Bitcoin’s price action has remained volatile in recent sessions, with recovery attempts struggling to gain traction. BTC has attempted to stabilize after recent pullbacks, yet demand from exchange-traded fund investors appears uneven.

Despite this hesitation, BlackRock continues to highlight Bitcoin as a core long-term allocation, signaling confidence that extends beyond short-term price swings.

Bitcoin Seems To Be A BlackRock Favorite

BlackRock has included its spot Bitcoin ETF among its three primary investment themes for 2025. The decision reflects long-term conviction rather than short-term trading momentum. While Bitcoin experienced sharp price fluctuations this year, capital flows into the ETF remain substantial.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

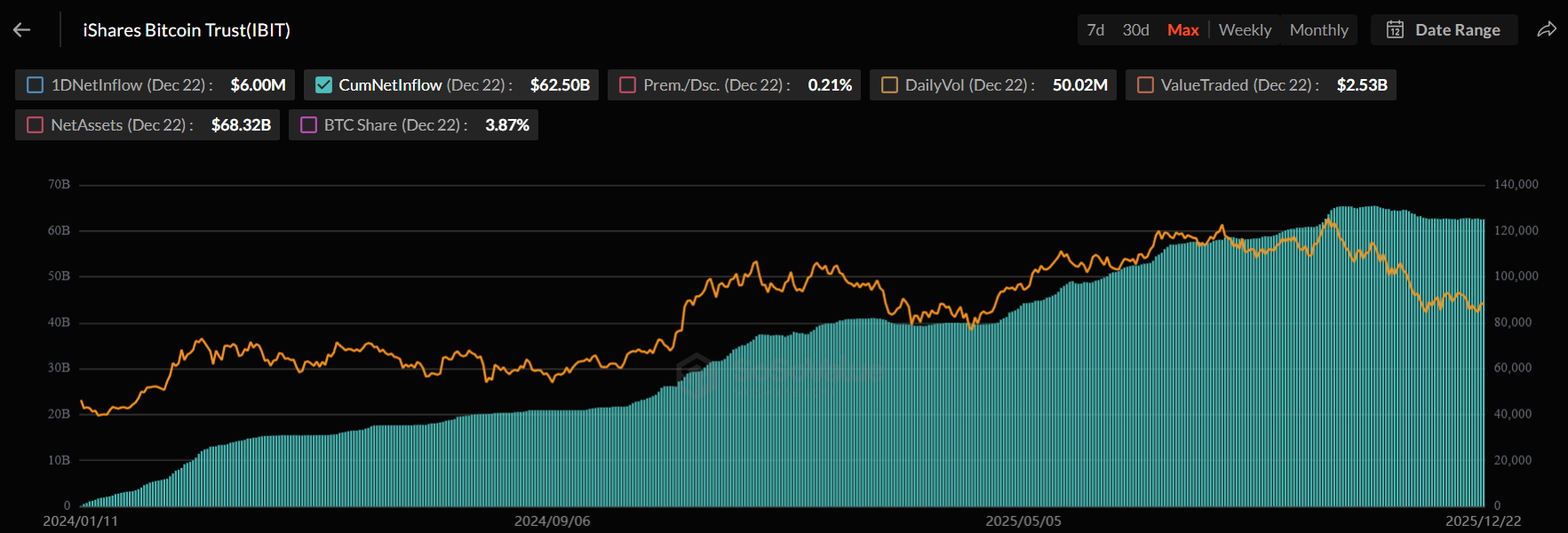

BlackRock Bitcoin ETF Cumulative Inflows. Source: SoSoValue

Year-to-date net inflows into BlackRock’s Bitcoin ETF stand at approximately $29.6 billion. Cumulative net inflows have reached $62.5 billion since launch. These figures underscore sustained institutional interest, helping explain why BlackRock continues to highlight Bitcoin within its strategic outlook despite market volatility.

