What is SOPR

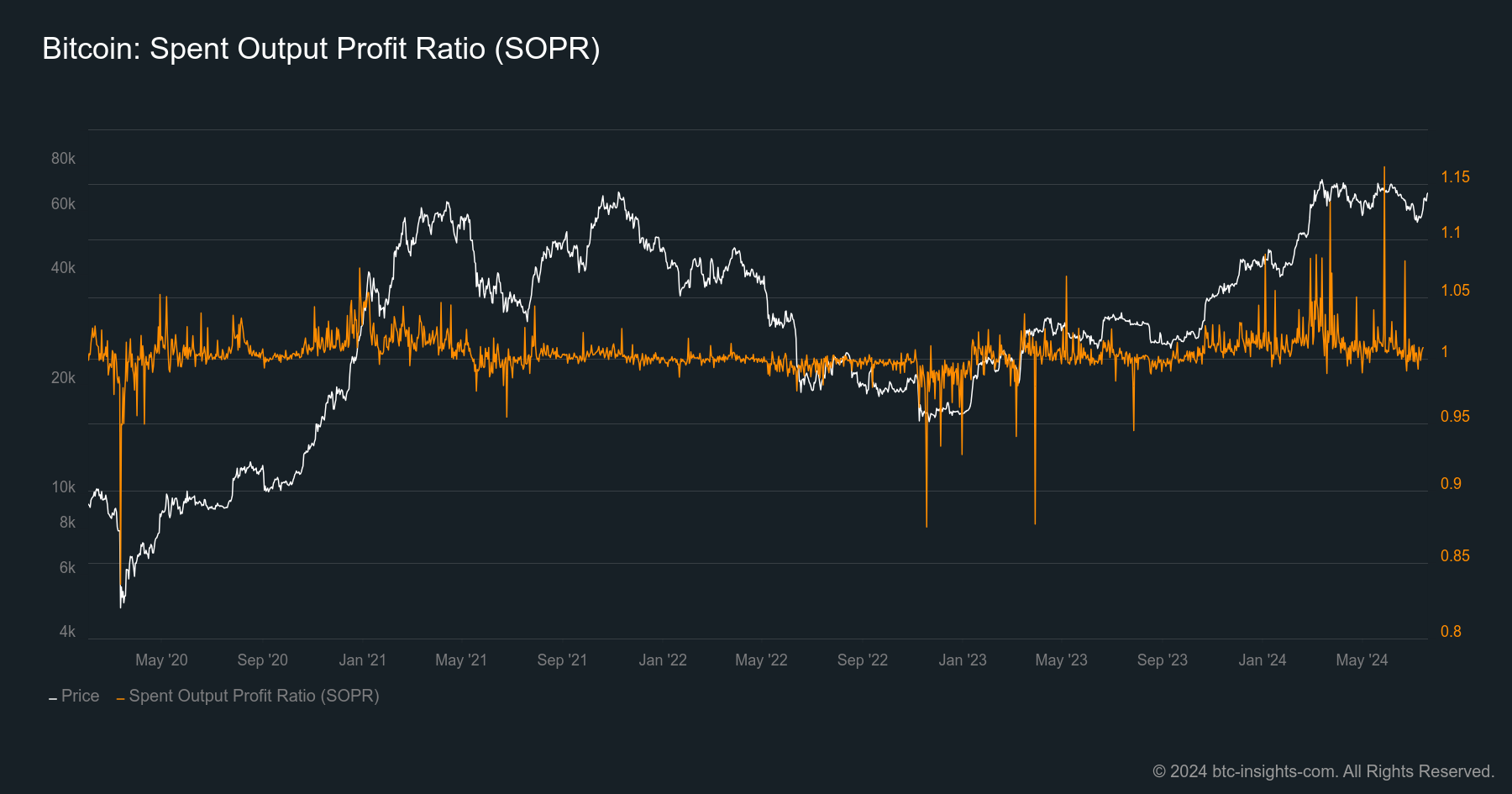

SOPR is the spent output profit ratio. It defines by how much all bitcoins that are moved are in profit. It is calculated by taking into account all transactions within a specific timeframe, generally one day.

Understanding SOPR

SOPR is calculated by taking the realized value of a spent output and dividing it by the value at the time of creation (when the coin last moved). It is therefore closely related to the realized profit and the realized loss.

It is always greater than zero as the price of Bitcoin is always greater than zero. SOPR values between 0 and 1 indicate that the coins are moved in loss on average, values above 1 indicate that the coins are moving in profit on average.

In theory SOPR can be infinitely high, in practice values above 1.1 are very seldom when taking into account all transferred coins, as trading and short-term holder activity makes up a great portion of all transactions.

The live chart can be found here.

The Significance of SOPR in the Crypto Market

SOPR is a very useful metric to track as it provides insight into the market sentiment. It is applicable in bull market territories as well as in bear markets.

How to interpret SOPR Values

As mentioned before, SOPR values above 1 indicate a regime of profit taking whereas SOPR values below 1 indicate a regime of loss realization. But the interpretation can be more nuanced.

