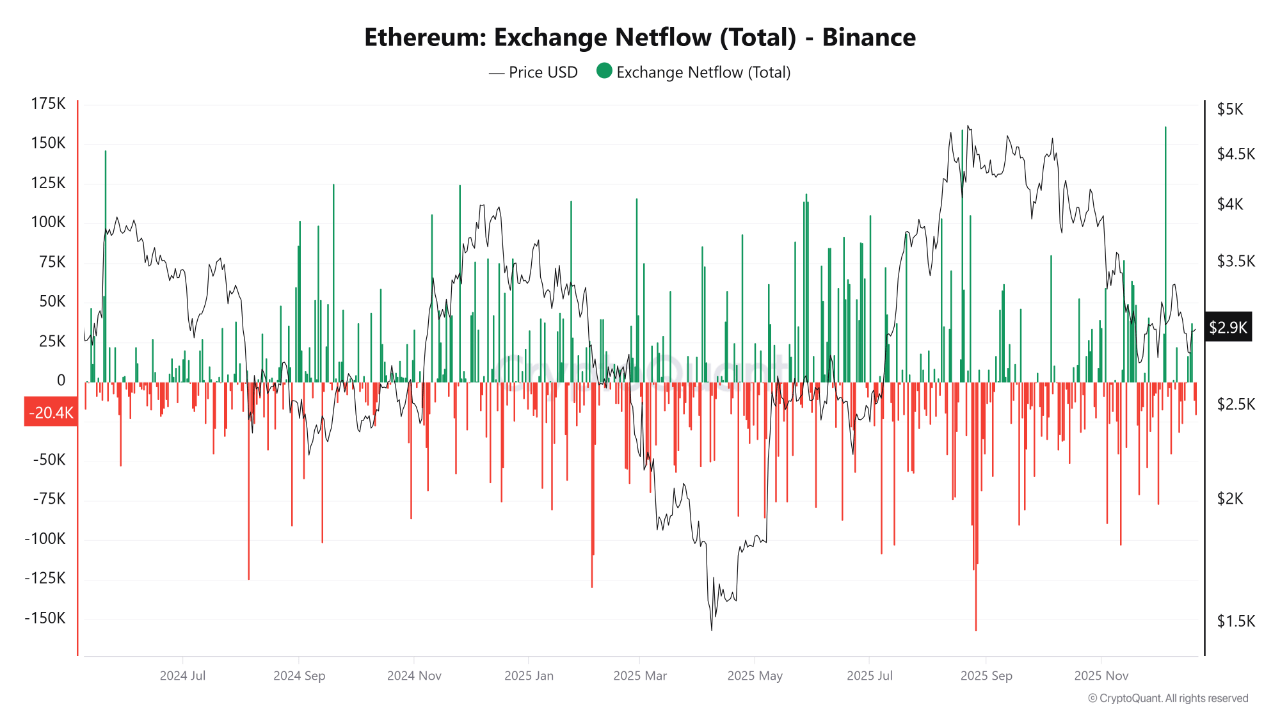

Exchange Outflows Signal Strategic Repositioning

According to the Arab Chain report, combining Ethereum’s NUPL data with exchange netflow metrics on Binance provides a clearer picture of current market dynamics. Recent data shows that Ethereum exchange netflows have consistently leaned toward net outflows, with frequent negative readings indicating that more ETH is being withdrawn from Binance than deposited. This behavior is typically associated with reduced immediate selling pressure, particularly when it occurs alongside a stable, positive NUPL reading.

What makes this setup notable is the absence of a sharp increase in NUPL despite these outflows. In past cycles, strong withdrawals during periods of rising unrealized profits often coincided with aggressive profit-taking and euphoric sentiment.

That pattern is not present today. Instead, the data suggests that holders are choosing to retain exposure rather than exit positions. ETH appears to be moving off exchanges for purposes such as long-term storage, staking, or participation within the broader Ethereum ecosystem, rather than for imminent liquidation.

This divergence between sustained exchange outflows and restrained NUPL levels points to a structurally healthier market environment. Profits exist, but they are not excessive, and selling pressure on Binance remains limited.

As a result, the probability of abrupt, sell-driven corrections is reduced. The medium-term outlook becomes more dependent on structural and fundamental developments, rather than short-term speculative behavior or emotional market swings.

Ethereum Consolidates Near a Critical Inflection Zone

Ethereum’s weekly chart shows price attempting to stabilize around the $3,000–$3,100 region after a volatile multi-month decline from the 2025 highs near $4,800. This area has emerged as a key technical pivot, aligning closely with the rising 200-week moving average, which historically acts as a long-term trend gauge. ETH is currently trading just above this level, suggesting that bulls are defending structural support, but without strong momentum confirmation.

The 50-week and 100-week moving averages are beginning to flatten and converge near current price, reflecting a broader transition from a strong uptrend into a consolidation phase. This compression often precedes a larger directional move. Notably, Ethereum has reclaimed the 100-week average but remains capped below the 50-week average, highlighting the ongoing struggle to re-establish a sustained bullish structure.

Volume has moderated compared to the distribution phase seen during the sell-off, indicating reduced forced selling rather than aggressive accumulation. This supports the view that the market is digesting prior gains rather than entering a new impulsive trend.

From a structural perspective, holding above the $2,900–$3,000 zone keeps the long-term uptrend intact. However, failure to reclaim the $3,300–$3,500 resistance range would leave ETH vulnerable to extended consolidation. For now, price action suggests balance, not resolution.

Featured image from ChatGPT, chart from TradingView.com