NEXO price prediction attracts many crypto enthusiasts who want to understand this token before investing. Nexo sits at the crossroads of crypto and traditional finance. It promises simple tools, passive income, and easy access to digital assets. For new users, this combination can feel both exciting and confusing.

At the moment, NEXO trades around $0.93. The token reached a monthly low of $0.89 on December 19. Earlier, it touched a monthly high of $1.03 on November 23. These moves show moderate volatility. They also reflect broader market sentiment rather than sudden internal shocks.

This article explains NEXO step by step. You will learn what Nexo is and how the token works. You will also see how Nexo price predictions form and why they change over time.

Later, we analyze historical price behavior. We also explore future outlooks from 2026 to 2050. Finally, we explain what truly drives NEXO’s price. The goal stays simple. You should finish this guide with clarity, not confusion. If you want to understand NEXO before risking capital, you are in the right place.

| Current NEXO Price | NEXO Price Prediction 2026 | NEXO Price Prediction 2030 |

| $0.93 | $2.5 | $10 |

Nexo (NEXO) Overview

Nexo is a blockchain-based financial platform. It focuses on digital asset lending, borrowing, and wealth management. The project launched in 2018. It was created by the team behind Credissimo, a fintech company with years of experience in online lending.

The NEXO token acts as the native utility token of the ecosystem. It connects users with platform benefits. Nexo designed the token to reward loyalty and long-term usage. Beginners often compare it to a membership token rather than a pure payment coin.

At its core, Nexo allows users to deposit cryptocurrencies and earn interest. Users can also borrow fiat or stablecoins without selling their crypto. The platform uses crypto-backed loans. This means your assets serve as collateral. You keep ownership while accessing liquidity.

NEXO plays a key role in this system. Token holders receive higher interest rates on savings. They also pay lower interest on loans. In addition, NEXO holders gain access to exclusive features and priority support.

Another important function involves revenue sharing. Nexo distributes part of its profits to eligible NEXO holders through structured reward programs. This creates a direct link between platform growth and token demand.

The supply of NEXO is fixed. No new tokens can be minted. This design limits inflation risk. Demand depends on user growth, platform adoption, and overall crypto market sentiment.

For beginners, Nexo aims to feel familiar. It mirrors traditional banking features but uses blockchain infrastructure. This hybrid model explains why NEXO often attracts long-term investors rather than short-term traders.

INJ Price Statistics

| Current Price | $0.93 |

| Market Cap | $602,517,012 |

| Volume (24h) | $12,187,946 |

| Market Rank | #75 |

| Circulating Supply | 646,145,840 NEXO |

| Total Supply | 1,000,000,000 NEXO |

| 1 Month High / Low | $1.03 / $0.89 |

| All-Time High | $4.07 May 12, 2021 |

NEXO Price Chart

CoinGecko, December 23, 2025

Nexo Price History Highlights

2018: Debut and Search for a Bottom

NEXO entered the market during a difficult time. After the ICO at around $0.1 in April, the token launched on exchanges in May. Strong early enthusiasm pushed the price close to $0.53. This move did not last long.

The broader crypto bear market quickly cooled sentiment. By the end of the year, NEXO traded near $0.08, falling below its ICO price. The most important milestone came in December, when Nexo paid its first-ever dividend, setting the token apart from most competitors.

2019: Accumulation and Stability

The year 2019 brought calm. NEXO moved sideways between $0.07 and $0.1 for most of the year. Volatility stayed low compared to other altcoins. Investors treated the token as a utility asset rather than a speculative play. Many held NEXO to access higher interest rates and dividend eligibility. This quiet phase helped build strong support around the $0.08 level.

2020: Awakening and DeFi Momentum

In 2020, sentiment changed. NEXO started near $0.1 and ended the year around $0.55. That marked a strong recovery. The rise of DeFi increased interest in crypto finance platforms. At the same time, Bitcoin’s rally lifted the entire market. A profitable dividend payout in August reinforced trust. NEXO broke key resistance levels and entered a clear uptrend.

2021: Euphoria, ATH, and Model Shift

This year defined NEXO’s history. The token climbed from about $0.6 to an all-time high of $4.07 in May. In June, the community approved a major governance change. Nexo replaced dividends with daily interest under the Nexonomics 2.0 model. This reduced regulatory risk. Despite a later correction, NEXO closed the year above $2.

