The founder and CEO of on-chain analytics firm CryptoQuant has revealed how Bitcoin on-chain capital inflows have stalled over the last couple of months.

Bitcoin Realized Cap Has Witnessed A Slowdown Recently

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has talked about how on-chain capital inflows have been weakening for Bitcoin recently. “After about 2.5 years of growth, realized cap has stalled over the past month,” noted Young Ju. The “Realized Cap” here refers to an on-chain capitalization model for Bitcoin that calculates its total value by assuming the value of each coin in circulation is equal to the price at which it was last transacted on the blockchain.

Since the last transaction of any coin is likely to represent the last instance of it changing hands, the price at that time can be considered as its current cost basis. Therefore, the Realized Cap is just a sum of the cost basis of the entire BTC supply. In other words, it tracks the capital that the investors used to purchase their tokens.

Realized Cap had been enjoying growth for the last couple of years, but as the CryptoQuant founder has revealed, capital inflows have dropped off. This suggests a decline in sentiment around Bitcoin.

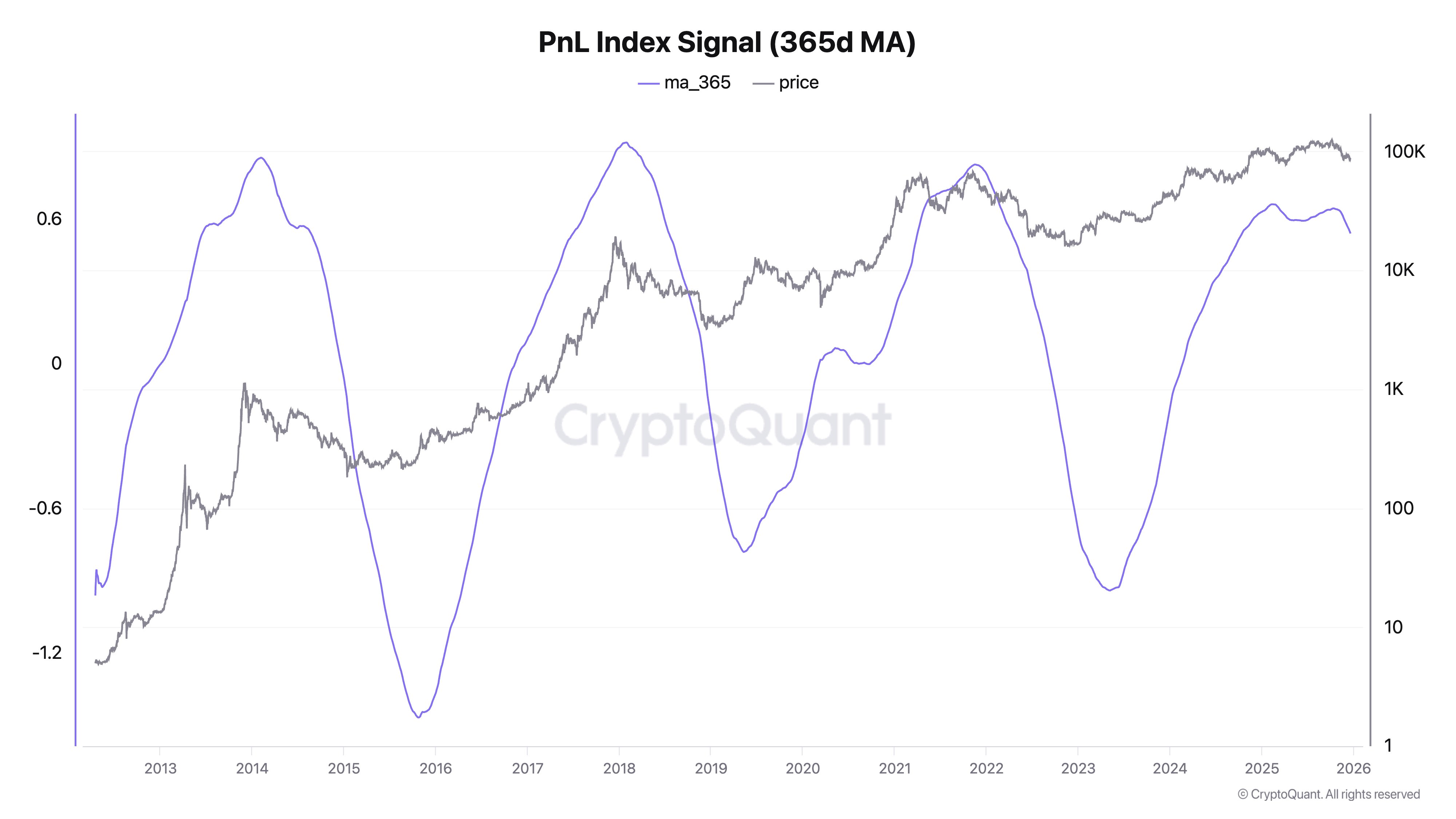

The turnaround in sentiment is also visible through the analytics firm’s PnL Index, which incorporates key on-chain indicators to build a single valuation metric for BTC.

The indicators in question are the MVRV Ratio, NUPL, and STH/LTH SOPR. The first two both deal with the amount of unrealized profit or loss held by the investors as a whole, while the latter provides a look into investor profit-taking.

Below is the chart shared by Young Ju that shows the trend in the 365-day moving average (MA) of the Bitcoin PnL Index over the history of the asset.

From the graph, it’s visible that the Bitcoin PnL Index saw its 365-day MA reach a high earlier in the year, implying that the coin had potentially become overvalued.

Since then, the metric has seen a reversal to the downside. Currently, its value is still notably positive, so the cryptocurrency may be considered to be in a bullish phase, but historically, drawdowns have tended to lead into bear markets.

Though there were a couple of instances where this pattern didn’t hold. One being the aftermath of the COVID crash and the other the decline that occurred in the early months of 2025.

So far, the indicator hasn’t shown signs of any turnaround back to the upside, although it should be noted that it’s an average over the past year, so there is some delay attached.

Based on the on-chain trend, Young Ju has said, “Sentiment recovery might take a few months.”

BTC Price

Bitcoin has made recovery from last week’s plunge as its price is now back at $89,800.