Solana’s price action this year has followed a clear but uncomfortable pattern. After pushing to a new all-time high around the $296 region in January, the rally quickly lost momentum and transitioned into a steady decline that has persisted for months.

Many traders have attributed this weakness to a risk-off sentiment across crypto, but a deeper on-chain breakdown shared by crypto analyst Ardi on X suggests the story began well before the January peak and has more to do with who was buying and who was quietly exiting.

Distribution Was Already Underway Before The January Peak

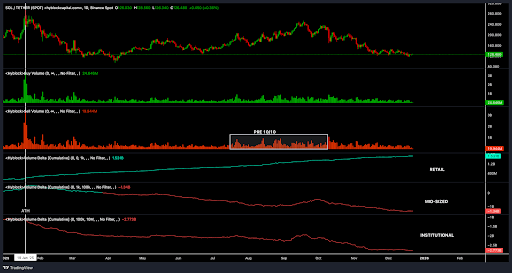

Solana has been on a clear downtrend since September, when it reached a lower high of around $247 compared to its January 19 all-time high of $293. One of the most important insights from Ardi’s analysis is that Solana’s January all-time high did not mark the start of distribution but rather the culmination of it.

The chart attached to his post shows that selling volume was already increasing months earlier, well ahead of October, meaning that large holders were positioning for exits long before price reached its final peak. From that perspective, the January high looks less like the beginning of a new expansion phase and more like the last push of a rally.

After that point, price action began forming lower highs, and each rebound attempt lacked the strength needed to reclaim the all-time high. Interestingly, Solana failed to reach a new all-time high, even as other large market cap cryptos like Bitcoin, Ethereum, XRP, and BNB pushed to new all-time highs during the year.

Another interesting feature of the data is the widening gap between retail behavior and that of larger players. Cumulative delta metrics on the chart show that retail-sized wallets have been consistently active throughout the year and are increasing their activity even as Solana’s price moved lower.

On the other hand, mid-sized and institutional wallets tell a very different story. Their activity has been trending downward for months, starting from the January peak and extending up until the time of writing.

Is Solana’s Price Becoming Dependent On Memecoin Activity?

Ardi’s analysis also raises a broader question about what is currently driving demand for Solana. Outside of retail activity on Solana itself, one of the few consistent sources of activity has been the memecoin sector. Successes and booms of meme coins like Cat in a Dogs World (MEW), Peanut the Squirrel (PNUT), and Fartcoin (FARTCOIN), which gained traction in the second half of 2024, contributed to Solana’s push to all-time highs during those periods.

Those meme coin successes culminated with the launch of the Official Trump ($TRUMP) token in January 2025 on Solana, which experienced eye-watering gains shortly after its launch. This, in turn, contributed to Solana’s all-time high in January.

However, since then, the TRUMP token and other Solana-based meme coins have been trending downwards in recent months and no longer command the same level of attention or trading intensity they had this time last year. That has led to the view that Solana’s price is increasingly sensitive to the success of memecoins in its ecosystem.

At the time of writing, Solana is trading at $121.50, down by about 58.6% from its January all-time high of $293.