2022: Crypto Winter and Stress Test

The market collapsed in 2022. NEXO dropped from $2.4 to a low near $0.55. Fear followed major failures in the lending sector. Unlike several rivals, Nexo remained operational. Buyback programs helped stabilize price action. By year-end, NEXO traded near $0.65.

2023: Legal Pressure and Recovery

Early 2023 brought heavy uncertainty. Regulatory actions and investigations hurt sentiment. The price dipped but did not collapse. Later, legal clarity improved. In December, charges in Bulgaria were dropped. NEXO finished the year stronger, around $0.84.

2024: Return of Bullish Sentiment

NEXO benefited from a broader market rally. The price rose from $0.87 to a peak near $1.45. Growth stayed steady rather than explosive. Product expansion and loyalty features supported confidence. The year ended close to $1.3.

2025: Current Correction Phase

In 2025, NEXO entered a correction. The price fell from $1.3 to about $0.93. Analysts view this range as consolidation. Despite weaker altcoin sentiment, long-term structure remains intact.

Nexo Price Prediction: 2026, 2027, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2026 | $1.34 | $4.19 | $2.5 | +170% |

| 2027 | $1.93 | $5.86 | $4 | +330% |

| 2030 | $5.7 | $15.04 | $10 | +975% |

| 2040 | $34.5 | $647.8 | $350 | +37,500% |

| 2050 | $816 | $4,289 | $2,500 | +269,000% |

NEXO Price Prediction 2026

DigitalCoinPrice analysts estimate that in 2026, NEXO could trade between $1.74 (+90%) at the lower end and $2.31 (+150%) at peak valuation. This outlook reflects gradual adoption and steady demand for crypto-backed lending services.

According to PricePrediction, NEXO is expected to remain more conservative. Their models forecast a minimum price of $1.34 (+45%), with a potential high of $1.65 (+75%), suggesting a consolidation phase rather than a strong breakout.

Telegaon presents a far more bullish scenario. Their 2026 forecast places NEXO between $2.43 (+160%) and $4.19 (+350%), assuming a renewed bull market and rising utility of CeFi platforms.

NEXO Price Prediction 2027

DigitalCoinPrice expects NEXO to continue its upward trend in 2027, with prices ranging from $2.42 (+160%) to $3.30 (+250%), driven by expanding product offerings and higher user retention.

PricePrediction aligns with a milder growth path. Their estimates suggest a floor of $1.93 (+110%) and a ceiling of $2.33 (+150%), pointing to steady but controlled appreciation.

Telegaon remains strongly bullish. Their 2027 outlook forecasts a price range of $4.21 (+350%) to $5.86 (+530%), reflecting confidence in long-term platform relevance.

NEXO Price Prediction 2030

By 2030, DigitalCoinPrice analysts believe NEXO could trade between $5.7 (+520%) and $7.37 (+690%), supported by broader crypto adoption and maturing lending markets.

PricePrediction sees a similar trajectory. Their projections indicate a minimum of $6.33 (+580%) and a maximum of $7.4 (+695%), assuming NEXO maintains its position among leading CeFi tokens.

Telegaon’s long-term forecast is significantly higher. According to their estimates, NEXO could range from $10.76 (+1,050%) to $15.04 (+1,500%) by 2030.

NEXO Price Prediction 2040

PricePrediction’s ultra-bullish 2040 scenario places NEXO between $518.57 (+56,000%) and $647.75 (+70,000%), reflecting expectations of massive global adoption and a dominant role in digital finance.

Telegaon offers a far more conservative—but still aggressive—outlook. Their 2040 price range spans from $34.5 (+3,600%) to $40.8 (+4,300%), accounting for regulation, competition, and long-term market cycles.

Nexo Price Prediction 2050

PricePrediction.net provides an extremely bullish long-term outlook for 2050. According to their model, NEXO could trade between $3,736 (+405,000%) and $4,289 (+465,000%).

Telegaon presents a more conservative, but still highly optimistic 2050 price predictions. Their projections place NEXO in a range between $816.3 (+87,500%) and $904.7 (+97,000%).

NEXO Price Prediction: What Do Experts Say?

Expert opinions on NEXO remain divided. Analysts look at different indicators, which leads to very different conclusions. For beginners, this mix of views can seem confusing. However, it also helps explain why NEXO price predictions vary so widely in the short and long term.

