Traditional payment systems — whether for individuals or enterprises — are plagued by inefficiencies. Cross-border transfers are painstakingly slow and costly, while access to credit is unevenly distributed. Furthermore, trust is often tied to outdated intermediaries and opaque infrastructure when transacting on these platforms.

In a world where real-time commerce and digital financial services require fast-paced and cost-efficient networks, these traditional systems fall short.

Enter Huma Finance.

This groundbreaking protocol is designed to reimagine payments and lending by leveraging web3 infrastructure powered by blockchain technology. With its innovative Payment Finance (PayFi) model. Huma enables programmable, on-chain cash flows that support use cases across various sectors.

By combining decentralized finance (DeFi) with real-world income streams, Huma is changing the way business is done to ensure a more inclusive, transparent and efficient global economy.

Key Takeaways:

Huma Finance is a pioneer Payment Finance (PayFi) protocol leveraging web3 products such as stablecoins and on-chain liquidity to transform the way money moves globally.

Its native token is HUMA, whose utilities include staking, powering the rewards and incentives program and governance.

You can buy HUMA on Bybit as a Spot trading pair or as a USDT Perpetual contract.

What is Huma Finance?

Huma Finance is the first Payment Finance (PayFi) protocol in the web3 space designed to provide 24/7 global blockchain-based payment solutions by leveraging stablecoins and on-chain liquidity.

Huma aims to counter the challenges plaguing traditional financial systems, such as slow transacting speed, high costs, opaque structures and use of third parties/intermediaries to process payments.

By leveraging stablecoins and different aspects of DeFi such as liquidity provision, Huma promises instantaneous and frictionless payments across borders. Catering to different stakeholders in the global economy, Huma taps into PayFi to accelerate the way money moves. Whether it’s suppliers seeking an affordable and fast payment option or people seeking to send money internationally, Huma will facilitate these payments with ease.

At the heart of this innovative PayFi protocol is the Huma crypto token, HUMA, which is used in Huma’s network for governance and as its utility token.

How does Huma Finance work?

To deliver frictionless and borderless financial solutions, Huma Finance relies on the concept of PayFi to deliver programmable, blockchain-based products. PayFi is seen as the internet of money, providing an open-source technological infrastructure to cater to different facets of the financial world. From transactions to compliance to custody, PayFi can handle it.

To understand how Huma operates, let’s look at the six foundational pillars of its PayFi stack, which are the forces behind its ecosystem.

1. Transaction Layer

This is the backbone of Huma’s PayFi ecosystem. It manages critical network aspects, such as transaction costs, speed and security. For optimal operation, Huma’s PayFi leverages two blockchains — Solana (SOL) and Stellar (XLM).

These two networks align with Huma’s use cases since they provide high speeds and low transaction costs without compromising security and decentralization.

2. Currency Layer

This layer features the stablecoin aspect of the ecosystem. With stablecoins, payment systems remain exactly that — stable — despite the inherent volatility of cryptocurrencies.

Through this layer, major stablecoins such as USDT, USDC and PayPal's PYUSD, can help facilitate seamless and compliant payments while providing much-needed stability for payment use cases. Other stablecoins, such as programmable stablecoins or yield-bearing stablecoins, can also be incorporated into this layer, which also allows integration with global financial systems in Europe, Asia and elsewhere.

3. Custody Layer

The Custody Layer uses DeFi to provide the digital infrastructure for the custody of assets during transactions, as opposed to the physical intermediaries required by traditional money transfer solutions.

This pillar of the PayFi stack leverages blockchain to allow multiple parties to share custody over assets without slowing down transactions.

It also features on-chain and off-chain asset management, and offers programmable asset locks and customization authorization mechanisms.

4. Compliance Layer

The Compliance Layer caters to regulatory requirements for stablecoin payment systems, especially those operating in heavily regulated jurisdictions, and facilitates real-time checks on compliance via features such as know your customer (KYC) and anti–money laundering (AML).

5. Financing Layer

The Financing Layer leverages blockchain technology to provide transparency in capital demand and supply, which is usually an opaque aspect of TradFi. Through the use of real-world assets (RWAs) and smart contracts, PayFi facilitates the automation of risk assessment by using real-world data. As such, pricing and structuring of assets are conducted transparently, rather than behind closed doors.

