Bitcoin is on track to close the year in negative territory, a development that has reinforced growing concerns among analysts who are increasingly positioning for a potential bear market ahead. After failing to sustain momentum above key psychological and technical levels, market sentiment has shifted toward caution, with investors closely monitoring liquidity behavior and exchange flows for early signals of regime change.

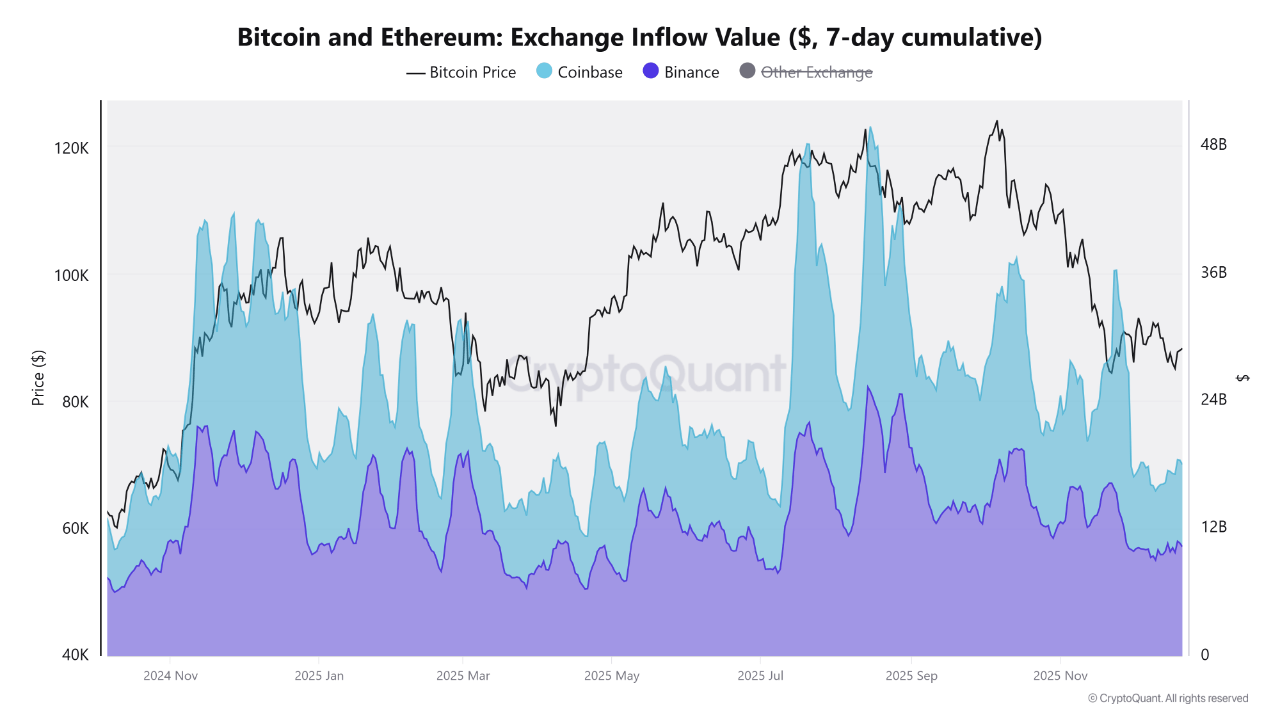

Recent analysis from Arab Chain, based on CryptoQuant’s Exchange Inflow Value (7-day cumulative) metric, highlights a notable divergence in liquidity patterns between major exchanges. The data aggregates Bitcoin and Ethereum inflows, providing a broader view of risk positioning across the two largest crypto assets.

On November 24, when Bitcoin was trading around $88,438, Coinbase recorded seven-day cumulative inflows totaling approximately $21.0 billion. In contrast, Binance saw lower, though still significant, inflows near $15.3 billion.

What stands out is that these elevated inflows occurred while prices were already well below prior highs. Rather than signaling aggressive accumulation, the data points to increased exchange activity consistent with portfolio rebalancing, hedging, or preparation for potential distribution.

Exchange Inflows Signal Liquidity Tightening Despite Stable Bitcoin Prices

By December 21, Bitcoin was trading near $88,635. Only marginally higher than late-November levels and still locked within a narrow consolidation range. While price action showed little progress, exchange flow data pointed to a notable shift in market conditions. Updated on-chain figures indicate that liquidity entering major trading venues declined sharply over the span of just a few weeks, underscoring a cooling in overall market activity.

Coinbase, often used as a proxy for institutional and US-based flows, saw seven-day cumulative inflows fall to roughly $7.8 billion. That represents a steep drop of more than 60% compared with inflow levels observed in late November. Binance also experienced a contraction, but the decline was materially less severe, with inflows totaling about $10.3 billion over the same period. As a result, Binance surpassed Coinbase in net inflows during December, reversing the earlier dynamic.

This divergence suggests that while broad liquidity has tightened, trading activity has become more concentrated on venues associated with shorter-term positioning and active risk management. At the same time, the absence of a significant price reaction highlights how Bitcoin has continued to trade sideways even as fresh capital flows slowed.

Taken together, the data points to a market operating with reduced turnover and lower urgency on both the buy and sell side. Bitcoin’s ability to remain range-bound amid shrinking inflows reflects a quieter, more constrained liquidity environment compared with conditions seen just one month earlier.

BTC Slips Below Key Moving Averages as Daily Trend Weakens

Bitcoin is trading near the $87,900 level on the daily chart, extending a corrective move that began after the failed breakout above $120,000 earlier in the quarter. The structure now reflects a clear shift in short-term trend dynamics, with price firmly below its major daily moving averages. Notably, Bitcoin has lost the 111-day and 200-day simple moving averages. Both of which have started to roll over and act as dynamic resistance rather than support.

The rejection from the $110,000–$115,000 zone marked a decisive lower high, followed by an impulsive sell-off toward the mid-$80,000 range. Since then, price action has compressed into a narrow consolidation, suggesting temporary stabilization rather than a confirmed reversal. However, the inability to reclaim the declining moving averages indicates that upside attempts remain fragile.

Volume behavior adds to the cautious outlook. Selling pressure expanded during the initial breakdown, while subsequent rebounds have occurred on muted volume, signaling limited conviction from buyers. This imbalance suggests that dip-buying demand is present but not strong enough to force a trend shift.

From a technical perspective, the $85,000–$88,000 area has become a critical near-term support zone. A sustained hold could allow for range formation. Failure to defend this level would increase the risk of a deeper retracement. For sentiment to improve, Bitcoin would need to reclaim the $95,000–$100,000 region and stabilize above its key daily averages.

Featured image from ChatGPT, chart from TradingView.com