KEY TAKEAWAYS

Baby Doge Coin is one of the longest-standing memecoins, having traded since 2021.

BabyDoge, which is based on the BNB blockchain, hit an all-time high in December 2024.

Our Baby Doge Coin price predictions suggest BabyDoge could reach $0.0000000378 in 2025.

Interested in buying or selling BABY DOGE COIN BABYDOGE? Read our review of the best exchanges to buy and sell BABY DOGE COIN BABYDOGE.

Baby Doge Coin was one of the first memecoins to cash in on Dogecoin’s success in the bull market of early 2021. Coming onto the open market later that year, the BNB-based token has earned its share of enthusiasts. The crypto did pretty well for itself in late 2024, hitting an all-time high in December before sliding back down.

On March 26, 2025, Baby Doge Coin was worth about $0.00000000148.

Let’s look at our Baby Doge Coin price predictions, made on March 26, 2025. We will also examine the Baby Doge Coin price history and talk a little about what Baby Doge Coin is and what it does.

Baby Doge Coin Price Prediction

Here are our Baby Doge Coin price predictions, made by CCN on March 26, 2025. While we take the utmost care with our price forecasts, we do need to remind you that price predictions, especially for something as potentially volatile as cryptocurrency, can often be wrong.

Baby Doge Coin Price Prediction 2025

In 2025, BabyDoge appears to be emerging from a prolonged corrective structure, with early signs of a five-wave impulse forming from the Z-wave low. If this initial recovery completes the impulse toward the 0.786 and 0.5 Fibonacci retracements, a reasonable price range lies between $0.0000000086 and $0.0000000378, with $0.0000000211 being a balanced median scenario.

Baby Doge Coin Price Prediction 2026

Assuming the 2025 impulse completes and enters a continuation pattern or larger cycle, the 2026 projection anticipates BabyDoge extending its move into higher Fibonacci levels. With previous resistance zones acting as potential future support, the price may range between $0.0000000211 and $0.000000065, with the 0.382 to 0.236 retracement area near $0.0000000447 representing a mid-range consolidation.

Baby Doge Coin Price Prediction 2030

By 2030, a full macro cycle completion could be underway, possibly bringing BabyDoge to new all-time highs. The minimum of $0.0000000447 reflects a sustained support level from 2026, while the average, at $0.000000095, and the maximum, at $0.00000018, assume exponential growth driven by broader adoption or speculative cycles.

