Dogecoin price has remained under pressure. The token is down around 2% over the past 24 hours and more than 12% over the past month. Price action has weakened, but the decline is slowing.

While the chart structure still leans bearish, on-chain behavior suggests the breakdown may not be a done deal yet. The next few sessions will decide whether DOGE slips into a deeper decline or stabilizes near current levels.

Dogecoin Price Pressure Builds as Short-Term Supply Exits

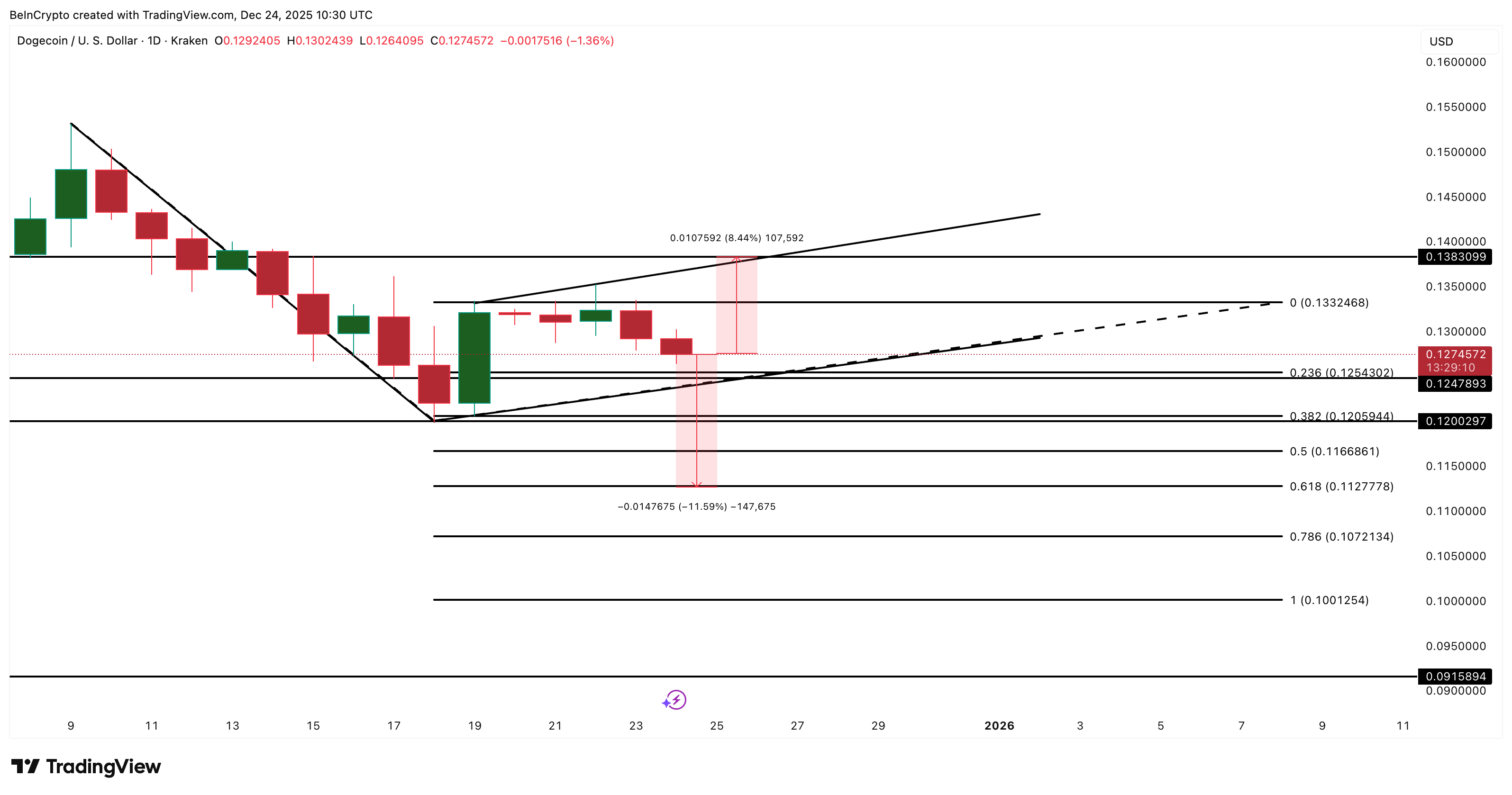

Dogecoin is trading near the lower boundary of a declining price structure, with a bear flag forming. That keeps downside risk active, especially if support near $0.124-$0.120 fails. However, what stands out is how speculative supply has behaved as price drifted lower.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bear Flag Forming: TradingView