In mid-December 2025, Aaryamann Shrivastava, an analyst contributing to PricePrediction and associated with FXStreet, presented a cautious short-term outlook. His analysis highlighted a persistent bearish trend on the daily timeframe. NEXO traded near $0.93 at the time. Shrivastava argued that the token failed to reclaim key resistance levels earlier in the fourth quarter. Because of this weakness, he projected a potential move down toward $0.81 before the end of December 2025. He described the structure as neutral on lower timeframes but bearish overall, warning investors to expect volatility before stabilization.

A more neutral perspective came from Hatake_x6, a crypto market analyst active on X. In late November 2025, he described NEXO as trading inside a clearly defined consolidation range. According to his analysis, the zone between $0.9 and $0.92 acts as strong support. He labeled this area as attractive for range-based strategies. On the upside, resistance sits near $1.05 to $1.08. Hatake emphasized that the price must close above $1.10 to change momentum. Without such a move, he expects NEXO to remain range-bound rather than trend strongly in either direction.

This neutral view aligns closely with research published by the Ainvest research team in early December 2025. Their report focused on the contrast between weak technical indicators and improving fundamentals. While moving averages still leaned bearish, on-chain data showed a 91% year-over-year increase in transaction count. The team identified $1.047 as a key breakout level. A sustained move above it could push NEXO toward $1.1 and $1.17 in early 2026. A drop below $0.93, however, could accelerate losses toward $0.85.

NEXO USDT Price Technical Analysis

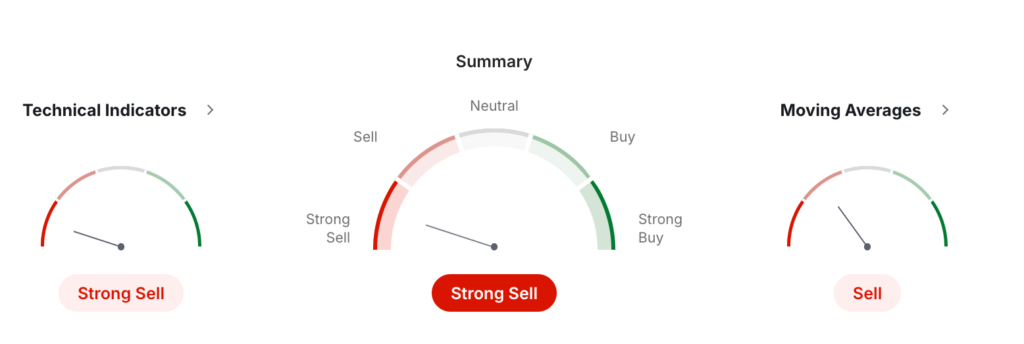

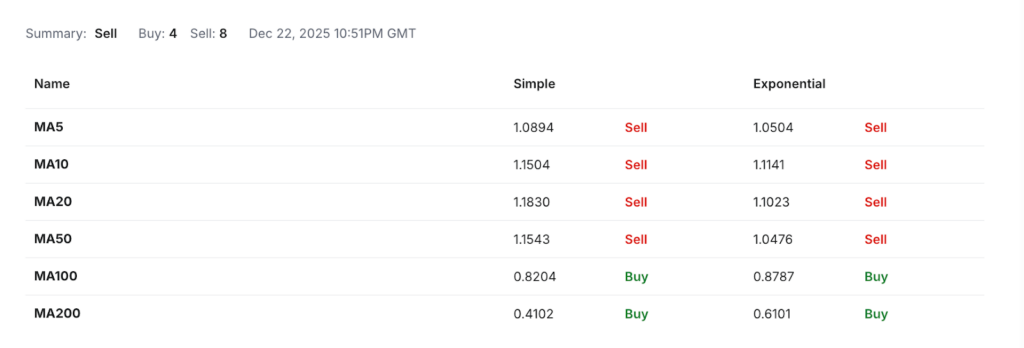

This section looks at the monthly technical data from Investing.com, updated in late December 2025. The overall picture remains cautious. The platform’s summary clearly labels NEXO USDT as Strong Sell, based on a combination of indicators and moving averages.

Investing, December 23, 2025

Technical indicators show clear weakness. Out of nine signals, eight point to selling pressure. The RSI sits near 44, which suggests fading momentum rather than strength. MACD remains negative, confirming bearish trend structure on higher timeframes. Several oscillators, including Williams %R and Stochastic RSI, signal oversold conditions. This does not guarantee a reversal. It only shows that selling pressure has already pushed the price down significantly.