Baby Doge Coin Price Analysis

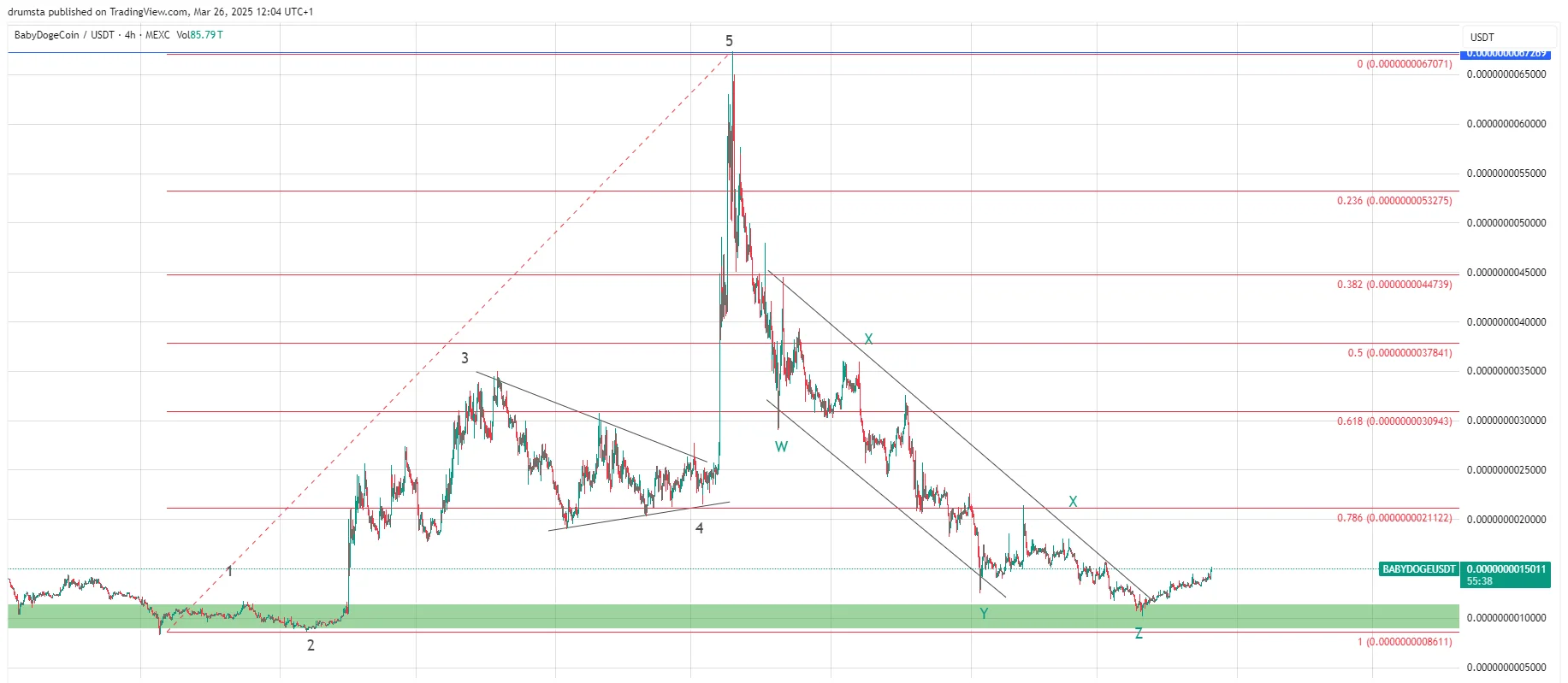

The four-hour chart reveals a completed W-X-Y-X-Z corrective structure, bottoming in the green demand zone near $0.000000008611.

Price has since broken out of the descending wedge, suggesting a potential reversal. The key Fibonacci retracements to monitor include 0.786 at $0.000000021122 and 0.618 at $0.000000030943. A sustained move above $0.000000015 would confirm strength, possibly initiating a bullish impulse towards $0.000000037841.

