Novo Nordisk shares jumped sharply on Tuesday, extending a strong rebound as investors reacted to a major regulatory milestone and improving technical signals after a difficult year for the stock.

The Danish drugmaker’s Class B shares climbed just over 8%, trading near 328 DKK ($47.50), marking one of the strongest single-day gains in months. The rally pushed Novo Nordisk back toward key technical levels after a prolonged period of weakness that had weighed heavily on sentiment throughout 2024 and most of 2025.

Key takeaways

Novo Nordisk shares jumped over 8%, marking one of the strongest sessions of the year

The rally was driven by U.S. approval of the Wegovy oral GLP-1 weight-loss pill

Technical indicators such as RSI and MACD have turned supportive

Analysts see average upside toward 385 DKK ($55.80), with bullish targets extending higher

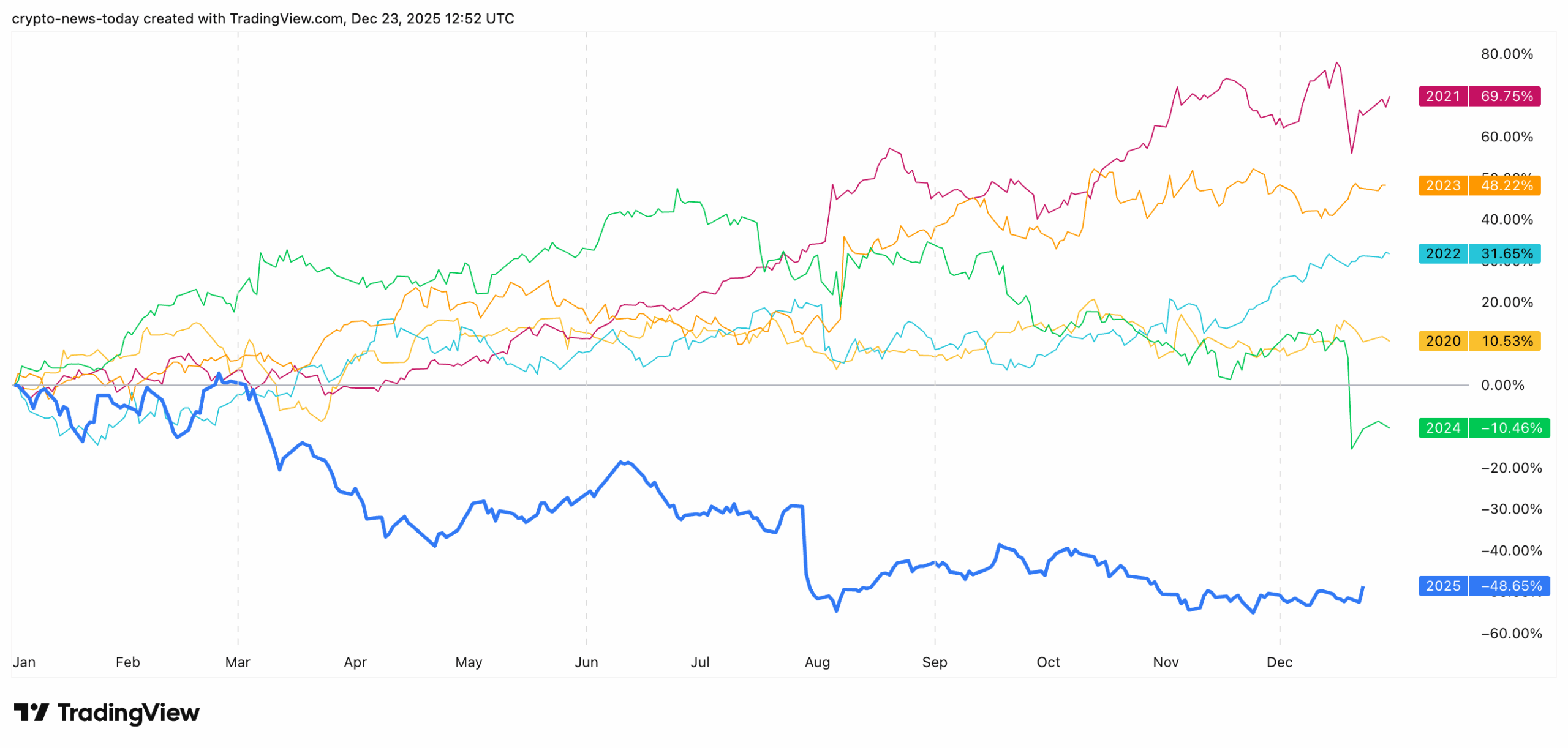

The move stands out against a backdrop of uneven historical performance. While Novo Nordisk delivered outsized gains in earlier years – including a nearly 70% advance in 2021 and solid returns in 2022 and 2023 – the stock struggled to maintain momentum in 2024 and fell sharply in 2025, with year-to-date losses previously approaching 50%.

Tuesday’s surge signals a potential turning point as buyers re-emerge.

Regulatory approval sparks renewed optimism

The immediate catalyst behind the rally was confirmation that U.S. regulators approved Novo Nordisk’s Wegovy pill, the first oral GLP-1 treatment cleared for chronic weight management. The drug is indicated for adults with obesity or overweight conditions and at least one related health issue, significantly expanding the potential patient base.

#PRESS The first GLP-1 pill for the treatment of obesity is now approved by the US Food and Drug Administration (FDA).

Learn more in our company announcement here: https://t.co/w9RVHx6Suy pic.twitter.com/p7wfdvXi0O

— Novo Nordisk (@novonordisk) December 22, 2025

According to the company, the pill demonstrated an average weight loss of 16.6% in late-stage trials and is expected to launch in the U.S. in early January 2026. The approval gives Novo Nordisk a strategic edge in the fast-growing obesity treatment market, where ease of administration is increasingly seen as a key differentiator versus injectable therapies.