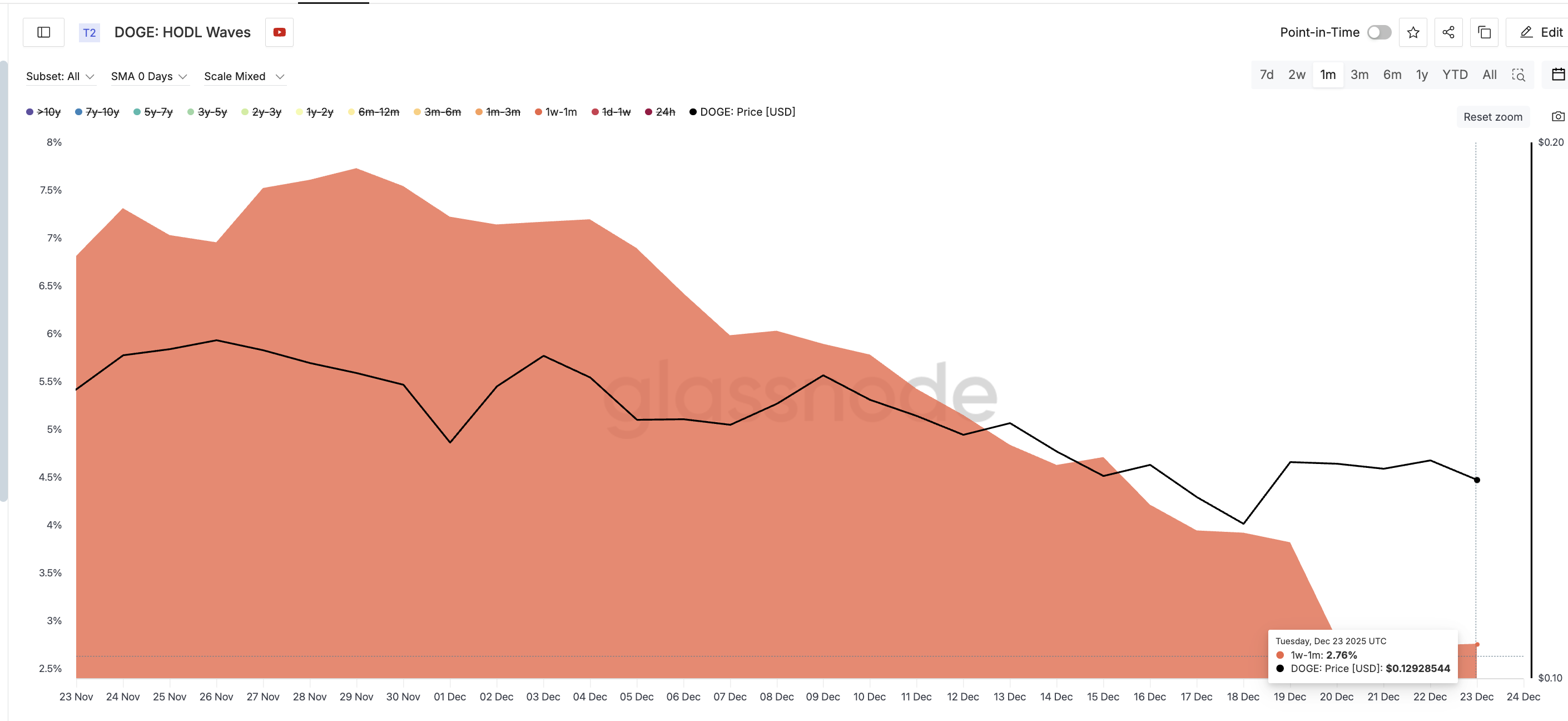

The 1-week-to-1-month-hold cohort, typically the most aggressive swing-trading group, has sharply reduced exposure, per the HODL Waves metric. This metric classifies hodlers by time.

On November 29, this cohort controlled roughly 7.73% of Dogecoin’s supply. As of December 23, that share has dropped to about 2.76%. That is a steep reduction in speculative positioning over a short period.

Speculative Holders Dumping DOGE: Glassnode

This matters because these holders tend to amplify downside when they panic sell. Their exit often reduces forced selling pressure near support.

