Key Notes

Bitcoin price shows a contrarian behavior to Bitcoin mining activity as the hashrate sees a sharpest drop since April 2024.

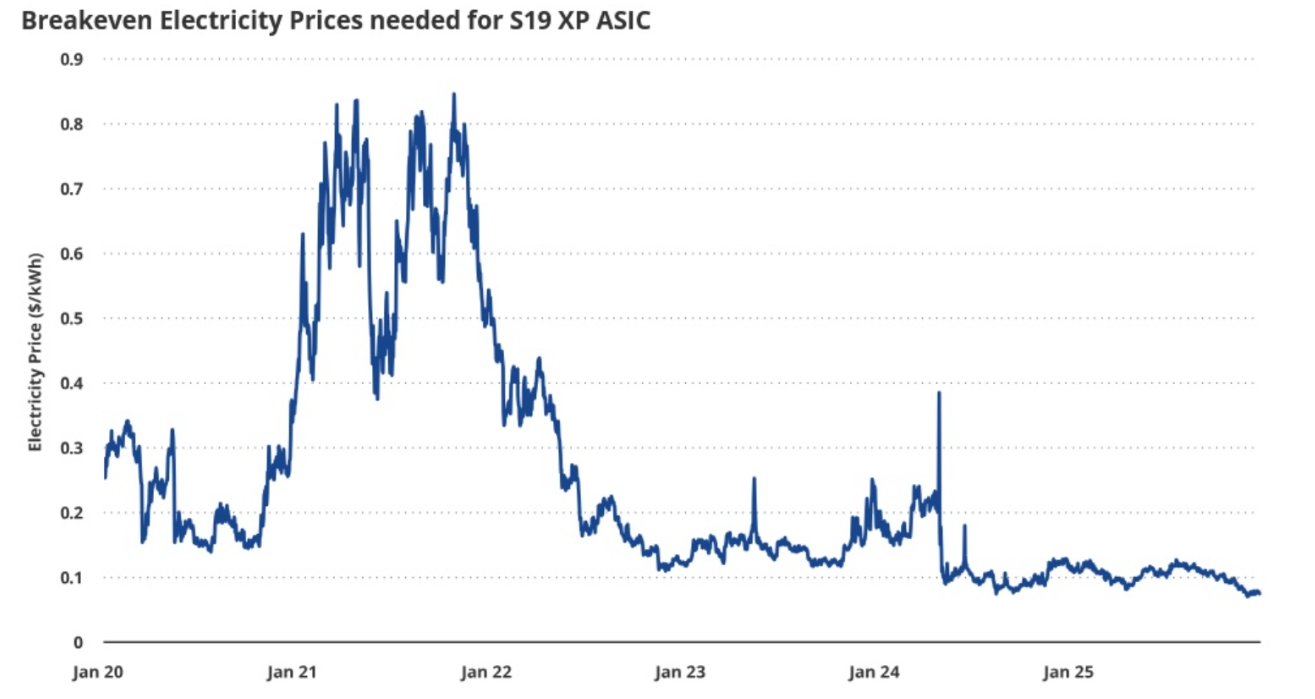

Breakeven electricity costs for rigs like the Antminer S19 XP have fallen about 35% since late 2024, suggesting a drop in profitability.

VanEck estimates nearly 400,000 mining machines have been shut down.

Crypto asset manager VanEck has recently released a report noting that the dip in Bitcoin mining activity suggests that the bottom is already here. Citing historical trends, they noted that miner capitulation has often been bullish for Bitcoin price. BTC is currently trading at $87,348 levels. However, finding it difficult to break past the $90K resistance level.

Bitcoin Price Can See Upside amid Miner Capitulation, Says VanEck

In its latest report, dubbed “Mid-December 2025 Bitcoin ChainCheck,” VanEck noted that the recent drop in mining activity suggests that the Bitcoin price bottom is here. Citing historical trends since 2014, the analysts said that Bitcoin’s 90-day forward returns have been positive 65% of the time during periods when network hashrate was declining.

Thus, the asset manager said that the falling hashrate works as a contrarian bullish signal for the Bitcoin price. It also reflects miner capitulation with less efficient miners exiting the network under financial pressure.

According to VanEck, this historical pattern is emerging again. They noted that Bitcoin’s hashrate has dropped about 4% in the month through Dec. 15, marking the steepest decline since April 2024.

The report also mentions that “when hashrate compression persists over longer periods, positive forward returns tend to occur more often and with greater magnitude.”

Breakeven Price for Bitcoin Miner Drops 35%

Amid the recent Bitcoin price correction, the mining profitability has also dropped in line. According to VanEck, breakeven electricity costs for a mid-generation mining rig such as the Antminer S19 XP have dropped sharply, falling from about $0.12 per kilowatt-hour in late 2024 to roughly $0.077 by mid-December 2025.

Drop in Bitcoin miner breakeven price | Source: VanEck

Breakeven electricity cost represents the highest power price miners can pay without operating at a loss. A declining breakeven price shows worsening mining economics, as only operators with access to cheaper electricity remain profitable.

As per VanEck, the recent 4% drop in Bitcoin hashrate is the steepest since April 2024. This drop was likely caused by the shutdown of around 1.3 gigawatts of mining capacity in China.

They added that a significant portion of this power capacity could be redirected to support growing demand from artificial intelligence workloads. According to their estimates, this shift could ultimately remove as much as 10% of Bitcoin’s total hashrate.

VanEck estimates that nearly 400,000 Bitcoin mining machines have been taken offline amid a prolonged period of weak mining profitability. The asset manager also said it believes as many as 13 countries are currently supporting Bitcoin mining through backing from central governments.