Celestia (TIA) is a blockchain that addresses Ethereum’s limitations. It is faster, more scalable, and decentralized, effectively solving the blockchain trilemma through an innovative modular structure that separates execution from consensus and data availability.

What sets it apart is its primary focus on data availability and consensus, allowing sovereign platforms, including layer-2 solutions and blockchains, to handle execution and settlement independently. Since launching in 2023, developers have successfully deployed scalable, independent blockchains called app chains on Celestia without bootstrapping a validator set.

Central to the blockchain is TIA, a utility currency considered as one of the best cryptos to buy. Over the years, TIA has garnered interest from traders and investors, many eager to know where TIA will be trading by the end of the decade.

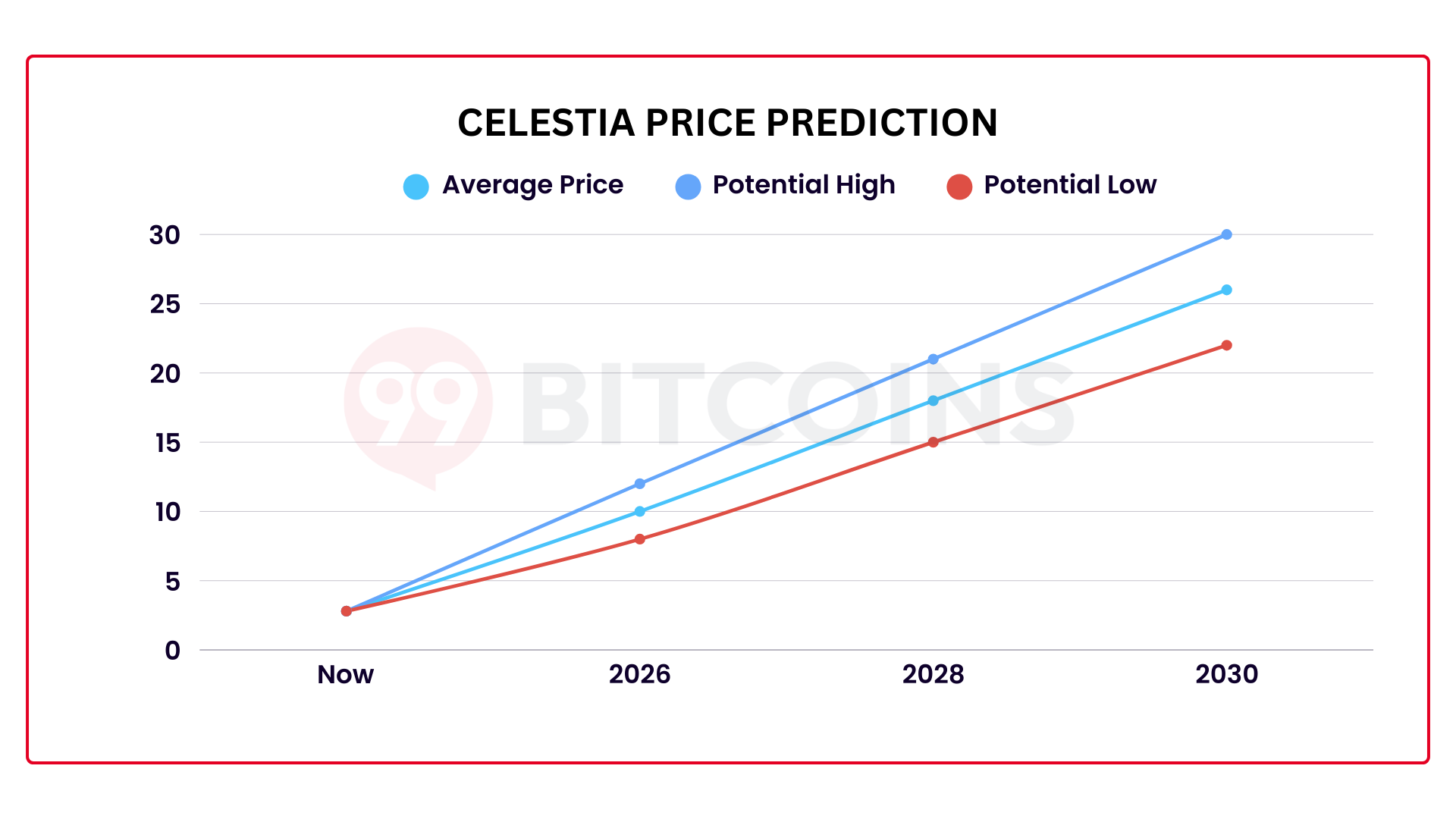

Celestia (TIA) Price Prediction 2025–2030

In this Celestia price prediction, we will analyze what Celestia aims to achieve, why it stands out, its roadmap, and whether the platform will gain market share and reward holders as institutions and countries embrace the blockchain.

