Best crypto to buy now is at the center of discussion in the crypto market after the broader market saw a slight recovery over the weekend. The largest crypto, Bitcoin, retested the $90,000 psychological level, while Ethereum surged above $3,000.

However, bearish dominance remains intact, causing prices to pull back on Monday. Top cryptos are still trading in range-bound action.

Meanwhile, the largest corporate Bitcoin holder, MicroStrategy, founded by Michael Saylor, has temporarily paused Bitcoin accumulation but is increasing its cash reserves to $2.19 billion. Currently, Strategy holds 671,268 BTC, with some analysts suggesting the halt was due to a prolonged crypto market correction.

Amid this chaos, some utility tokens are emerging as strategic safe-haven bets. One name is Bitcoin Hyper, a layer-2 infrastructure project aiming to transform Bitcoin’s utility. While the established tokens are bleeding in a bearish market, HYPER has held its support. With a well-planned roadmap and unique infrastructure, Bitcoin Hyper is leading the race for the best crypto to buy now.

Broader Market Struggle As Top Tokens Stagnate

The broader crypto market has once again failed to break out of the bear grip. On Monday, top cryptos saw sharp rejection from previous highs. The total crypto market cap has dropped to $3.08 trillion after a slight recovery.

In the weekend’s attempt, Bitcoin failed to break above the psychologically important $90,000 mark decisively. Other established tokens, including Ethereum, Solana, and BNB, are also struggling near their immediate resistance levels. The pullback came after cooling institutional demand and cautious positioning ahead of the year-end holiday period.

Bitcoin Price Chart. Image Courtesy: TradingView

ETF products also suffered in this market correction with a volatile December. The month saw heavy selling pressure hit both Bitcoin and Ethereum exchange-traded funds (ETFs), with last week’s outflow of $1.1 billion.

The bear cycle has stretched for nearly six months now. Experts believe that the crypto market could soon find a bottom, prompting investors to scan for the best crypto to buy now.

Strategy Halts Bitcoin Buying, Focuses on Cash Reserves

Strategy, one of the largest corporate holders of Bitcoin, has stopped buying BTC for the first time since July. Instead of adding more coins, the company has been building cash reserves, which now stand at $2.19 billion. This move suggests the firm may be bracing for a more extended period of weakness in the crypto market.

No new orange dots this week — just a $9 billion reminder of why we HODL. pic.twitter.com/P84m14WF3G

— Michael Saylor (@saylor) October 5, 2025

Executive Chairman Michael Saylor confirmed the updated cash position and said the company still holds 671,268 Bitcoin. While Strategy has paused fresh purchases, it has not reduced its existing holdings. For a company known for consistently buying Bitcoin, this marks an apparent change in approach.

This pause is not entirely new for Strategy in 2025. Earlier in the year, the company slowed its buying during a highly volatile market phase. Soon after, Bitcoin fell below Strategy’s average purchase price, dropping in April. Those earlier buys remained underwater for weeks before the price recovered in early May, when BTC climbed back above $97,000.

While institutions pull money out of established tokens, new projects with strong fundamentals are seeing massive traction.

Why Some Investors See Bitcoin Hyper as a “Smart Hedge”

As the broader market experiences significant volatility, finding the best crypto to buy now has become difficult. The Bitcoin Hyper DeFi project has shown strong momentum in these market conditions, already selling more than 650 million tokens and raising nearly $30 million in its ongoing presale.

Bitcoin was designed to be highly secure and decentralized, but that focus comes with trade-offs. Speed and scalability take a back seat, limiting the network to roughly 7 transactions per second. When demand rises, transaction fees climb quickly, making everyday use costly and slow.

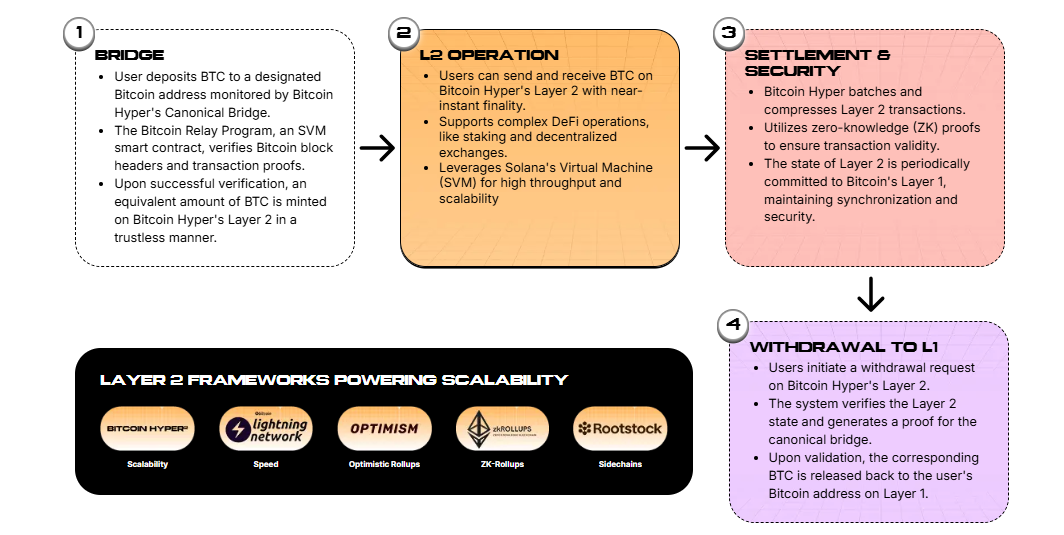

Bitcoin Hyper is built to solve this bottleneck. Instead of working within Bitcoin’s constraints, it operates as a fast Layer 2 system that brings Bitcoin-level value into a modern execution environment. By using a high-performance virtual machine inspired by Solana’s architecture, it can process transactions quickly, scale efficiently, and support advanced applications that the Bitcoin base layer cannot manage on its own.

The process is straightforward. A user sends Bitcoin to a dedicated address monitored by Bitcoin Hyper’s bridge. The system independently verifies the transaction on the Bitcoin network. After confirmation, the same amount of Bitcoin becomes available on Bitcoin Hyper’s Layer 2. This entire flow runs without intermediaries, ensuring users stay in control without trusting a central authority.

Bitcoin Hyper: Positioning For Wider Adoption

$2 trillion Bitcoin capital in the market opportunity

Strict security audits are increasing investors’ confidence

39% APY staking rewards for ICO adopters

Over $29.69 million raised and 650 million+ tokens sold

Presale is providing a discounted price opportunity of $0.013465 per HYPER token

Bitcoin Hyper is still trading at a highly undervalued price and is emerging as a top crypto below $1 with real-world use. Its layer-2 design, transforming $2 trillion in Bitcoin utility, Coinsult and Spywolf’s audited security, and growing demand from institutions and retail show long-term growth. As investors are looking to recover losses, Bitcoin Hyper is seeing massive adoption.