KEY TAKEAWAYS

Lido DAO has underperformed over the last 12 months or so despite an upturn in late 2023.

A court found Lido’s members could face legal responsibility for the DAO in November.

Lido DAO is sunsetting its activity on Polygon.

Our Lido DAO price prediction says LDO could fall to $0.50 by the end of the year.

Interested in buying or selling LIDO DAO LDO coin? Read our review of the best exchanges to buy and sell LIDO DAO LDO.

Lido DAO’s LDO token surged in late 2023 and early 2024 as the market thrived. New upgrades for the system’s nodes boosted the token, which helps power a staking platform. However, it made a downturn, and in November, a California court ruled that Lido DAO members would be responsible for any legal cases against the platform.

However, LDO’s price improved after that, with the token peaking at just under $2.40 in early December and trading above $2 at various points up to the start of February 2025. By Feb. 6, however, with Lido DAO winding down its activity on Polygon, it was worth about $1.80.

Let’s take a look at our Lido DAO price prediction. We’ll also examine some of LDO’s price history and discuss what Lido DAO is and what it does.

Lido DAO Price Prediction

Let’s look at the LDO price predictions made by CCN on February 6, 2025. The predictions will be made using the wave count method. We will add and remove 20% from them to create the minimum and maximum targets.

| Minimum LDO Price Prediction | Average LDO Price Prediction | Maximum LDO Price Prediction | |

|---|---|---|---|

| 2025 | $0.50 | $0.62 | $0.74 |

| 2026 | $0.53 | $0.66 | $0.77 |

| 2030 | $0.64 | $0.80 | $0.96 |

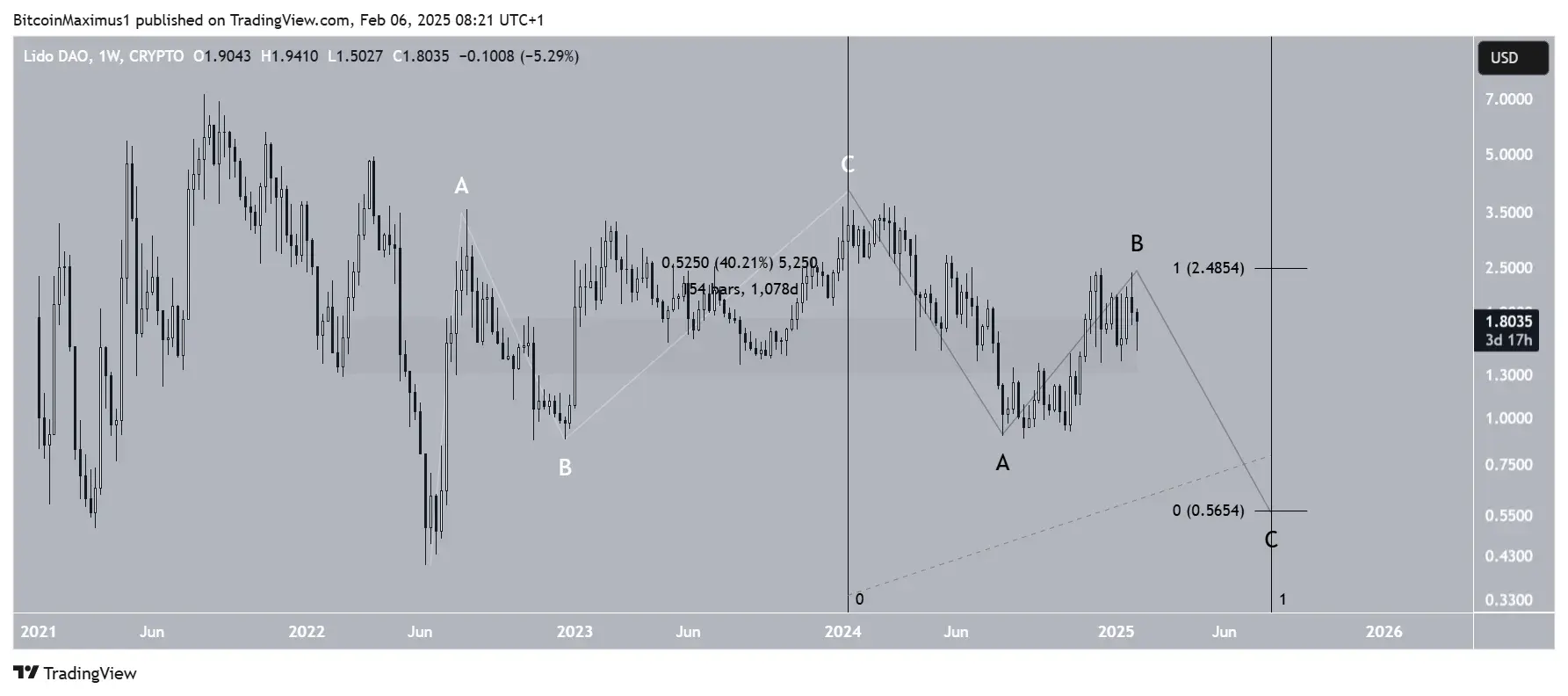

The most likely wave count suggests that LDO completed an upward A-B-C correction starting in July 2022 (white). If that is the case, a new A-B-C correction (black) has now been started, and wave B has just been completed.

