Dogecoin extends its decline as risk-off sentiment dominates across the crypto market.

DOGE’s derivatives market remains weak amid suppressed futures Open Interest and perpetual funding rate.

The MACD indicator rises on the daily chart, signaling a potential turnaround if investors buy the dip.

Dogecoin (DOGE) is hammering on $0.13 support at the time of writing on Tuesday as overhead pressure continues to spread across the crypto market. The largest meme coin by market capitalization faces a deteriorating technical structure, weighed down by a weak derivatives market.

Dogecoin derivatives market stays silent

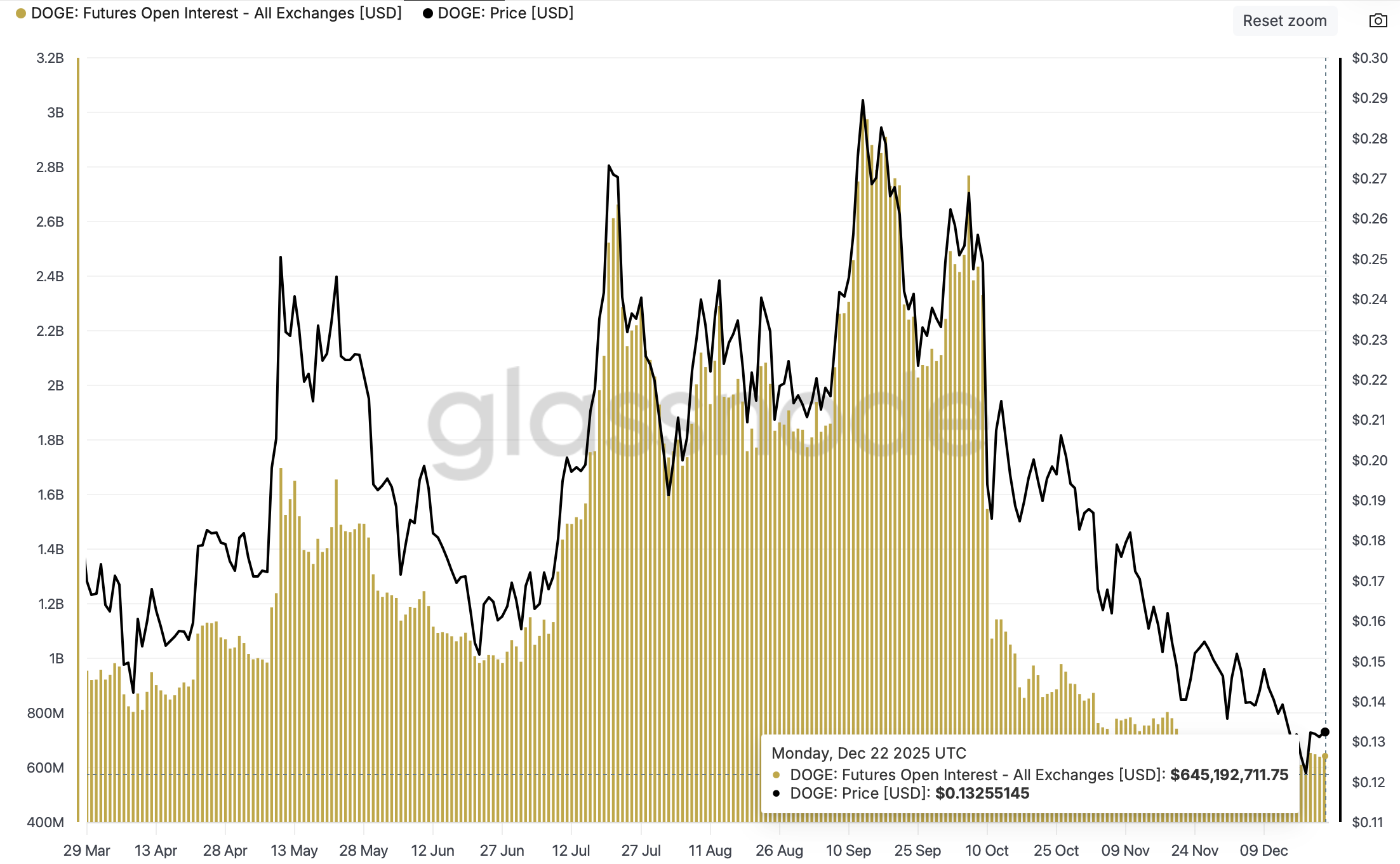

The Dogecoin derivatives market has remained significantly suppressed since the October 10 crash, which led to extensive deleveraging. According to Glassnode’s data, futures Open Interest (OI) across all exchanges stood at approximately $645,000 as of Monday, up slightly from roughly $640,000 the previous day but significantly below the $1.5 billion recorded on October 10.

Dogecoin’s OI hit a record high of approximately $3 billion on September 13, which emphasizes the significant decline in trader interest and confidence. The suppressed OI suggests that traders are unwilling to take on risk, a situation that continues to limit rebounds.

