Avalanche ticks lower on Wednesday, risking a drop below $12.00.

Grayscale files an updated S-1 form with the US SEC to convert its Avalanche Trust into an ETF.

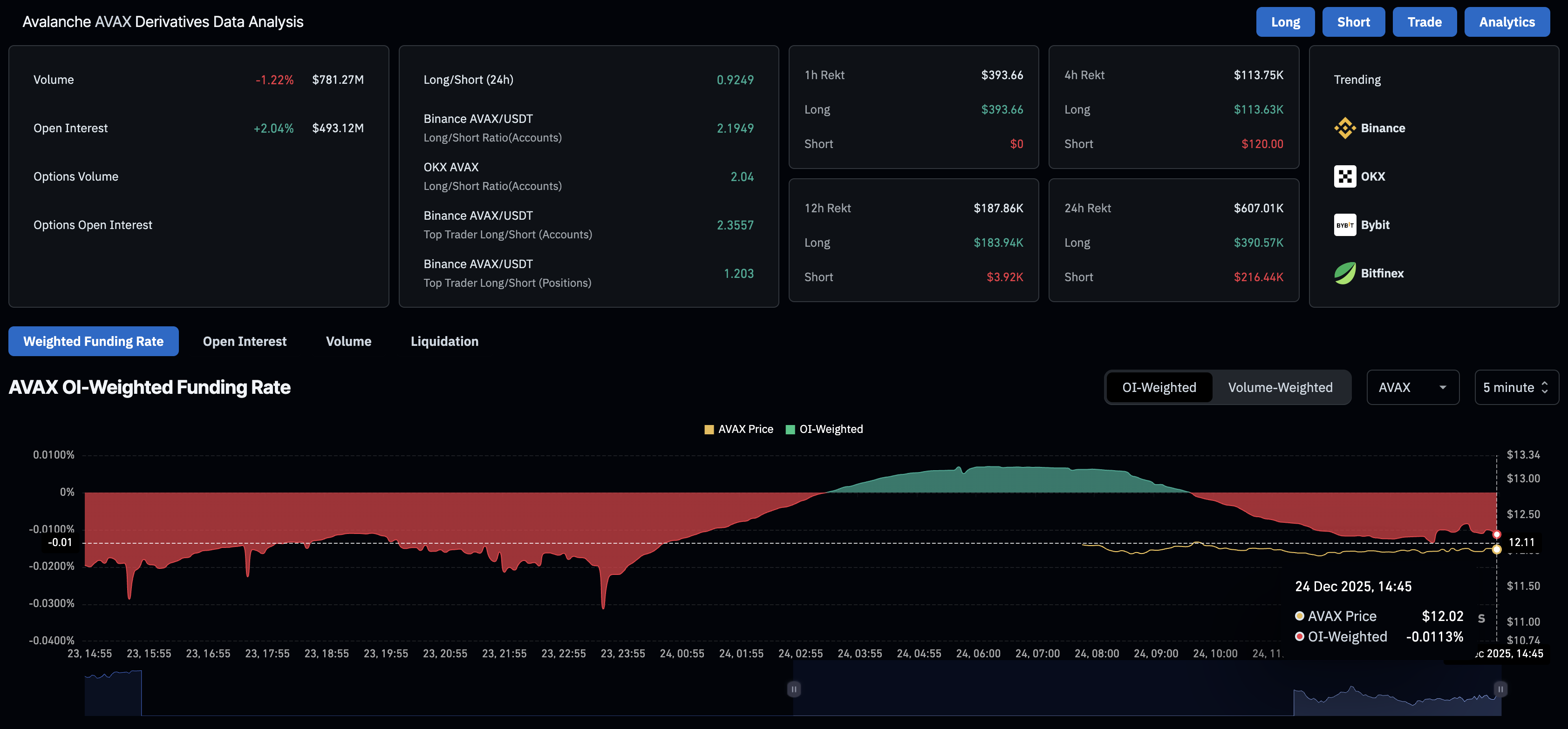

Derivatives data show an increase in AVAX futures Open Interest, suggesting renewed capital inflows.

Avalanche (AVAX) trades close to $12 by press time on Wednesday, extending the nearly 2% drop from the previous day. Grayscale filed an updated form to convert its Avalanche-focused Trust into an Exchange Traded Fund (ETF) with the US Securities and Exchange Commission (SEC). Derivatives data suggest a rise in retail interest amid negative funding rates, which point to a persistent bearish trend.

Retail demand falters amid Grayscale’s updated AVAX ETF filing

Grayscale updated the sponsor details to Grayscale Investments Sponsors LLC in the S-1 form filed for the Avalanche Trust conversion into an ETF. However, the crypto asset manager has not revealed any management or staking fees or waivers. A listing of this ETF on Nasdaq could boost institutional support for AVAX.

On the derivatives front, Avalanche sees fresh capital inflows as futures Open Interest (OI) jumps 2.04% in the last 24 hours, reaching $493.12 million. This indicates that traders are building new positions, including long and short.

However, the negative funding rate of -0.0113% indicates that traders are willing to hold short positions by paying a premium.

Technical outlook: Will AVAX bounce back?

Avalanche is down over 1% at press time on Wednesday, risking a break below the $12.00 level. The intraday pullback, extending the nearly 2% loss from Tuesday, aims for the S1 Pivot Point at $11.18.

A potential slip below this level could further decline AVAX to $8.66, aligning with the S2 Pivot Point.

The Relative Strength Index (RSI) on the daily chart is at 38, still in bearish zone amid renewed selling pressure. On the other hand, the Moving Average Convergence Divergence (MACD) shows a steady upward trend above its signal line, suggesting underlying bullish momentum.

On the upside, if AVAX rebounds from $11.18, it could target the overhead trendline connecting the October 29 and November 11 highs, near $12.78.