Spark (SPK) is a next-generation DeFi protocol optimizing yield across stablecoins and real-world assets (RWAs). Over the past month, Spark soared from $0.02924 to its all-time high of $0.1865 (+540%). It has captured market attention after this staggering price surge, fueled by its upcoming CoinDCX listing and robust fundamentals, including over $6 billion in Total Value Locked (TVL) and accelerating demand for its DeFi yield solutions. How will the project develop in the future? This article dives into Spark price prediction, examining on-chain data and macroeconomic catalysts to separate signal from noise in its turbulent market.

| Current SPK Price | SPK Prediction 2025 | SPK Price Prediction 2030 |

| $0.126 | $0.17 | $0.45 |

Spark (SPK) Overview

Spark is a next-generation DeFi platform that optimizes yield generation by intelligently allocating capital across stablecoins, DeFi protocols, and real-world assets. With over $3.8 billion deployed, it solves key industry challenges like fragmented liquidity and volatile yields, offering users a seamless way to earn stable, competitive returns. The platform acts as an automated yield engine, streamlining complex strategies into simple, accessible products, effectively turning crypto into a high-yield savings account.

At the heart of Spark’s ecosystem is its native token, SPK, which powers governance, staking, and platform incentives. By holding SPK, users can participate in decision-making while earning rewards, aligning their interests with the protocol’s long-term success. Rather than competing with existing DeFi platforms, Spark enhances them by providing deeper liquidity and more stable yields. This collaborative approach, combined with user-friendly design, makes Spark a compelling option for both casual investors and DeFi veterans, ushering in a new era of efficient, accessible crypto finance.

SPK Price Statistics

| Current Price | $0.126 |

| Market Cap | $141,765,872 |

| Volume (24h) | $468,329,976 |

| Market Rank | #273 |

| Circulating Supply | 1,124,660,089 SPK |

| Total Supply | 10,000,000,000 SPK |

| 1 Month High / Low | $0.1865 / $0.02924 |

| All-Time High | $0.1865 Jul 24, 2025 |

The project was conceived within the broader Sky ecosystem (formerly MakerDAO), designed to leverage Sky’s massive $6.5B stablecoin reserves to create a meaningful impact across decentralized finance. Spark was developed by Phoenix Labs, a team of former MakerDAO engineers, and launched in May 2023 as part of MakerDAO’s ‘Endgame Plan’ to decentralize its ecosystem into subDAOs.

Spark Features

SPK coin offers several features within the crypto space:

Three integrated protocols: Spark is powered by three protocols: Savings (yield generation), SparkLend (USDS, DAI lending), and Spark Liquidity Layer (automated cross-chain capital allocation).

Helps solve fragmented liquidity across protocols: Spark solves the liquidity problem by creating a unified liquidity layer that aggregates and optimally allocates capital across the entire DeFi ecosystem.

Addresses unstable yields: Spark addresses unstable yields through its connection to Sky’s stable yield infrastructure, providing users with predictable, sustainable yields backed by diversified revenue streams.

Cross-chain automation: Spark’s Liquidity Layer automates cross-chain capital deployment, enabling seamless liquidity provision across multiple networks while maintaining security and efficiency.

SPK Price Chart

CoinGecko, August 4, 2025

Spark Price History Highlights

Spark’s native token, SPK, was officially launched in June 2025 and hit its all-time high of $0.1865 at the end of July. At the moment, its price hovers between $0.12 and $0.13.

Spark Price Prediction: 2025, 2026, 2030

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.07 | $0.27 | $0.17 | +35% |

| 2026 | $0.077 | $0.32 | $0.19 | +50% |

| 2030 | $0.23 | $0.67 | $0.45 | +260% |

SPK Coin Price Prediction 2025

DigitalCoinPrice crypto experts think that in 2025, SPK coin could reach a maximum of $0.27 (+120%), with a potential low of $0.11 (-10%).

Meanwhile, CoinCodex analysts project a more bullish scenario, estimating a minimum price of $0.070363 (-40%) and a peak of $0.078236 (-35%), reflecting steady growth potential.

Spark Crypto Price Prediction 2026

DigitalCoinPrice projects a bullish but measured trajectory for SPK in 2026, forecasting a maximum price of $0.32 (+160%) and a minimum of $0.26 (+110%). This outlook reflects confidence in Spark’s yield-optimization fundamentals, including its huge TVL and institutional-grade RWA integrations, which could sustain demand despite market volatility.

In contrast, CoinCodex presents a more volatile forecast, anticipating a wide trading range between $0.077387 (-35%) and $0.290948 (+135%). This disparity highlights the token’s sensitivity to macroeconomic factors, such as Bitcoin’s performance and regulatory shifts in DeFi.