Bitcoin Is Doing Well In The Futures Market

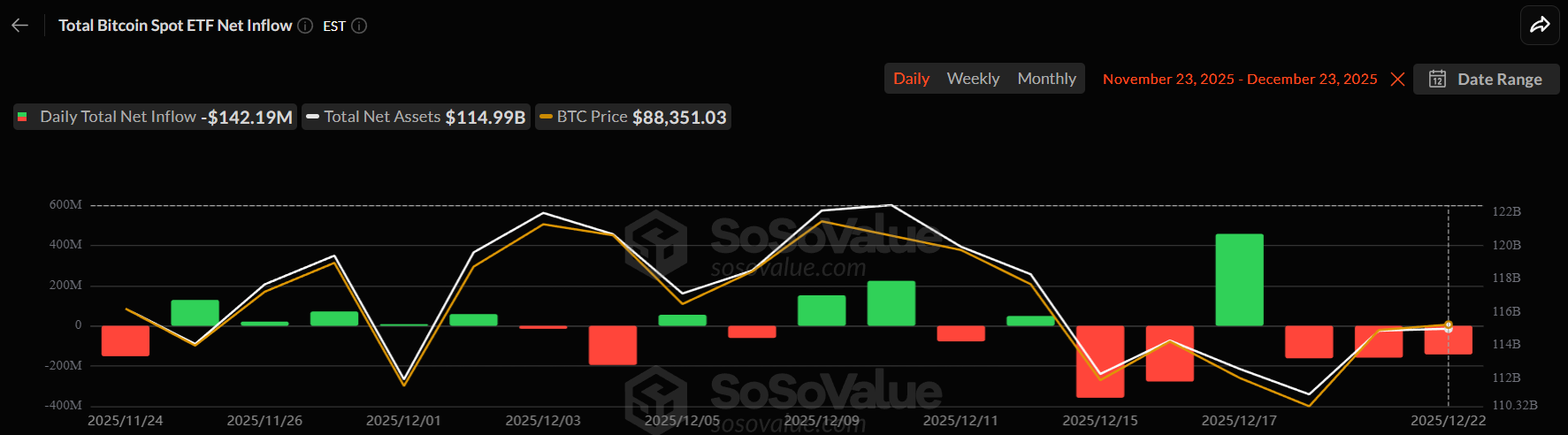

Short-term ETF trends present a contrasting picture. Bitcoin ETFs have recorded outflows on roughly half of the trading days over the past month. This pattern indicates cooling demand among some investors, particularly those with shorter time horizons.

On Monday, Bitcoin ETFs collectively registered $142 million in net outflows. The decline highlights hesitation amid price uncertainty. While long-term capital remains committed, near-term flows suggest investors are cautious, waiting for clearer signals before increasing exposure.

