As markets look ahead to 2026, investors are increasingly focused on companies with durable earnings power, structural growth drivers, and the ability to navigate shifting macro conditions.

While short-term volatility remains a constant, long-term positioning continues to favor businesses with scale, pricing power, and exposure to multi-year themes such as artificial intelligence, financial modernization, and healthcare innovation. Below are five stock market picks that analysts and long-term investors are closely watching as potential leaders into 2026.

Key Takeaways

2026 positioning favors quality, cash flow, and structural growth themes.

Technology, healthcare, and financials remain central to long-term portfolios.

Market leadership is expected to concentrate in companies with strong balance sheets and recurring revenue.

These picks emphasize resilience over speculation.

Technology Leaders Anchoring Growth

Large-cap technology continues to form the backbone of long-term equity strategies, driven by artificial intelligence adoption, cloud infrastructure, and platform dominance.

Microsoft stands out as a core holding for 2026. Its deep integration of AI across enterprise software, cloud services, and productivity tools gives it exposure to both near-term monetization and long-term infrastructure spending. Azure growth, coupled with strong free cash flow, positions the company well even in slower economic environments.

NVIDIA remains central to the AI buildout. Demand for data center accelerators, high-performance computing, and AI-specific chips continues to exceed supply. While valuation sensitivity is a risk, NVIDIA’s role as a foundational supplier for AI infrastructure makes it difficult to ignore in a 2026 outlook.

Consumer and Healthcare Resilience

Beyond technology, defensive growth sectors are expected to play a larger role as investors balance innovation with stability.

Apple offers a blend of consistency and optionality. Its services segment continues to expand margins, while hardware upgrades, ecosystem lock-in, and potential AI-driven device features provide longer-term upside. Apple’s balance sheet strength also gives it flexibility for buybacks and strategic investment.

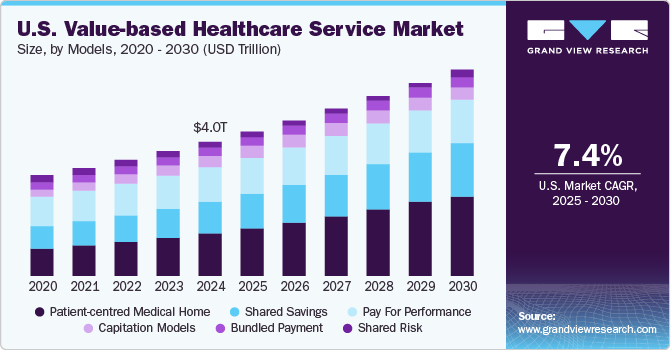

In healthcare, Eli Lilly is widely viewed as one of the strongest growth stories heading into 2026. Its leadership in obesity and diabetes treatments has reshaped expectations for the sector, with demand trends suggesting multi-year revenue expansion. Continued pipeline development further supports long-term confidence.

Financials Positioned for Structural Change

Financial stocks are often overlooked in growth-focused portfolios, but selective exposure may prove valuable over the next cycle.

JPMorgan Chase remains a standout among global banks. Its scale, diversified revenue streams, and technological investment give it a competitive edge as financial markets evolve. As capital markets activity normalizes and digital finance expands, JPMorgan is positioned to benefit without relying on excessive risk-taking.

Looking Ahead to 2026

These five stocks reflect a broader theme shaping expectations for 2026: concentration in quality. Rather than broad-based rallies, market leadership is increasingly expected to come from companies with proven execution, strong cash generation, and exposure to long-term economic shifts.

While no forecast is without risk, focusing on durable business models rather than short-term narratives may offer investors a steadier path as the next market phase unfolds.