Let’s first loot at the profit taking regime:

SOPR above 1

When SOPR is above 1 and is trending higher it implies that sellers are more and more confident of locking in higher profits. This is typically observed in bull markets.

A trend to lower SOPR values above 1 is often observed in bull market corrections when new investors who see a short-term correction panic sell their position whereas more experienced long-term holders stop distributing their coins in expectation of a trend reversal and near term higher prices.

Now let’s loot at the loss realization:

SOPR below 1

When SOPR is below 1 and is trending lower it implies that short as well as long-term holder are afraid of even lower prices, so they sell at a loss just to exit their position.

A trend to higher SOPR values below 1 is often observed after the final capitulation in bear markets. Long-term investors start accumulating again and there are less and less liquid coins left to spend.

Comparing Long-Term Holder and Short-Term Holder SOPR

The values of the spent output profit ratio differ a lot between short-term holders (holding Bitcoin for 150 days or less) and long-term holders (holding Bitcoin for 150 and more). Here is how:

Short-Term Holder SOPR

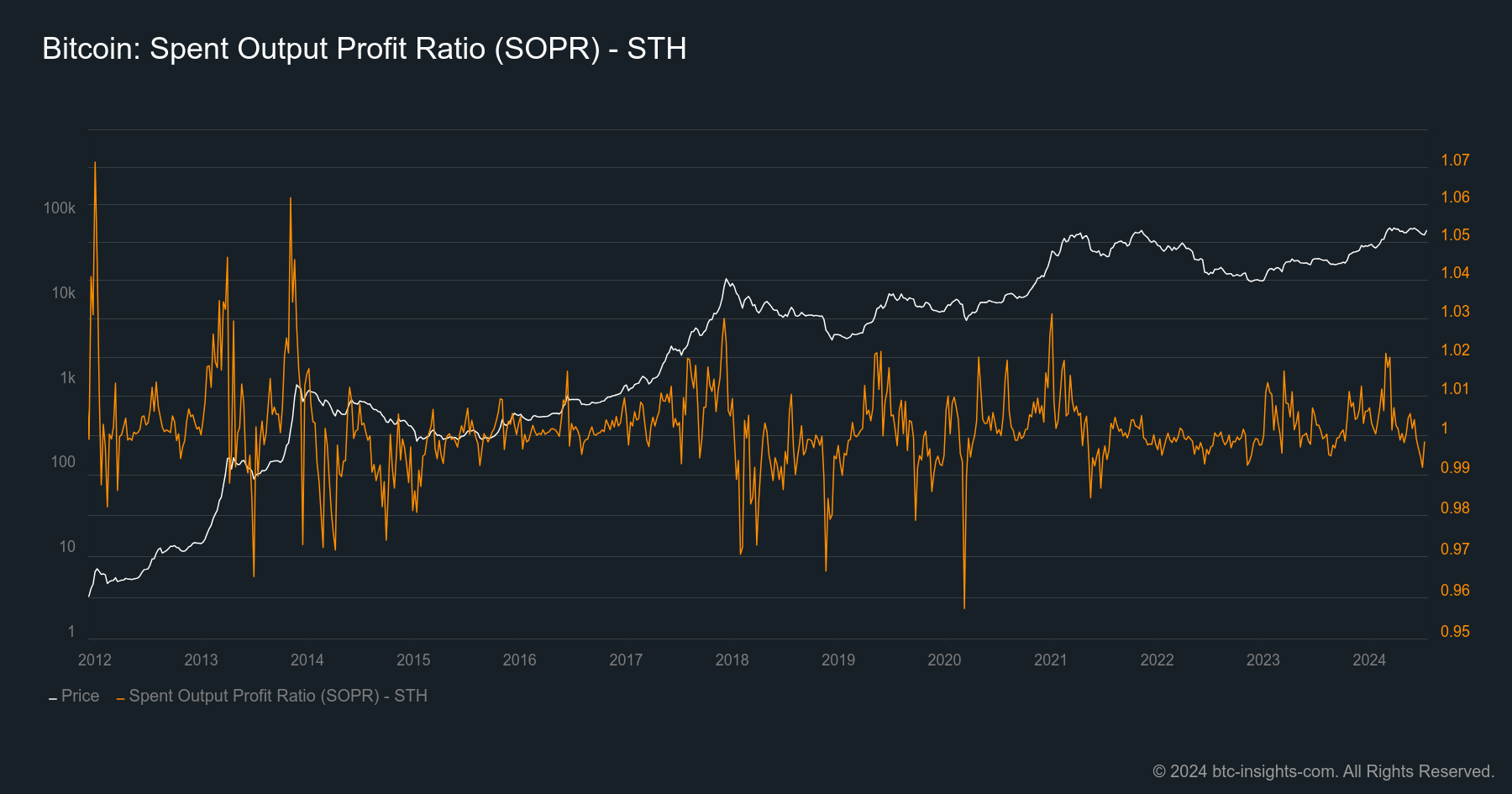

Short-term holder SOPR is very similar to SOPR taking into account all spent outputs because most activity on the blockchain naturally comes from short-term holders.