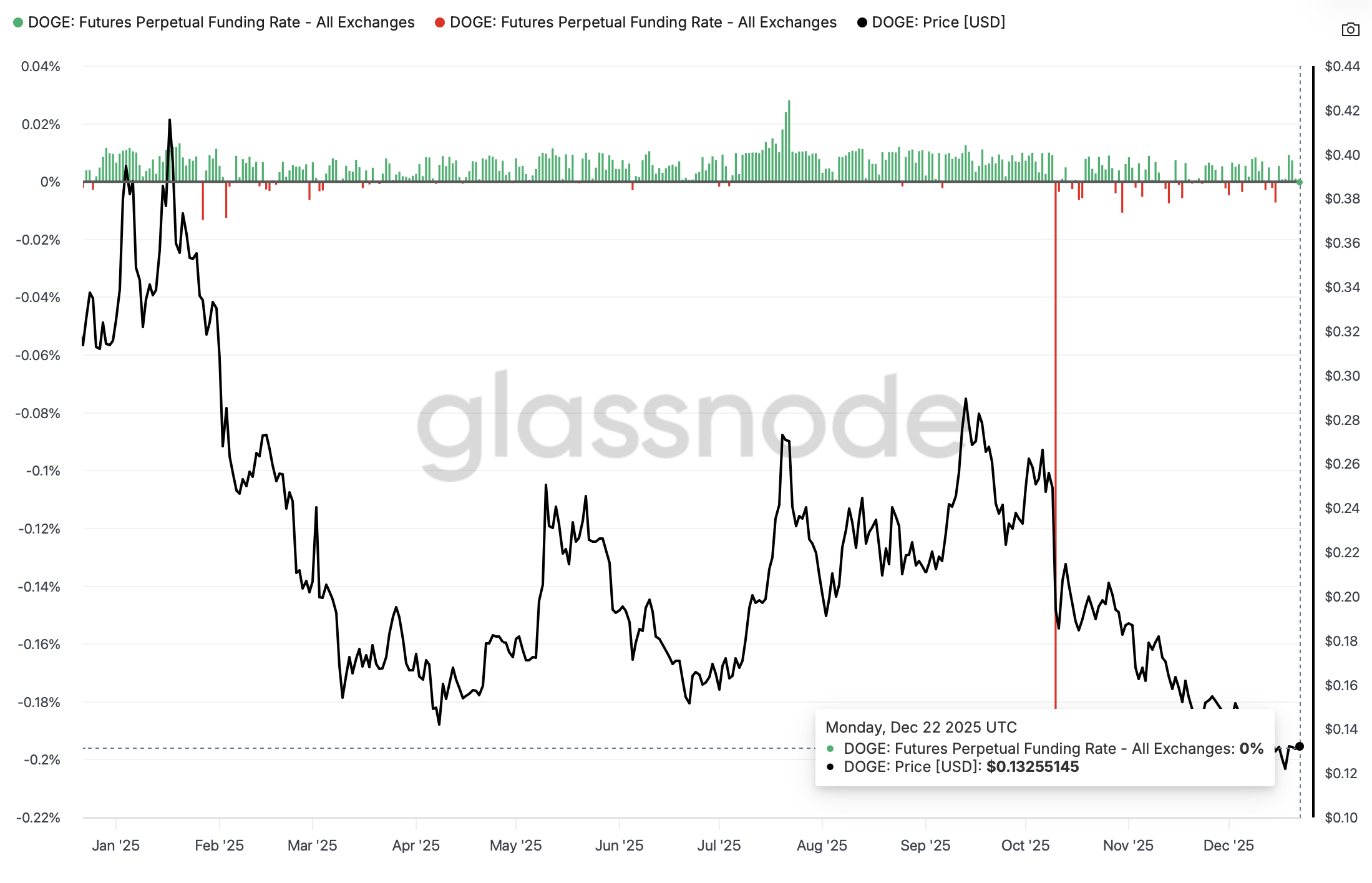

Dogecoin’s futures perpetual funding rate continues to fluctuate, depriving the meme coin of the tailwind it needs to sustain its recovery. According to Glassnode’s data, the funding rate is silent at zero as of Monday, down from 0.001% the previous day and 0.007% on Sunday.

A negative funding rate indicates that traders are piling into short positions, helping keep the price suppressed. A positive but low funding rate suggests that fewer traders are increasing exposure to the meme coin. On the other hand, a rising funding rate would support the bullish outlook and increase the odds of a steady uptrend.

Technical outlook: Dogecoin trades sideways and under pressure

Dogecoin is trading above $0.13 at the time of writing on Tuesday. The meme coin holds below the falling 50-day Exponential Moving Average (EMA) at $0.15, the 100-day EMA at $0.17 and the 200-day EMA at $0.19, all of which underscore a bearish setup.

The Relative Strength Index (RSI) stands at 41, below the midline on the daily chart, confirming restrained buying interest. If the RSI declines further toward oversold territory, the path with the least resistance would stay downward, increasing the odds of DOGE retesting support at $0.12.

Still, a bullish crossover emerges as the Moving Average Convergence Divergence (MACD) line climbs above the signal line on the same chart. The green histogram bars have turned slightly positive above the mean line, suggesting improving momentum.

However, a sustained break above $0.15 resistance could open the way toward the 100-day EMA at $0.17. Failure to reclaim that barrier would keep bears in control beneath the 200-day EMA at $0.19. Meanwhile, the Average Directional Index (ADX) at 36 continues to fade, pointing to softer trend strength and a consolidative tone until a clear break.