Bitcoin Spot ETF Flows. Source: SoSoValue

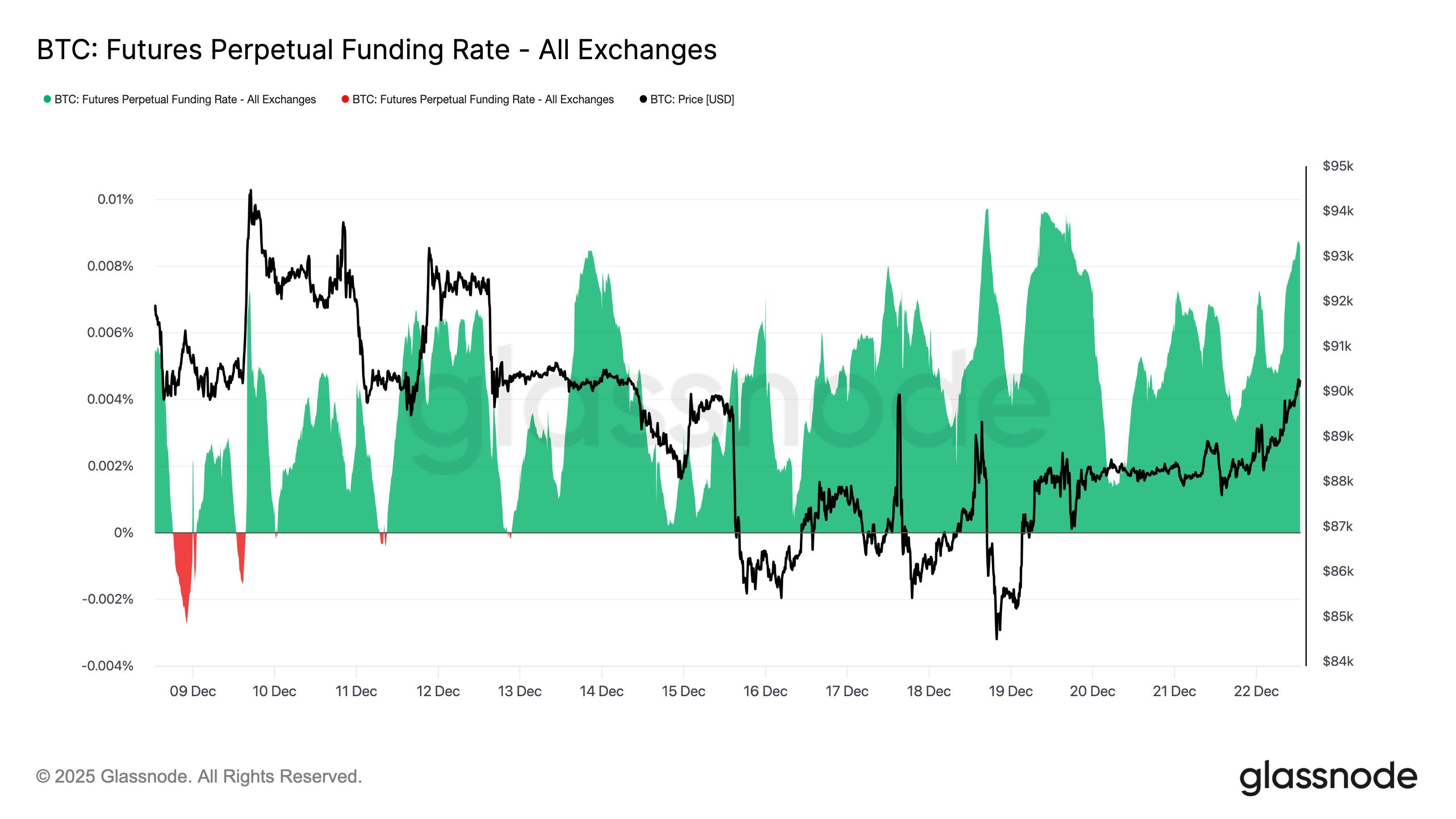

Derivatives data adds another layer to the outlook. Despite uneven spot demand, perpetual futures positioning is expanding. With Bitcoin recently trading back above $90,000, perpetual open interest increased from 304,000 BTC to 310,000 BTC, a roughly 2% rise.

Funding rates have also climbed, moving from 0.04% to 0.09%. This combination suggests renewed leveraged long positioning. Traders appear to be positioning for a potential year-end move, increasing risk appetite even as spot demand remains mixed.

Rising open interest alongside higher funding often reflects growing optimism. However, it also increases sensitivity to volatility. If price momentum weakens, leveraged positions can unwind quickly, amplifying short-term swings.