SPK Token Price Prediction 2030

By 2030, DigitalCoinPrice estimates a peak of $0.67 (+440%) and a low of $0.58 (+370%). This optimism stems from Spark’s institutional-grade yield products and multi-chain expansion (Ethereum, Arbitrum, Base), enhancing liquidity efficiency.

CoinCodex offers a more tempered outlook, predicting a peak of $0.46216 (+270%) and a floor of $0.230124 (+85%), reflecting concerns about tokenomics risks and market volatility given SPK’s price swings and only 10% circulating supply.

Spark (SPK) Price Prediction: What Do Experts Say?

Spark has emerged as one of the most closely watched DeFi tokens following its explosive 500% rally in mid-2025. Market analysts remain divided on its short-term trajectory, with bullish forecasts pointing to a potential rise to $0.2 if the protocol continues attracting institutional capital and expanding its real-world asset integrations. The token’s strong fundamentals (including several billion in TVL and strategic partnerships with traditional finance giants) suggest long-term upside potential. Spark’s venture into RWAs, such as investing in BlackRock’s fund, also brings stable yields into the crypto space and could attract institutional capital.

Looking further ahead, Spark’s unique position as a yield optimization hub within the broader Sky ecosystem could drive sustained demand for SPK tokens. Experts note the protocol’s innovative liquidity layer and governance model may help it weather crypto market cycles better than pure speculative assets. Some experts, like Gate, also believe that the coin will not achieve considerable price levels: they expect that in 2035, $SPK will hit a maximum of $0.175 per coin.

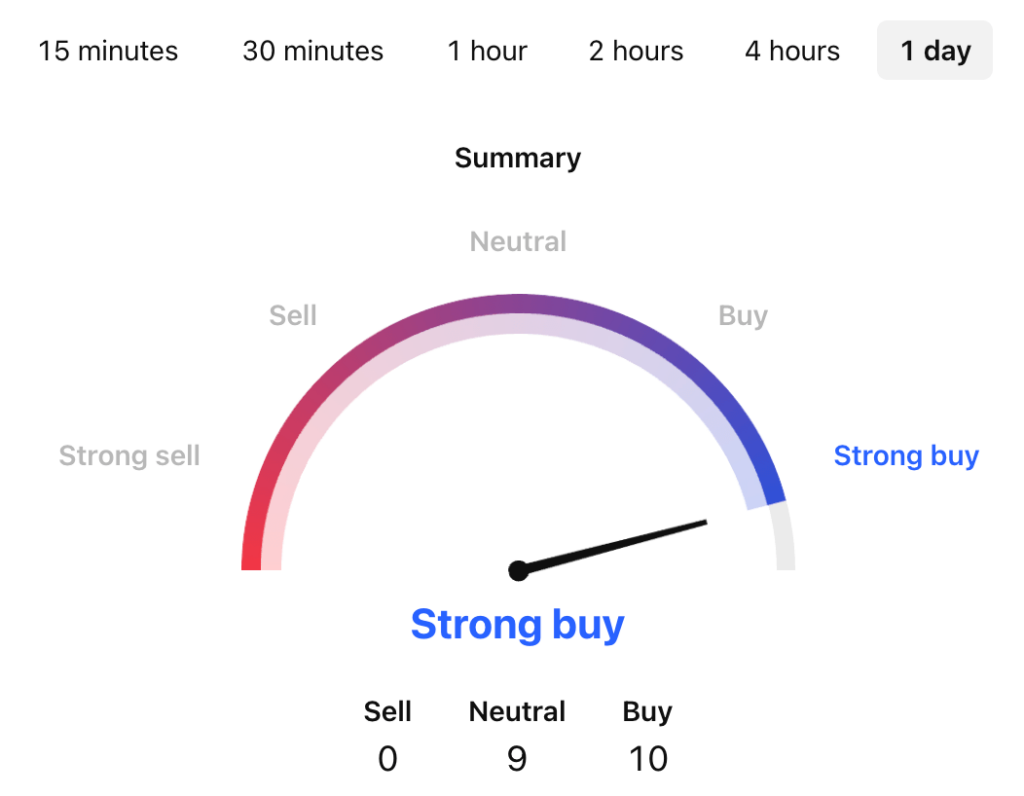

SPK USDT Price Technical Analysis

Tradingview, August 4, 2025

Now that we’ve seen possible price predictions for Spark, let’s find out a bit more about the factors that can influence its price.

What Does the SPK Price Depend On?

The price of Spark (SPK) depends primarily on market demand and adoption of its DeFi ecosystem, which includes products like SparkLend, Spark Savings, and the Spark Liquidity Layer (SLL). Key demand drivers include the protocol’s TVL and its ability to generate stable yields from DeFi, CeFi, and RWAs. Additionally, exchange listings (e.g., Binance, Coinbase) and whale accumulation can create buying pressure, while airdrop sell-offs and token unlocks can suppress prices.