If waves A:C have the same length, the LDO price will fall to a low of $0.56. Using the length of the previous upward movement indicates the low will be reached in August.

Since the trend’s direction is unclear afterward, we will use the daily rate of increase for the past three years to make an LDO prediction for the end of 2025, 2026, and 2030.

LDO has increased by 40% since February 2022, for a daily rate of 0.036%. Projecting this increase forward leads to LDO price predictions of $0.62, $0.66, and $0.80 for the end of 2025, 2026, and 2030, respectively.

Lido DAO Price Prediction for 2025

The wave count method combined with the daily rate of increase gives an LDO price prediction range between $0.50 and $0.74 for the end of 2025.

Lido DAO Price Prediction for 2026

The wave count method combined with the daily rate of increase gives an LDO price prediction range between $0.53 and $0.77 for the end of 2026.

Lido DAO Price Prediction for 2030

The wave count method combined with the daily rate of increase gives an LDO price prediction range between $0.64 and $0.96 for the end of 2030.

Lido DAO Price Analysis

The weekly time frame LDO chart shows that the price has fallen under a descending resistance trend line since its cycle high of $4.03 in January 2024. The trend line has caused numerous rejections (black icons), the most recent one last week.

Despite the trend line’s rejection, the LDO price bounced at the $1.50 horizontal support area. This is the most important horizontal level in LDO’s price history. It has provided support since 2022, except for two deviations in 2022 and 2024 (black circles).

Therefore, the trend can still be considered bullish while the LDO price trades above it. Saying that, it is worth keeping in mind that the trend line and support area create a descending triangle, considered a bearish pattern.

Like the price action, technical indicators do not provide a clear direction for the future trend.

Looking for a safe place to buy and sell LIDO DAO LDO? See the leading platforms for buying and selling LIDO DAO LDO

The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) are both neutral. The RSI is at 50 while the MACD is close to 0, failing to confirm the trend’s direction.

Short-Term LDO Price Prediction

The LDO price prediction for the next 24 hours is bearish. LDO will likely decline toward the $1.50 horizontal support area and eventually break down.