Market participants also noted that the decision helps Novo Nordisk regain momentum in its competitive battle with Eli Lilly, particularly after concerns earlier this year that rivals were narrowing the gap in next-generation weight-loss treatments.

Technical indicators turn supportive

Beyond the headline news, the technical picture has started to improve. On the daily chart, Novo Nordisk’s Relative Strength Index climbed toward the upper-50s, moving away from oversold territory and suggesting strengthening bullish momentum. At the same time, the MACD histogram has flipped positive, with the signal lines converging after months of negative readings.

Moving averages are also beginning to align more constructively. Short-term averages have turned upward, and TradingView’s indicator summary for the daily timeframe now leans toward a “Buy” signal, with moving averages and oscillators both flashing supportive readings.

Analysts see room for further upside

Analyst forecasts reinforce the improving outlook. The average one-year price target stands near 385 DKK ($55.80), implying upside of roughly 17% from current levels. The most bullish projections reach as high as 540 DKK ($78.30), while the most cautious estimates cluster around 230 DKK ($33.40), highlighting a wide dispersion of views but a generally positive skew.

Ratings data show a clear tilt toward optimism, with a majority of analysts maintaining Buy or Strong Buy recommendations. While a meaningful minority still urges caution following the stock’s volatile year, the balance has shifted decisively in favor of upside scenarios.

A brighter outlook after a turbulent year

Novo Nordisk’s surge comes after a period marked by sharp drawdowns, uneven quarterly performance, and rising competitive pressure. For much of the past year, the stock lagged both healthcare peers and broader equity benchmarks, eroding confidence among momentum-driven investors.

The latest rally does not erase those challenges overnight, but it does reshape the near-term narrative. With regulatory risk reduced, technical momentum improving, and analysts pointing to renewed upside potential, the stock appears to be entering a new phase – one defined less by retracement and more by recovery.