6. Application Layer

As PayFi's topmost layer, the Application Layer brings tangible financial tools to life that developers can incorporate into their creations. Through this layer, payment solutions such as crypto payment, DePIN infrastructure, trade finance innovations, forex, staking and OTC services can be integrated into financial products.

Huma Finance key products

Huma Finance's key products are Huma 2.0 (permissionless access) and Huma Institutional (permissioned access to institutional investors). Let’s take a deeper look at the two.

Huma 2.0

Launched in April 2025, Huma 2.0 (or simply Huma) is the protocol's entry into democratizing DeFi by allowing permissionless access to payment yields for different stakeholders.

Huma 2.0 is an upgrade from Huma Institutional, which only allowed permissioned access to institutions. Its key features are a dedicated DApp for interaction, Solana-powered liquidity pools, a dedicated price oracle and off-chain auto tasks to manage tasks in the pools.

Powered by Solana, Huma 2.0 leverages its high speed and low cost of transacting to provide investors with accelerated ways to make cross-border payments. Some Solana protocols integrated with the platform that offer instant liquidity are Jupiter, Kamino, Meteora and RateX.

Huma 2.0 offers two modes for earning yield to liquidity providers (LPs) who lock up their HUMA tokens.. LPs can choose from the Classic mode, which generates stable yields (currently at 10.5% in liquidity pools on Solana) plus Huma Feathers rewards, or Maxi mode, which allows LPs to forego the APY on stable yields and maximize their Huma Feathers rewards.

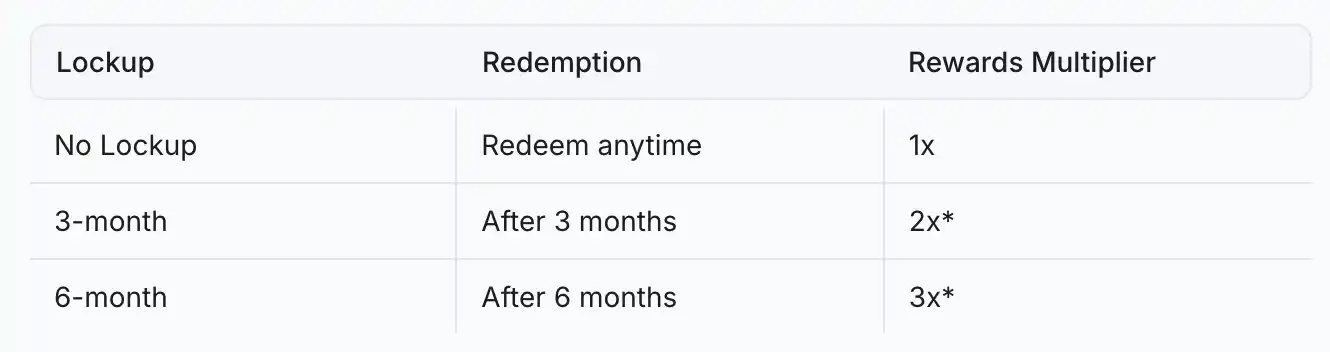

You can also lock funds into Huma liquidity pools to generate passive rewards in the form of enhanced Huma Feathers. Huma offers varying lockup options: no lockup period, 3-month lockup or 6-month lockup. Your Feathers Rewards scale directly to your lockup duration.

Source: docs.huma.finance

While you can't shorten the lockup period, you can always extend it for better flexibility and control. You cannot redeem your funds before the lockup period is over, and any token transfer conducted during the set lockup time leads to forfeiture of the bonus earned.

Huma Institutional

Huma Institutional is a permissioned platform designed to provide institutional investors with decentralized credit opportunities backed by real-world assets (RWAs), such as invoices, inventory or intellectual property. It’s available on Solana and via Ethereum virtual machine (EVM) networks and Stellar. It supports structured finance features such as tranches, tokenization and first-loss cover, allowing investors to participate in receivables-backed pools with customizable risk and yield profiles.

Huma Institutional uses a two-tranche system to manage credit risk and yield for institutional lenders:

Senior tranche — Offers lower risk with priority in repayments, but yields lower returns.

Junior tranche — Carries higher risk, receiving repayments after the senior tranche, but offers higher potential returns.