Long-Term Holders Quietly Add as Coin Activity Drops

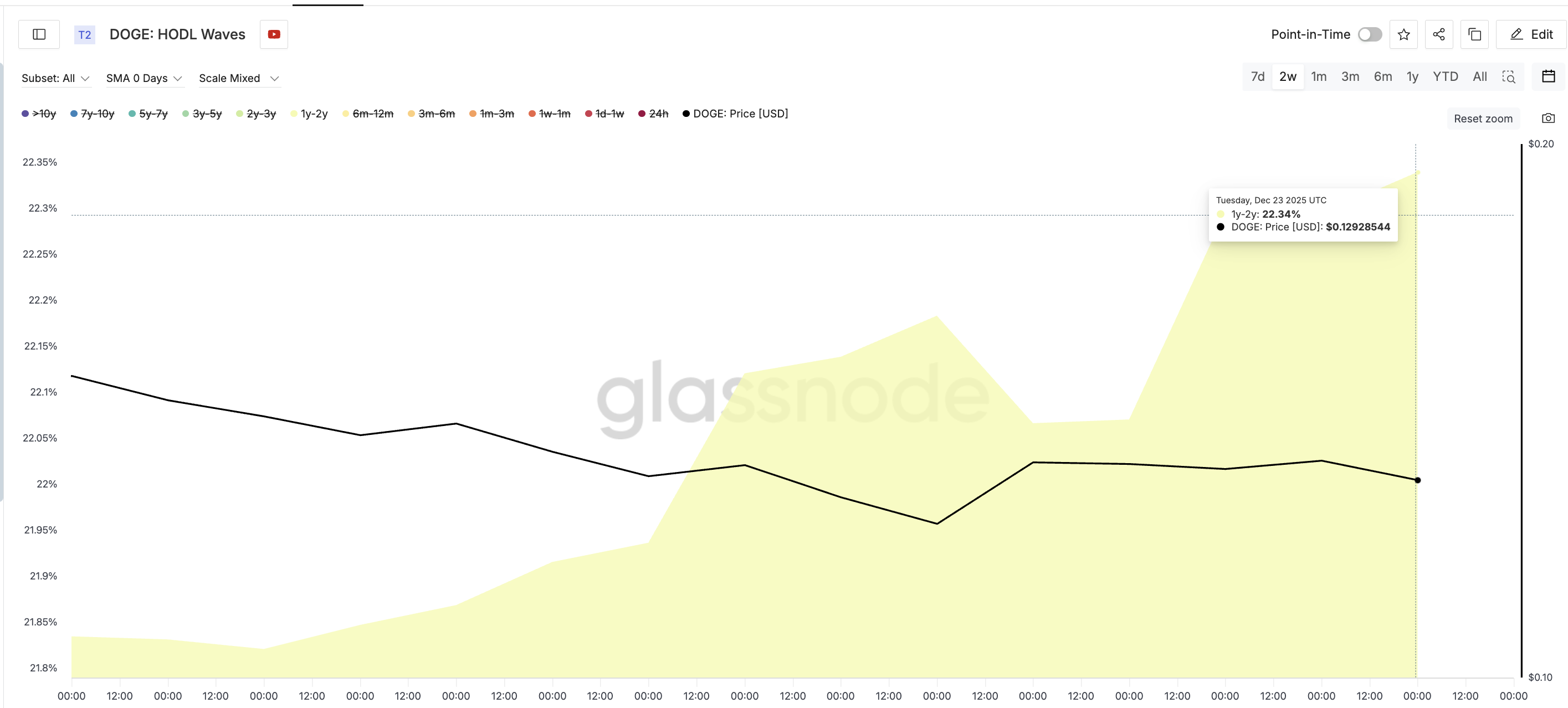

At the same time speculative supply is shrinking, longer-term holders are showing early signs of accumulation. The 1-year to 2-year holder cohort has increased its share of Dogecoin supply from around 21.84% to 22.34%. The increase is small, but the signal matters.

These holders typically add only when they believe downside risk is starting to fade.

Long-Term Holders Buying: Glassnode

Coin activity across the network, measured via the spent coins metric, supports that view. Spent coins activity has fallen sharply. The spent coins age band metric dropped from roughly 251.97 million DOGE to about 94.34 million DOGE. That represents a decline of more than 60% in coin movement.

Coin Activity Drops: Santiment

Lower coin activity possibly means fewer holders are rushing to move or sell tokens. Historically, similar drops in activity have preceded short-term relief rallies in Dogecoin. Earlier in December, a similar slowdown preceded a rally from near $0.132 to $0.151, a near 15% move, within three days.

This does not guarantee a rally, but it shows selling aggression is cooling rather than accelerating.

Key Dogecoin Price Levels That Decide Breakdown or Recovery

The technical picture now hinges on a narrow price range. The $0.120 level remains the most important near-term support. A decisive daily close below it would expose the Dogecoin price to deeper downside toward the $0.112 zone and potentially lower if momentum builds.

On the upside, the recovery case depends on reclaiming nearby resistance. A move back above $0.133 would signal that selling pressure is easing. A stronger reclaim of $0.138 would confirm that buyers are regaining control and that the recent decline was corrective rather than the start of a larger breakdown.

Dogecoin Price Analysis: TradingView

In simple terms, Dogecoin is at a crossroads. Price structure still carries risk, but on-chain data shows speculative supply leaving, long-term holders slowly stepping in, and overall coin activity drying up. If support holds, those factors can help stabilize the price. If it fails, the breakdown remains valid.