Bitcoin Futures Perpetual Funding Rate. Source: Glassnode

BTC Price Could Register Gains In The Short-Term

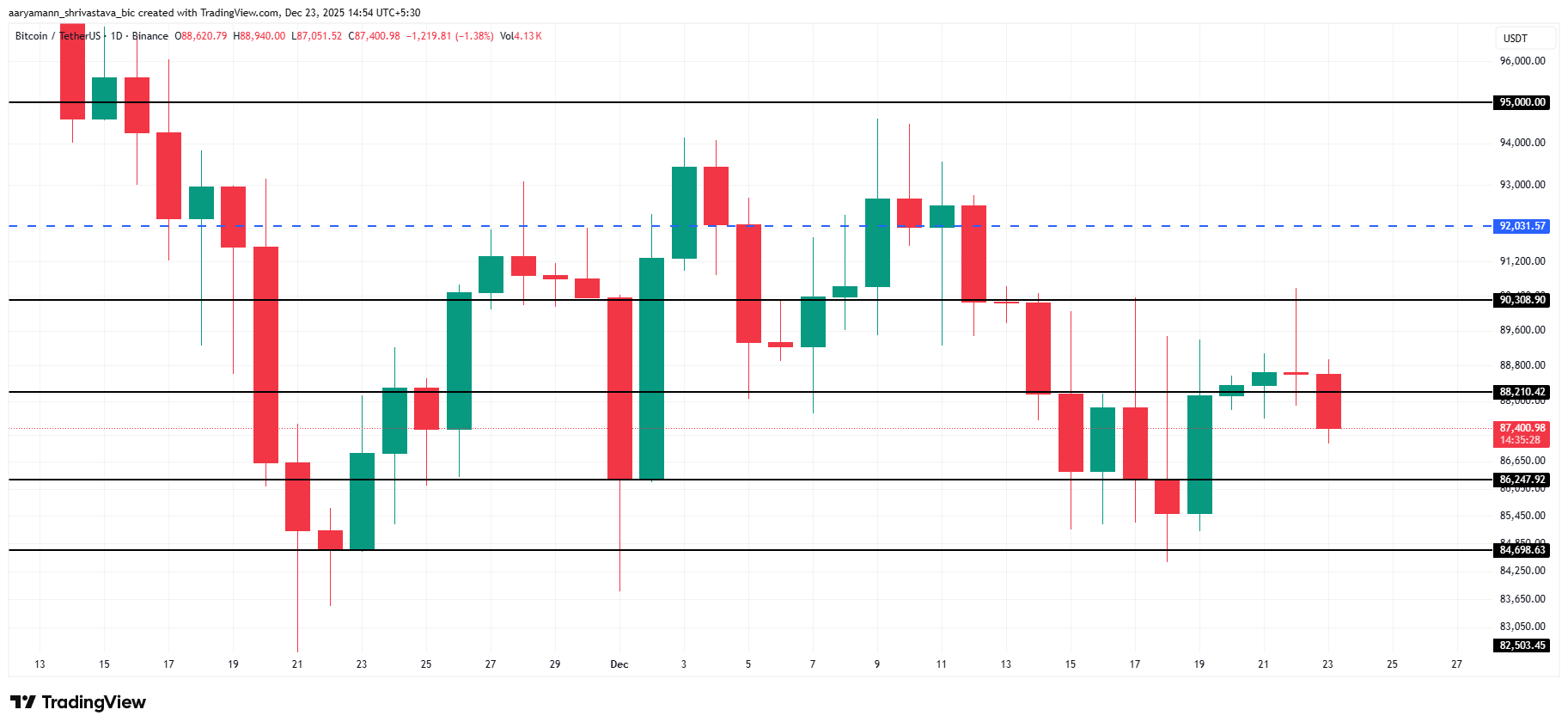

Bitcoin trades near $87,400 at the time of writing, sitting just below the $88,210 resistance. Technical structure suggests room for an upside attempt. Short-term momentum could improve if buyers defend current levels and broader sentiment stabilizes.

Seasonal factors may influence price action. The Christmas trading week has historically brought increased inflows and reduced liquidity. If demand improves, Bitcoin could push toward $90,308, supported by leveraged positioning and renewed investor interest.

Bitcoin Price Analysis. Source: TradingView

Downside risks remain if optimism fails to materialize. A breakdown below $86,247 would weaken the recovery structure. In that scenario, Bitcoin could slide toward $84,698. Such a move would invalidate the bullish thesis and reinforce near-term caution despite long-term institutional support.