Some investment pools may feature both tranches, while others might have only a junior tranche. Lenders choose which tranche to invest in, based on their risk tolerance and desired return. Investors looking for safer, more predictable income may invest in senior tranches, while those willing to take on more risk for higher yield may opt for junior tranches. Those who are interested in participating must undergo approval processes, including KYC/KYB checks and signing necessary legal documents.

Huma supports both fixed yield (whereby senior tranche returns are steady unless losses occur) and risk-adjusted yield (whereby a portion of senior tranche returns is redirected to junior tranches, based on pool structure). Pools enforce a maximum leverage ratio of 4:1 to protect senior capital, meaning that juniors must make up at least 20% of the pool.

While most pools on Huma are backed by income or receivables, first-loss covers serve as an added layer of protection for lenders to partially or fully absorb losses in the event of defaults. Each pool can have up to 16 types of first-loss cover, including collateral from borrowers and insurance.

Interaction between lenders and borrowers

Lenders provide liquidity to pools by investing in tranches. In return, they earn yields based on the performance of the underlying assets.

Borrowers, such as businesses needing financing, access funds by tokenizing their receivables. Depending upon the pool's terms, they’re obligated to make timely interest payments, and may need to make minimum principal repayments each period.

This system creates a transparent and efficient ecosystem in which lenders earn returns and borrowers gain access to necessary capital.

What is the Huma Finance crypto token (HUMA)?

The Huma Finance crypto token (HUMA) is the native utility and governance token for the Huma ecosystem. It's designed to provide long-term incentives to various stakeholders on Huma, such as liquidity providers and builders. Its key utilities are as follows:

Protocol governance — As a HUMA token holder, you can stake your tokens to participate in the protocol's governance. The number of tokens you stake dictates your voting power. HUMA token holders can vote on various decisions, such as whether incentives should be allocated to liquidity and how they’re distributed.

Rewards — The HUMA token is essential for Huma's ecosystem incentives program, which is designed to drive growth and adoption. HUMA rewards liquidity providers for injecting capital into the liquidity pools. Stakers are also rewarded using HUMA tokens, while ecosystem partners who hit certain key performance indicators (KPIs) also earn HUMA. Community contributors also receive HUMA in recognition of their efforts.

Currency — In the future, Huma plans to incorporate HUMA as the ecosystem's currency, to be used for advanced features like real-time redemption and even value-accrual mechanisms.