Macroeconomic factors and crypto market sentiment also play a significant role. SPK’s price often correlates with broader altcoin trends, Bitcoin’s performance, and regulatory developments affecting DeFi (e.g., MiCA in Europe). Long-term price sustainability hinges on Spark’s ability to maintain competitive yields, expand cross-chain integrations, and manage inflationary tokenomics.

Risks and Opportunities

Spark presents compelling opportunities as a next-generation DeFi protocol, particularly due to its huge TVL and innovative yield-optimization mechanisms. The platform’s integration with RWAs, such as BlackRock’s tokenized funds, offers stable, institutional-grade yields, a rarity in volatile crypto markets. Additionally, Spark’s Spark SLL efficiently routes capital across DeFi, CeFi, and RWAs, addressing fragmented liquidity while delivering double-digit APYs on stablecoins like DAI and USDC. With strong backing from MakerDAO’s ecosystem and a rapidly growing user base, SPK is well-positioned to capitalize on the booming demand for decentralized yield solutions.

Another key opportunity lies in Spark’s multi-chain expansion and governance model. By deploying across Ethereum, Arbitrum, and Base, Spark enhances accessibility and scalability, attracting liquidity from diverse networks. The SPK token’s utility (staking, governance, and rewards) aligns user incentives with protocol growth, fostering long-term engagement. Analysts note that SPK’s current market cap appears undervalued relative to its TVL, suggesting significant upside if adoption accelerates.

Is Spark a Good Investment?

Spark presents a high-risk, high-reward investment opportunity, with strong fundamentals like institutional-grade yield products and backing from MakerDAO’s ecosystem, but its price volatility, token inflation, and regulatory risks for U.S. users could lead to sharp corrections. The token’s price can swing wildly based on the state of the market, with little warning, making it a risky choice for those unfamiliar with the fast-paced and unpredictable nature of crypto markets.

What Is SPK Coin?

SPK coin is the native cryptocurrency of the Spark Protocol, a DeFi platform designed to optimize stablecoin liquidity and yield generation across multiple blockchain networks.

How Much Is Spark Crypto Worth Now?

At the moment, SPK coin costs around $0.126.

Can SPK Hit $1?

SPK has the potential to reach $1, but achieving this milestone would require significant adoption, sustained demand, and favorable market conditions. SPK would need a substantial price surge, which could be driven by continued growth in TVL, deeper RWA integrations (e.g., BlackRock’s BUIDL), and expanded DeFi adoption.

Will Spark Reach $10?

Hitting $10 per SPK token would represent a huge increase from its current price. While theoretically possible in the long term, this target faces significant challenges based on Spark’s tokenomics, market dynamics, and historical precedents in DeFi. Reaching this price level would depend on SPK’s performance, a variety of crypto market factors, and represents a speculative scenario.

Will Spark Reach $100?

Reaching $100 per SPK token is extremely unlikely given Spark’s 10 billion token max supply, which would require a $1 trillion market capitalization, far exceeding Bitcoin’s current valuation. Even with aggressive adoption of its DeFi ecosystem, such a price would demand unprecedented demand, sustained yield growth, and large-scale token burns to offset inflation from future unlocks.

Will Spark Coin Go Up?

Spark coin has the potential to rise in value, driven by its TVL, institutional-grade yield products, and strategic integrations with RWAs. However, short-term volatility remains a concern due to profit-taking after its 500% July rally and only 10% of its 10B supply circulating, which could lead to inflationary pressure.

What Is the Price Prediction for Spark 2025?

According to DigitalCoinPrice, in 2025, $SPK can go as high as $0.27.

What Is the Price Prediction for SPK Coin in 2030?

According to CoinCodex, in 2030, the maximum price level Spark can reach is $0.46.

What Is the Price Prediction for Spark in 2040?

According to CoinCodex, in 2040, Spark coin can reach a peak of $0.83.

Conclusion

Spark has emerged as one of the most innovative DeFi protocols, combining robust yield-generation capabilities with deep liquidity across stablecoins and RWAs. Its unique position within the MakerDAO ecosystem, its huge TVL, and institutional-grade integrations position it as a leader in next-generation decentralized finance. The protocol’s advanced liquidity management and multi-chain expansion offer significant growth potential, particularly as DeFi adoption accelerates. However, success will depend on Spark’s ability to navigate regulatory hurdles, maintain competitive yields, and balance token supply with demand. As the crypto market evolves, SPK could become a cornerstone of decentralized finance, but only if it sustains its technological edge and community trust.