ChatGPT-5 predicts a turbulent but promising future for Bitcoin, especially as gold and silver surge to all-time highs. Bitcoin is currently trading at $87,360, down 2.57% in the last 24 hours. While traditional assets like gold sit above $4,481/oz and silver climbs toward $2,234/kg, many investors are reevaluating their crypto exposure.

AI models like ChatGPT-5 are now being used to anticipate medium- to long-term movements. With Fed rate cuts expected in 2026, ETF volatility rising, and Bitcoin’s tight supply near 19.96M BTC, the stage is set for an upward trajectory – but not without short-term swings.

At the same time, interest in early-stage coins like Bitcoin Hyper is growing fast. With over $29.7M raised and less than $400K to go before the next price hike, this presale is capturing retail momentum that Bitcoin may be too large to absorb.

ETF Outflows and Macro Forces Are Still Holding BTC Back

Macro trends remain supportive. Inflation in the US is cooling, with recent CPI data pushing expectations for rate cuts by 2026. As real yields fall, Bitcoin’s appeal as a store of value increases. However, ETF flows tell a mixed story.

By December 19, Bitcoin ETFs reported net outflows of $479.1 million, bringing December’s total to $298.2 million. November, in contrast, saw inflows of $3.47 billion. These swings have become a primary driver of price consolidation.

Despite strong macro tailwinds, short-term sentiment remains cautious. Investors are still adjusting to how ETFs interact with Bitcoin’s fixed supply, especially with only 1.97M BTC left to be mined.

Technical Setup: Bullish Flag Nearing Breakout?

On the technical side, Bitcoin has formed a bullish flag on the 4-hour chart, with a breakout point at $89,500. If confirmed, ChatGPT-5 predicts a potential move above $90,000 in the short term.

Currently, BTC is ranging between $84,000 and $95,000. RSI has recovered near 50, and MACD is still negative but rising. These signals suggest upward momentum may resume soon.

Analysts point out that holding the $87,000–$88,000 level is critical. A breakdown risks invalidating the short-term bullish thesis. Investors should watch for volatility as ETF outflows settle and sentiment adjusts post-holiday.

ChatGPT-5 Predicts: Mid- and Long-Term Outlook Remains Strong

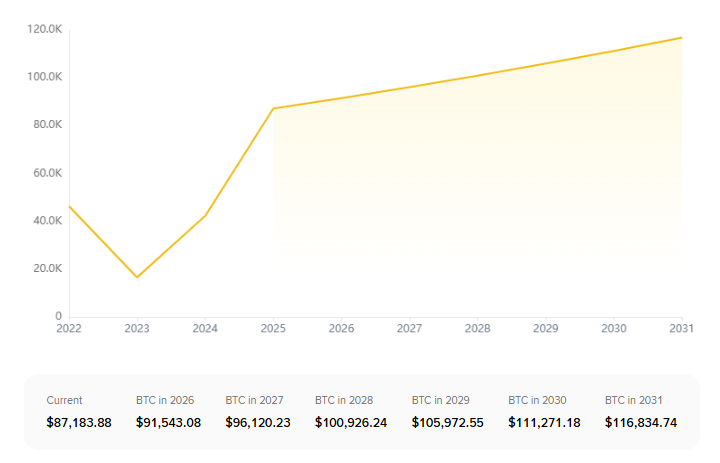

Looking beyond current chop, ChatGPT-5 predicts the following yearly averages based on trend extrapolations and macro alignment:

| Year | Predicted Bitcoin Price |

| 2026 | $93,067.80 |

| 2027 | $97,721.19 |

| 2028 | $102,607.25 |

| 2029 | $107,737.61 |

| 2030 | $113,124.49 |

| 2031 | $118,780.72 |

Other models place BTC near $100,926 by 2028 and crossing $116,834 by 2031. These projections align closely with expected Fed easing cycles, declining dollar strength, and continued institutional adoption.

Near-term forecasts also remain steady. The Bitcoin price is expected to trade around $87,195.54 on Dec 24, and $87,534.20 by Jan 22, 2026, suggesting range-bound movement until larger macro catalysts emerge.

Gold and Silver Rally: Safe Havens Regain Attention

Bitcoin’s competitor as a store of value – gold – is having a breakout December. Gold recently hit $4,481/oz, up 1.06% in a single day. Silver has surged past $69.56, marking one of its strongest runs since 2020.

This shift into metals reflects broader safe-haven demand. However, many younger traders and risk-on investors are turning instead to alternative digital assets like Bitcoin Hyper, where potential upside isn’t capped by slow-moving traditional markets.

Bitcoin Hyper Gains Momentum as BTC Consolidates

With Bitcoin stuck near support, new capital is flowing into Bitcoin Hyper. At $0.013465 per token, the project has now raised over $29.7 million, nearing its $30M milestone. Once this threshold is passed, the price will automatically rise.

ChatGPT-5 predicts that Bitcoin Hyper could benefit from this rotation. Early-stage investors looking for 5×–10× returns may find BTC too mature, while Hyper’s presale status and timing give it significant upside as Bitcoin digests macro flows.