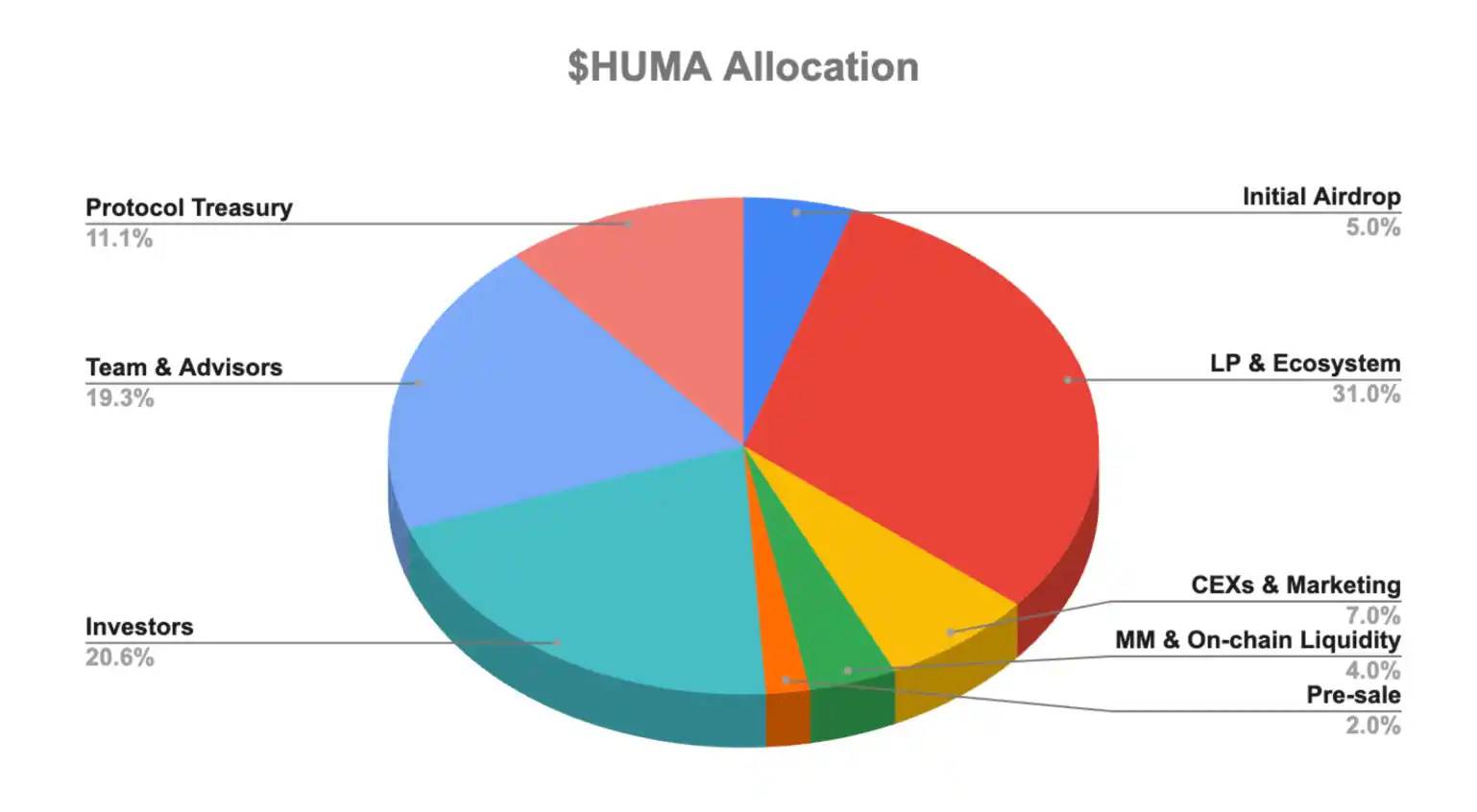

HUMA has a maximum supply of 10 billion tokens, with an initial circulating supply of 1.73 billion. The tokens are distributed as shown in the chart below:

Source: Huma Finance

Where to buy HUMA

You can buy HUMA on Bybit as a Spot trading pair or a USDT Perpetual contract. To celebrate HUMA’s listing, Bybit is holding a Token Splash event in which 12 million HUMA tokens are up for grabs. The event runs through Jun 9, 2025, 9AM UTC, and is split into two parts:

Event 1 — Reserved for new users who sign up on Bybit, complete Identity Verification and accumulate a deposit volume of 1,100 HUMA, or deposit 100 USDT and trade 100 USDT worth of HUMA tokens for a chance to share in the 7 million HUMA prize pool.

Event 2 — With a reward pool of 5 million HUMA tokens, traders can share in the prizes by trading at least 500 USDT worth of HUMA.

Huma Finance (HUMA) price prediction

As of Jun 6, 2025, HUMA is trading at $0.04173, a 64% drop from its all-time high of $0.1156 on May 26, 2025 and a 16.1% increase from its all-time low of $0.03589 on May 31, 2025.

Price prediction experts are conservatively bullish on HUMA's future price. According to CoinCodex, a price prediction platform, HUMA may hit a maximum price of $0.067 in 2027 but decline to $0.14 by 2030.

That said, such price prediction isn't investment advice, and doesn't guarantee the future price of HUMA. We highly recommend you do your own research before investing in HUMA or any other cryptocurrencies.

Closing Thoughts

As the first PayFi network in web3, Huma Finance is pioneering a transformative approach to global payments. By leveraging blockchain technology and stablecoins, Huma enables real-time, 24/7 settlements, effectively addressing the inefficiencies of traditional finance systems. Its modular PayFi Stack integrates Transaction, Currency, Custody, Compliance, Financing and Application layers in order to provide a comprehensive framework for seamless financial operations.

By tokenizing real-world assets, such as invoices and inventory, Huma offers businesses immediate access to liquidity, while investors benefit from sustainable, real-world yields.

With a transaction volume of over $4.6 billion and a focus on inclusivity, Huma Finance isn’t just redefining payment financing — it’s also setting the stage for a more efficient and accessible global financial ecosystem.