End of 2025

As of May 2025, TIA has reversed gains posted in 2023 and 2024. After peaking at around $21, prices fell sharply from early 2024, dropping to as low as $2, effectively erasing gains posted after the Celestia mainnet launch. Although there were minor gains in late 2024, bears regained control, pushing the coin to around 2023 lows. Unless the broader crypto market recovers, the path of least resistance is downward. For this reason, we predict TIA prices will range between $2 and $8 in 2025.

End of 2026

The TIA price trajectory in 2026 will depend on its performance in 2025. If bulls succeed, a push above Q4 2024 highs of $8 could propel the coin to at least $12 by the end of 2026. Continued upgrades, such as Lemongrass (released in September 2024), or additional funding, like the $100 million raise from Bain Capital and Placeholder in 2024, could drive growth. Conversely, TIA risks plunging to new all-time lows if bears push prices below $2 in 2025. The situation could worsen if, for example, the planned Ginger upgrade scheduled for 2025 is delayed or the project fails to scale to 1GB blocks as planned.

End of 2030

By 2030, TIA could break $22 if Celestia becomes a preferred scaling network for projects building data-intensive dApps eager to reduce costs while scaling. The platform could power real-world applications demanding high performance. If it enhances interoperability through lazybridging, TIA could rally. Tailwinds may come from Bitcoin, Ethereum, and Solana, printing new all-time highs, such as $250,000 for BTC or $1,000 for Solana.

TIA Price Prediction 2025–2026: Short-Term Drivers

While our targets for TIA are ambitious, several factors align with our predictions. In 2024, developers activated Lemongrass on the mainnet beta, enhancing stability and performance.

Concurrently, the foundation raised $100 million from investors, including Bain Capital and Placeholder, increasing total funds to $155 million to support scaling efforts and ecosystem development.

Building

The September 2024 roadmap provided a glimpse of what lies ahead. The development team aims to expand blockspace to support high-throughput rollups while optimizing consensus for larger block production. They also plan to improve data availability to enable effective sampling and reconstruction of larger blocks without requiring excessive resources.

Following the roadmap, developers released the Mammoth mini-testnet in October 2024 and the Mamo-1 testnet in April 2025, implementing 88 MB blocks with a 27 MB/s data throughput.

Integrations

The network also integrated zero-knowledge verification into the mainnet, enabling lazybridging and improving interoperability. In 2025, the Lotus release will aim to make TIA deflationary while incorporating staking rewards into vesting schedules for all locked TIA coins.

Developers plan to activate Ginger, the second major consensus upgrade after Lemongrass, to halve block production times and enhance user experience by improving transaction finality. Expanding the rollup ecosystem and increasing block space to 1 GB, combined with rising crypto prices, will likely support TIA prices going into 2026. As a result, we expect TIA to range between $8 to $12 by 2026.

TIA Price Forecast: Long-Term Outlook 2027–2030

By 2030, TIA could trade above $22 and surpass 2023 highs, though this depends on multiple external and internal factors.

Scaling Efforts

A key part of Celestia’s roadmap is scaling blockspace to dominate the scaling sphere. If it scales beyond 1GB blocks, achieving throughput exceeding 1GB/s, Celestia could attract more dApps as a host for unstoppable applications, offering developers full-stack control.

We also expect Celestia to optimize data availability sampling, allowing low-resource devices, such as mobile phones, to run nodes. More node operators would make the network more decentralized. Implementing internal sharding for fast data processing, optimizing consensus efficiency via CometBFT block propagation, and enabling compact blocks to lower bandwidth requirements would boost Celestia and TIA.

Moreover, the integrations with Manta, Polygon CDK, and Ethereum rollups like Optimism and Arbitrum have boosted its data availability market share to over 40%. Its interoperability with Hyperlane and the Cosmos ecosystem via IBC has facilitated cross-rollup communication, giving it an edge.

