While leading Layer-1 (L1) blockchains, such as Ethereum, Solana, and BNB Chain, continue to dominate media coverage, Bitcoin Cash (BCH) has emerged as a “silent star.”

BCH is likely to be one of the few Layer-1 altcoins to end 2025 with strong positive performance. Several key drivers support this scenario.

How Bitcoin Cash (BCH) Outperformed Other Layer-1s in 2025

Data shows that BCH has risen nearly 32% year-to-date, making it the best-performing Layer-1 altcoin. It has outpaced rivals such as Tron, Ethereum, and Solana.

Notably, BCH has remained largely outside the ETF and strategic reserve (DATs) narrative. While altcoins like ETH, SOL, and XRP benefit from expectations of institutional accumulation, BCH has advanced without relying on those catalysts.

This performance highlights BCH’s intrinsic strength as a Bitcoin fork that has survived multiple market cycles.

Layer-1 Price Performance. Source: Dexu

At its current price above $570, BCH could close 2025 higher than its opening price of $430 at the start of the year.

However, many analysts expect more. They believe BCH will break above the current $600 resistance and set a new yearly high.

“Once price decisively breaks above the $610–$650 resistance zone, BCH is likely to move significantly higher, similar to ZEC’s run in September,” investor Karamata predicted.

If BCH breaks above $650, it could mark a two-year high. A move above $720 could establish its highest level since 2022. Several on-chain drivers support this outlook.

Positive Signals Supporting a Potential BCH Breakout

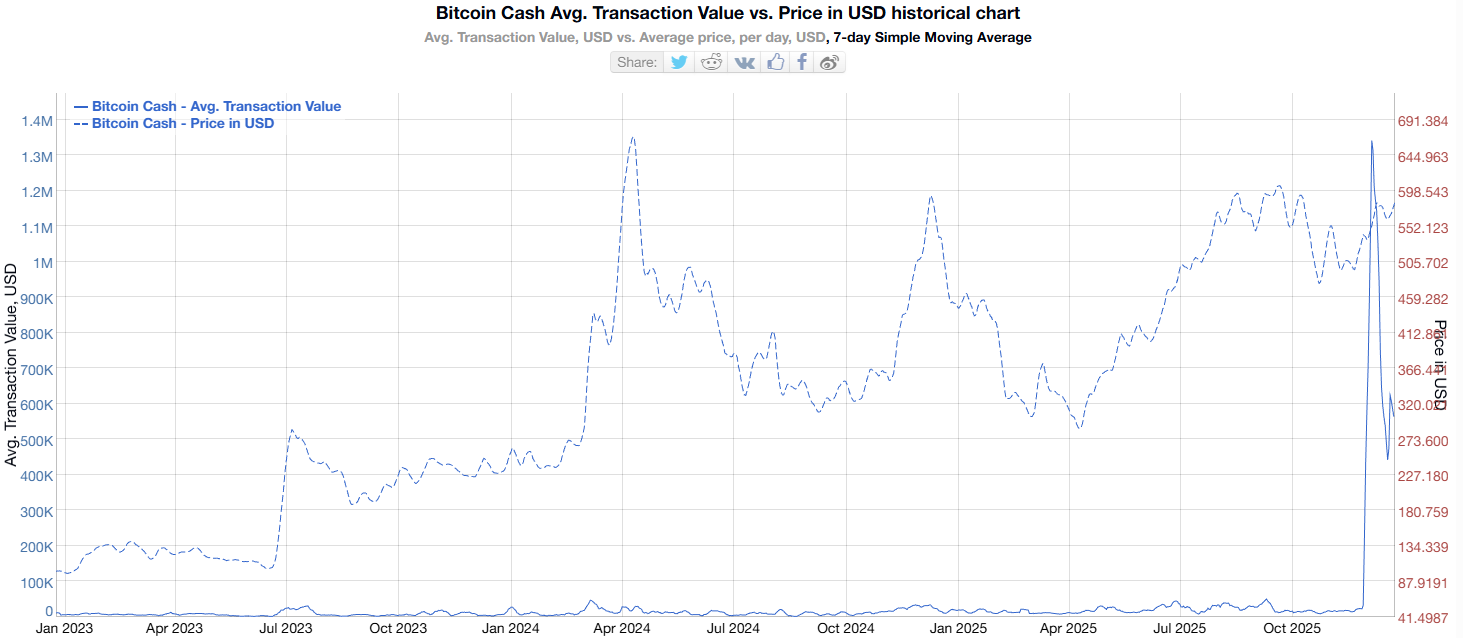

One notable bullish signal is the surge in Bitcoin Cash’s average transaction value in December 2025.