Short-term Baby Doge Coin Price Prediction

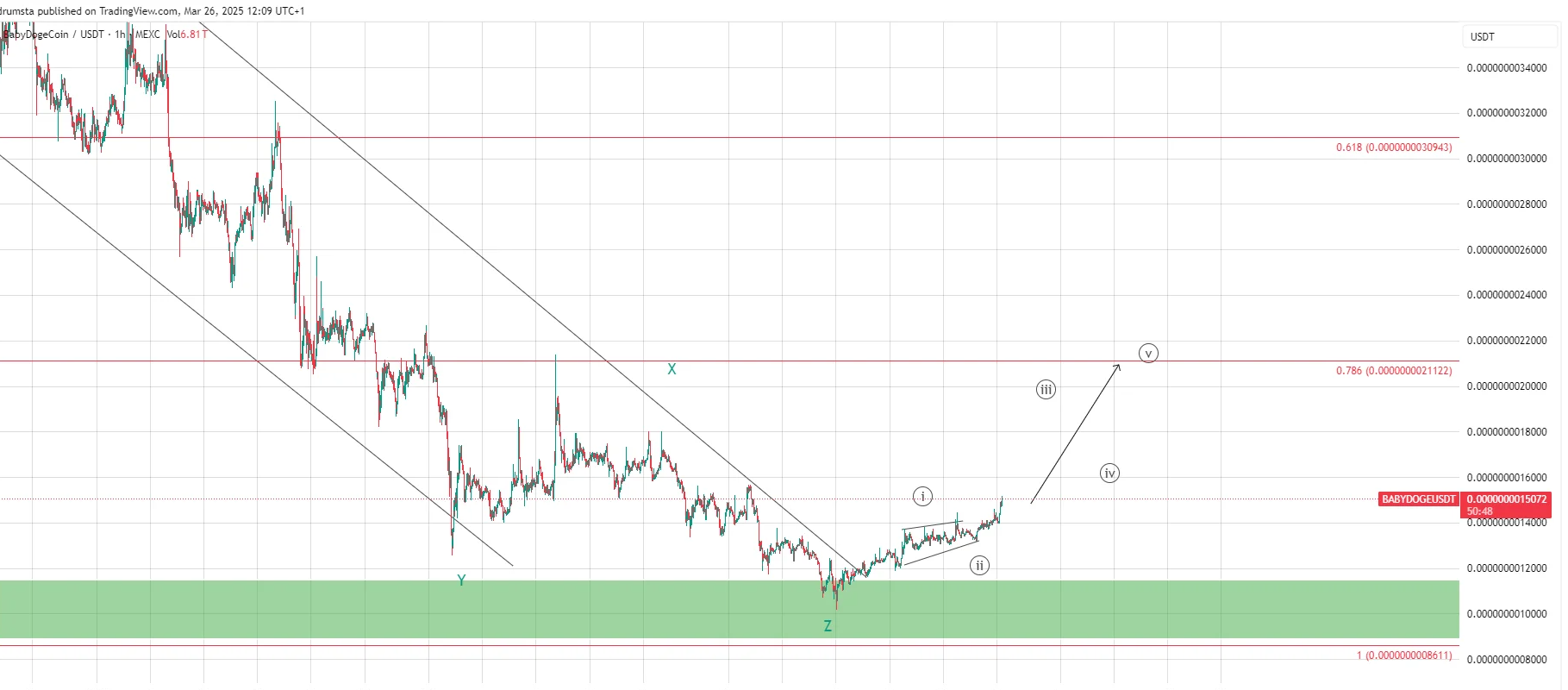

The one-hour chart shows the early stages of a five-wave impulsive structure forming from the Z-wave low. Waves one and two are confirmed, with wave three now developing.

This structure potentially targets $0.000000021122 as a more optimistic Baby Doge Coin price prediction for the next 24 hours.

A short wave four retracement is expected before a push toward wave five. The structure remains bullish above $0.000000012, with invalidation only below the green accumulation zone near $0.000000008611.

Looking for a safe place to buy and sell BABY DOGE COIN BABYDOGE? See the leading platforms for buying and selling BABY DOGE COIN BABYDOGE.