Partnerships with infrastructure providers like Blockdaemon have simplified deployment on the platform. If Celestia becomes a leading data availability layer hosting thousands of independent chains and app chains by 2030, TIA prices could exceed expectations.

Tokenomics

However, investors should monitor the TIA vesting schedule. The project began unlocking tokens in late 2023. They will continue releasing tokens daily, with the final unlock set for November 1, 2027. Tokens will be used to fund research and development, with others distributed to Series A and B investors, the team, and seed investors.

We project TIA prices to expand rapidly after the final unlock in late 2027, assuming demand rises above current levels. Our forecast places TIA above $22 by the end of the decade.

Our Celestia Price Prediction Methodology

This TIA price prediction considers technical analysis, examining price levels and whether bulls can prevent a drop below 2023 lows.

Fundamentals are critical. We emphasized the pace of Celestia’s innovative updates and network enhancements, distinguishing it from competitors.

We also analyzed market conditions, tokenomics, and the team’s plan to manage inflation.

TIA Price History

Celestia raised funds through community rounds, during which TIA traded at various prices. In March 2021, during the seed round, the team raised $1.59 million by selling TIA at $0.01 to investors, including Binance Labs.

In October 2022, the team raised $15 million during the Series A round, selling TIA at $0.0955. In the Series B round that same month, they raised $40 million, with TIA sold at $1. Two years later, in September 2024, they raised $100 million from investors, including Bain Capital and Placeholder.

After listing in October 2023, prices rallied to $21 by February 2024 before cooling off. Currently, as of December 23, 2025, TIA token is trading at $0.45 , which is a -2.72% (24 hours) change over the past 24 hours. It has a market cap of $278,860,083 .

What Is Celestia (TIA)?

Celestia is widely regarded as the first true modular blockchain, purpose-built to deliver low-cost, secure data availability for the next generation of rollups. Instead of forcing blockchains to bundle execution, consensus, and data availability together, Celestia allows independent rollups to plug into its consensus and DA layer, giving developers the freedom to build scalable chains without needing their own validator sets.

At its core, Celestia is built with the Cosmos SDK and relies on CometBFT for consensus, a combination known for reliability and high throughput.

What makes Celestia unique is its strict separation of roles:

• Execution happens on rollups

• Consensus happens on Celestia

• Data availability is guaranteed by Celestia’s network

This contrasts sharply with monolithic chains like Ethereum, Solana, and Avalanche, where all components compete for blockspace on the same layer, creating bottlenecks as demand grows. Celestia’s model enables horizontal scaling and allows even lightweight nodes to verify data availability through data availability sampling, reducing trust assumptions without sacrificing security.

Within this architecture, TIA is the economic engine of the ecosystem. It is used to:

• Pay for blobspace (data availability)

• Cover gas fees for rollups settling on Celestia

• Secure the network through staking

• Participate in governance and protocol upgrades

Staked TIA helps protect the network against malicious actors while giving delegators and validators a say in system changes. Celestia launched with a 1 billion TIA total supply, distributed across ecosystem contributors, community allocations, investors, and long-term development funds.

Is Celestia (TIA) a Buy?

As of mid-May 2025, TIA is a top 100 crypto with a market cap exceeding $1.7 billion, attracting users and investors alike. However, like all assets, TIA is volatile. Our predictions for the end of the decade may or may not materialize.

Instead of storing TIA on centralized exchanges, use a self-custodial wallet like Best Wallet. It is highly rated and secure, allowing users to explore and consider investing in some of the hottest presales. The wallet comes with a built-in DEX that lets you buy, sell, swap and stake various cryptocurrencies across 60+ blockchains.

It supports 1000+ cryptocurrencies and offers strong security features like two-factor authentication (2FA), biometric verification, and third-party insurance through Fireblocks. If you want to know more about this mobile wallet, consider checking out our dedicated Best Wallet review.

Conclusion

Celestia addresses a critical need in crypto: scalable layers for dApps solving real-world problems. Its modular architecture and broad integration network drive developer adoption, directly supporting TIA prices. Whether TIA surpasses expectations and reverses losses from its first two years post-listing remains to be seen.

If Celestia continues to build, TIA could easily exceed $23 by the end of the decade. However, if the 2024–2025 bull cycle ends and prices begin correcting, TIA and other cryptos could fall below key swing lows.