Short-term holder SOPR is best analyzed taking a moving average of 7 days or longer to cut out the noise. Most values fluctuate around 1 with slightly higher values in bull markets and slightly lower values in bear markets. Values above 1.05 or below 0.95 are very rare and only occur at the top of a market cycle or at major shake outs.

The live chart can be found here.

Long-term holder SOPR

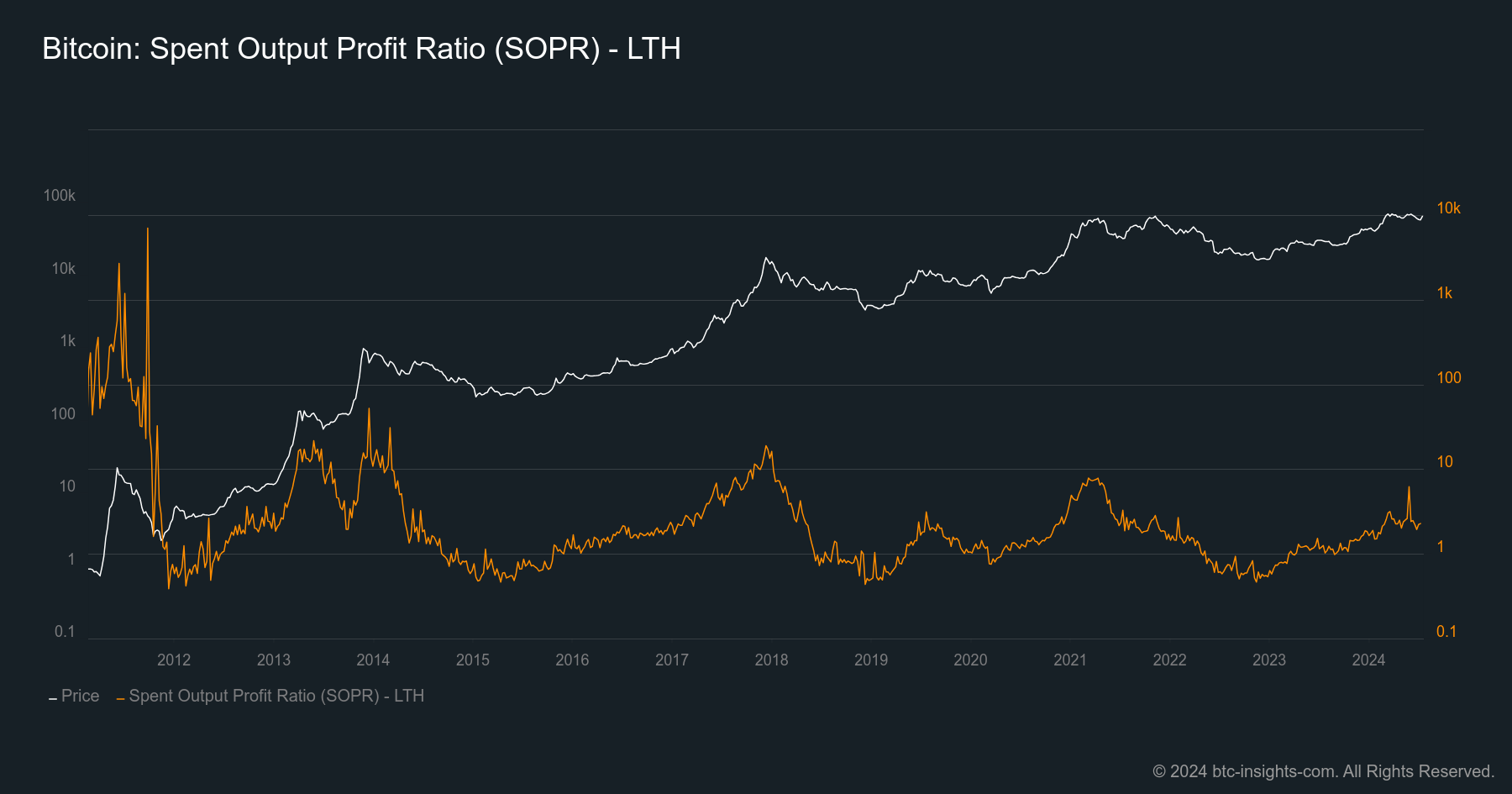

Long-term holder SOPR shows a very cyclical behavior that tracks the Bitcoin cycles quite well. It tends to have much higher, but also much lower values than short-term holders. At the bottom of bear markets long-term holders who bought the peak get spooked out of their position with much higher losses than short-term holders. On the other hand, investors who bought the last cycle or the cycle low can take home high profits near the tops.

The live chart can be found here.

Key Takeaways and Practical Applications

SOPR, or Spent Output Profit Ratio, is a powerful tool that provides deep insights into market behavior and investor sentiment in the Bitcoin and also the cryptocurrency space. SOPR helps to identify market trends and reversals by understanding the state of profit-taking and loss-realization. Therefore we see it as an essential part of any comprehensive market analysis strategy.