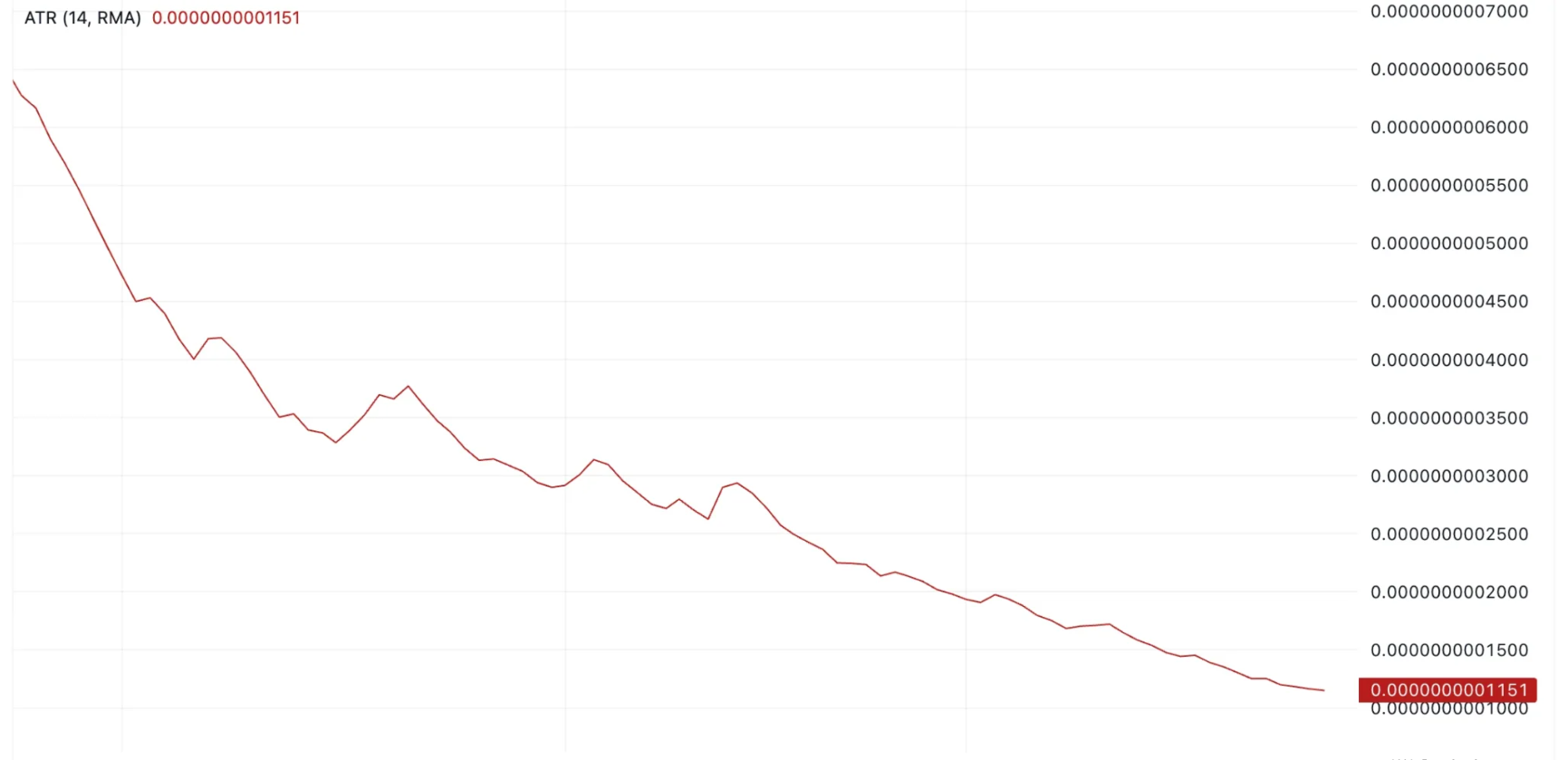

Baby Doge Coin Average True Range (ATR): BabyDoge Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility.

Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On March 26, 2025, Baby Doge Coin’s ATR was 0.0000000001151, suggesting average volatility.