Trend strength indicators offer a mixed signal. ADX stays close to neutral, which suggests the downtrend exists but lacks strong acceleration. ATR readings indicate lower volatility. This often appears during consolidation phases rather than panic selling. In simple terms, NEXO is drifting lower, not collapsing.

Moving averages also support the bearish bias. Short- and mid-term averages, from MA5 to MA50, all signal sell conditions. Price remains below these levels, confirming weak momentum. Long-term averages tell a different story. Both the 100-day and 200-day moving averages still show buy signals. This suggests that while short-term pressure dominates, the broader structure has not fully broken down.

Pivot point analysis helps identify key zones. The main monthly pivot sits near $0.99. This level acts as a balance point. Price below it favors sellers. Resistance levels cluster between $1.05 and $1.12, aligning with previously mentioned breakout zones. On the downside, support appears near $0.8 and $0.7, which match areas of past accumulation.

In summary, monthly technicals lean bearish. However, oversold signals and long-term support levels suggest downside may slow. For beginners, this environment favors patience over aggressive entries.

What Does the NEXO Price Depend On?

The price of NEXO does not move randomly. Several key factors influence its value over time. For beginners, understanding these drivers helps reduce emotional decisions and unrealistic expectations. NEXO behaves like a hybrid asset. It reacts both to crypto market cycles and to the performance of the Nexo platform itself.

First, overall market sentiment plays a major role. When Bitcoin and large-cap cryptocurrencies rise, capital usually flows into altcoins. In bearish periods, investors reduce risk. This often pushes utility tokens like NEXO lower, even if fundamentals stay stable.

Second, platform adoption strongly affects demand. NEXO gains value when more users deposit assets, take loans, and use loyalty tiers. Higher usage increases the need to hold NEXO for benefits. This creates organic demand rather than pure speculation.

Third, regulatory developments matter. Nexo operates in multiple jurisdictions. Clear and favorable regulation supports confidence. Legal uncertainty, on the other hand, creates fear and selling pressure. Past price drops often followed regulatory headlines rather than product failures.

Fourth, yield and interest incentives influence investor behavior. NEXO holders earn higher interest rates and lower borrowing costs. When yields look attractive compared to competitors, demand increases. When yields fall, or rivals offer better terms, capital can rotate away.

Other important factors include:

Token utility within loyalty tiers and reward programs.

Buyback programs that reduce circulating supply.

Competition from other CeFi and DeFi lending platforms.

Liquidity on major exchanges and trading pairs.

Technical structure also shapes short-term price moves. Support and resistance levels guide trader behavior. Breakouts above key levels often attract momentum buyers. Failures at resistance usually trigger pullbacks.

Long-term expectations depend on trust. Investors watch how Nexo manages risk, transparency, and solvency. During market stress, survival matters more than growth. NEXO’s ability to operate through downturns has become a core part of its valuation narrative.

Nexo Features

The NEXO token uses a clear and conservative technical design. It operates on the Ethereum blockchain as an ERC-20 smart contract. This standard ensures broad wallet support, exchange compatibility, and transparent on-chain tracking. The contract code follows widely accepted security practices, which lowers operational risk for users.

Nexo also supports a wrapped version on Binance Chain. This improves accessibility and allows interaction across ecosystems. Cross-chain availability helps users move assets more efficiently without changing exposure to the token itself.

Security plays a central role in NEXO’s design. The smart contract relies on OpenZeppelin libraries, including SafeMath. These components protect against overflow errors and unsafe transfers. A security audit conducted by Callisto Network identified only low-severity issues. This result confirmed that the contract was safe for production use.

From a tokenomics perspective, NEXO has a fixed maximum supply of 1 billion tokens. The model is non-inflationary. No new tokens can be minted. As of August 2025, around 646 million tokens circulate, representing over 64% of the total supply. All vesting schedules have ended, which means no future unlock shocks remain.

Initial allocation followed a structured plan. Tokens were distributed across company reserves, founders, team members, community incentives, and advisors. Each category used time-based vesting. This reduced early selling pressure and aligned long-term incentives. Today, this structure is fully complete.

Nexo also runs an active buyback program. In December 2025, the company approved a $50 million token buyback. Earlier, it completed a $100 million program in 2023. Repurchased tokens move to an on-chain Investor Protection Reserve. After vesting, they support interest payouts and ecosystem development.

This approach reduces circulating supply pressure while improving utility. It also signals long-term commitment from Nexo. For beginners, these features suggest a focus on stability, transparency, and sustainable token economics.