Historical data from BitInfoCharts shows the average transaction value spiking above $1.34 million at several peaks, while BCH traded near $600.

BCH Average Transaction Value. Source: BitInfoCharts

This represents the highest average transaction value in BCH’s history. It reflects a rise in large transactions, potentially from large investors or whales, signaling real capital inflows into the network.

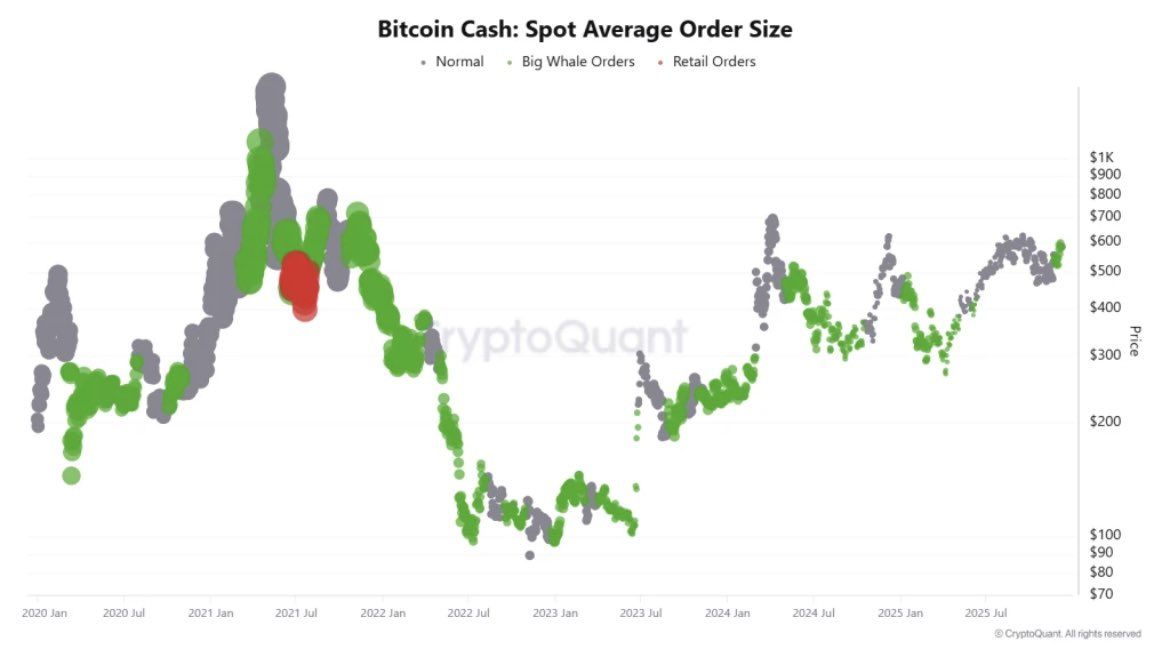

Additional spot trading data further reinforces this trend. The Bitcoin Cash Spot Average Order Size chart from CryptoQuant reveals that whale activity has dominated the order book over the past several years.

Bitcoin Cash Spot Average Order Size. Source: CryptoQuant

Large whale orders have reappeared over the past two months, as BCH traded around the $600 resistance zone.

Beyond trading metrics, BCH remains one of the most widely accepted altcoins for payments. According to Cryptwerk, BCH ranks fourth with 2,468 merchants accepting it, trailing only BTC, ETH, and LTC.

These factors could contribute to a successful breakout and push BCH toward new records in 2026.

However, challenges remain. Liquidity constraints and extremely fearful market sentiment continue to act as barriers, making a rapid BCH breakout more difficult.