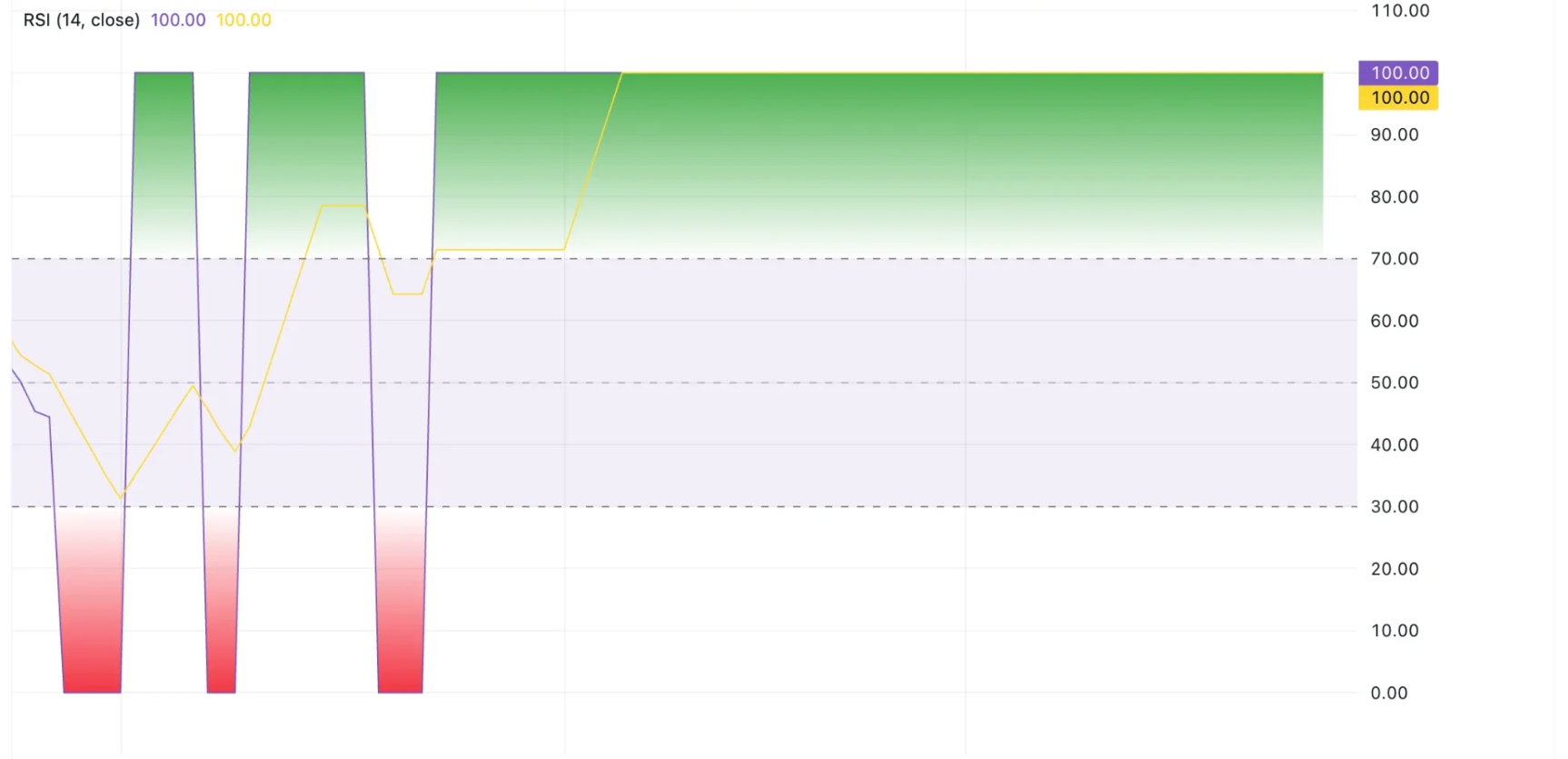

Baby Doge Coin Relative Strength Index (RSI): Is BabyDoge Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold. Movements above 70 and below 30 show overbought and oversold conditions, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On March 26, 2025, the Baby Doge Coin RSI was at 100, indicating very much overbought conditions.

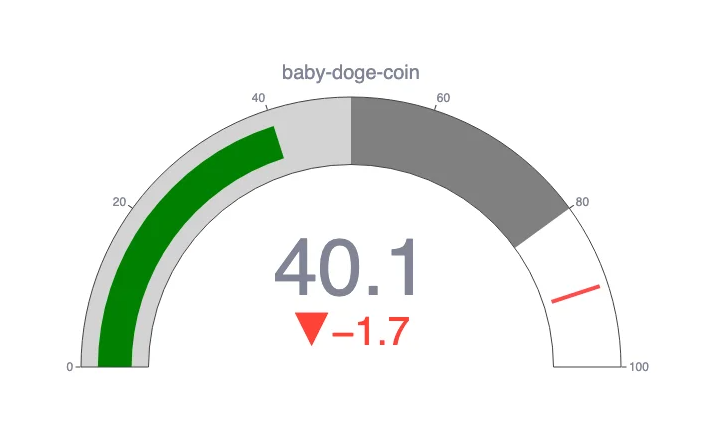

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but the score will slowly adjust back up as volatility decreases.

On March 26, 2025, Baby Doge Coin scored 40.1 on the CCN Index, suggesting weak momentum.

Baby Doge Coin Price Performance Comparisons

BabyDoge is a memecoin, so let’s compare how it performed over the last 12 months with other cryptos from the same category with similar market caps.

Best Days and Months to Buy Baby Doge Coin

We looked at the Baby Doge Coin price history and found the best times to buy BabyDoge.

| Day of the Week | Sunday |

| Week | 26 |

| Month | June |

| Quarter | Second |

BabyDoge Price History

Let’s now look at some of the key dates in the Baby Doge Coin price history. While past performance should never be taken as an indicator of future results, knowing what the token has done in the past can give us some much-needed context when it comes to either making or interpreting a BabyDoge price prediction.

| Time period | BabyDoge Price |

|---|---|

| Last week (March 19, 2025) | $0.000000001361 |

| Last month (Feb. 26, 2025) | $0.000000001515 |

| Three months ago (Dec. 26, 2024) | $0.00000000366 |

| One year ago (March 26, 2024) | $0.00000000268 |

| Launch price (Sept. 14, 2021) | $0.000000000751 |

| All-time high (Dec. 10, 2024) | $0.000000006604 |

| All-time low (Sept. 26, 2021) | $0.0000000005341 |

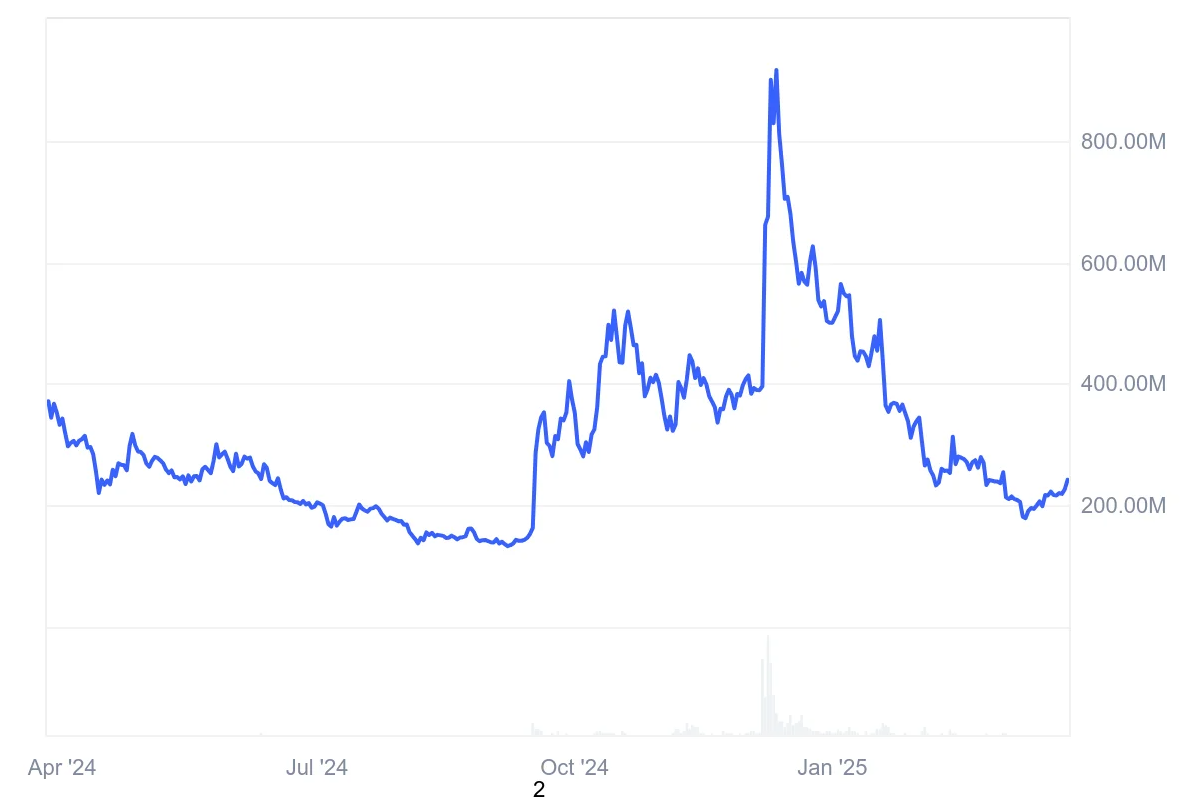

Baby Doge Coin Market Cap

The market capitalization, or market cap, is the sum of the total number of BabyDoge in circulation multiplied by its price.

On March 26, 2025, Baby Doge Coin’s market cap was $242 million, making it the 174th-largest crypto by that metric.

Who Owns the Most Baby Doge Coin?

On March 26, 2025, one wallet held nearly 80% of the BabyDoge supply.

What is Baby Doge Coin?

Baby Doge Coin is a memecoin based on Binance’s BNB blockchain.

Because BabyDoge is based on BNB, it is, despite its name, a token, not a coin. You might see references to such things as a Baby Doge Coin coin price prediction, but these are wrong.

How Baby Doge Coin Works

People can hold BabyDoge in the hope that its value will go up. Meanwhile, people can buy, sell, and trade it on exchanges.

Is Baby Doge Coin a Good Investment?

It is hard to say. Although BabyDoge hit an all-time high a little over three months ago, it has dropped since then. Since Baby Doge Coin is a memecoin, a lot will depend on how the market performs as a whole.

As always with crypto, you must do your own research before deciding whether or not to invest in Baby Doge Coin.

Will Baby Doge Coin Go Up or Down?

No one can really tell right now. While the Baby Doge Coin crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can and do go down and up.

Should I Invest in Baby Doge Coin?

Before you decide whether or not to invest in Baby Doge Coin, you will have to do your own research on BabyDoge and other related coins and tokens, such as Ethereum (ETH). Either way, you will also need to ensure you never invest more money than you can afford to lose.