Lido DAO Average True Range (ATR): LDO Volatility

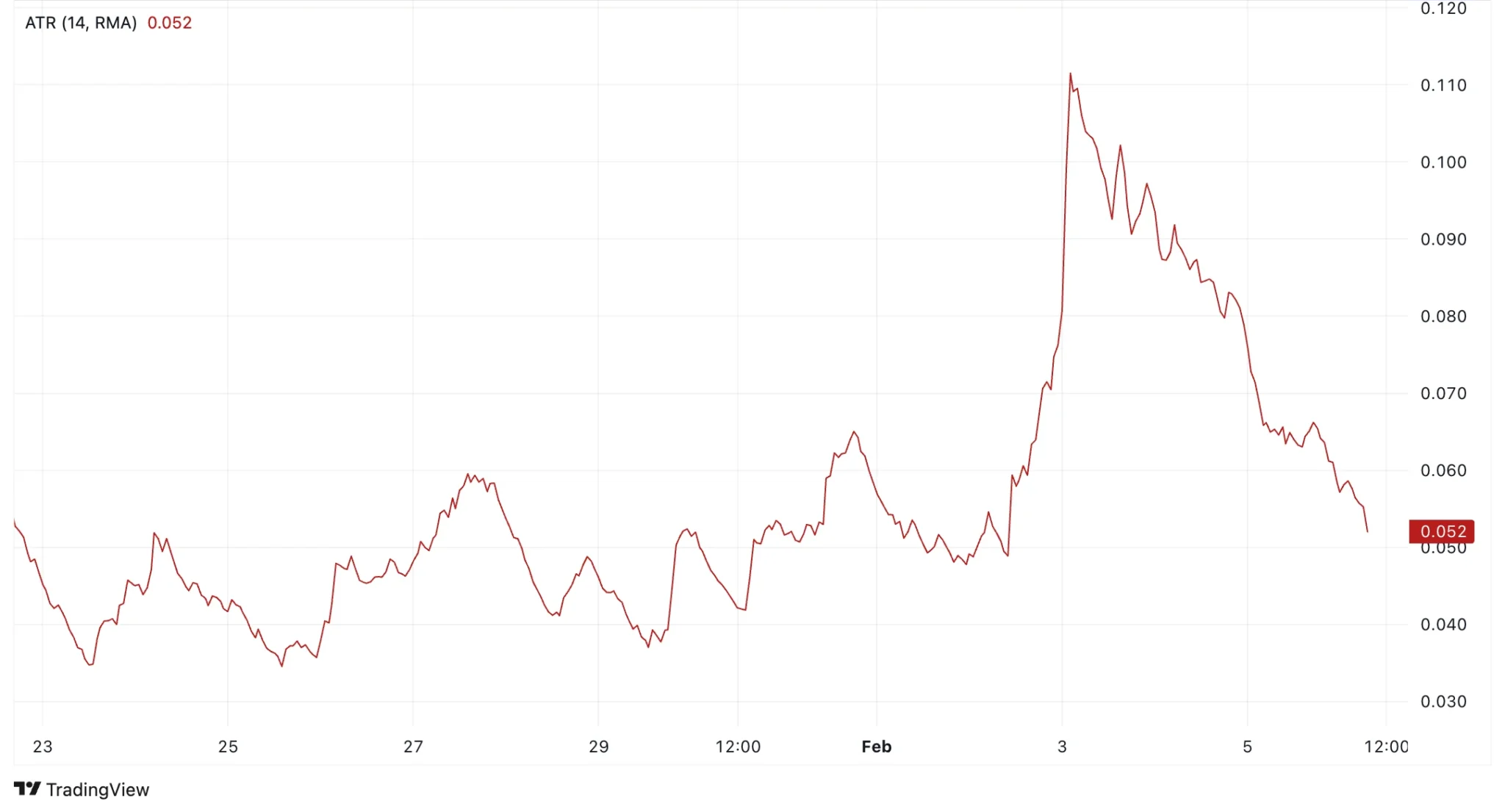

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days. A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On Feb. 6, 2025, Lido DAO’s ATR was 0.052, suggesting relatively low volatility.

Lido DAO Relative Strength Index (RSI): Is LDO Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold. Movements above 70 and below 30 show over and undervaluation, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On Feb. 6, 2025, the Lido DAO RSI was at 60, indicating bullish conditions.

Lido DAO Market Cap to TVL Ratio

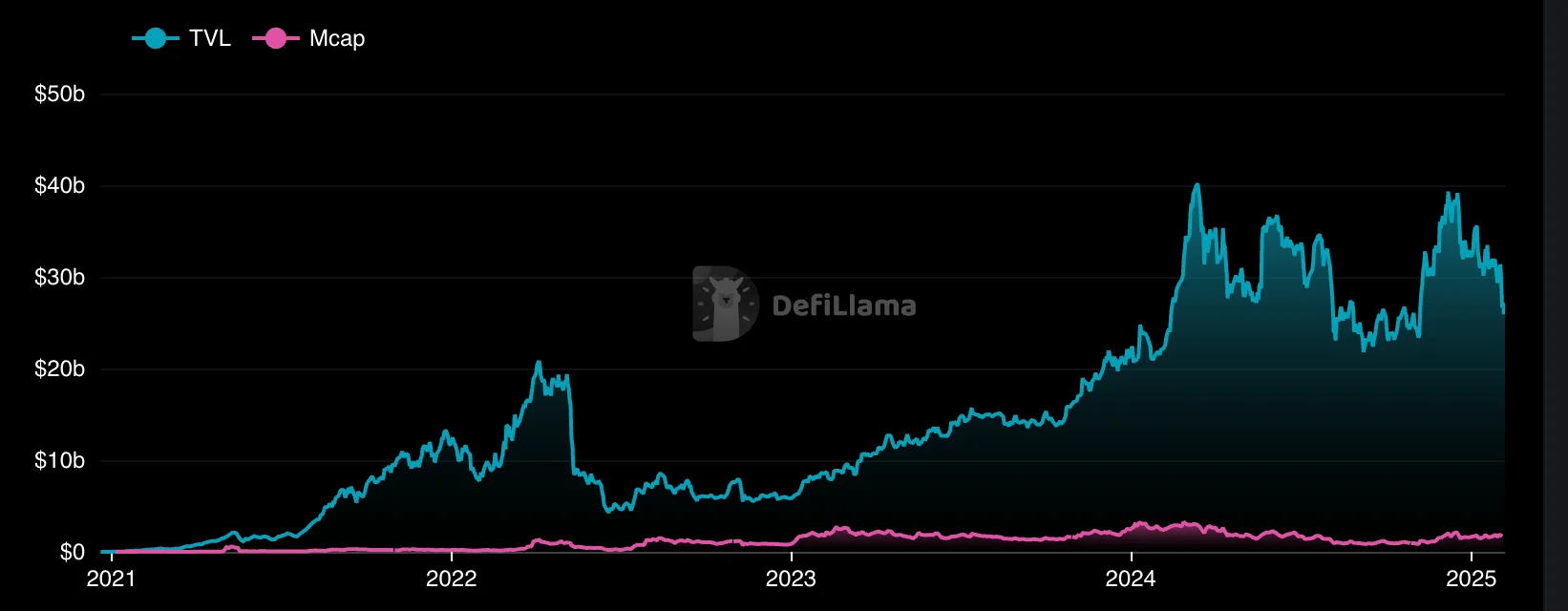

The Total Value Locked (TVL) to market cap ratio (TVL ratio) measures the valuation of a decentralized finance (DeFi) project by comparing its market capitalization to the total value of assets locked in its smart contracts. This ratio shows the project’s utilization and links the platform’s health to locked asset value.

A ratio above 1.0 indicates overvaluation because the market cap exceeds the value of assets used in the platform. A ratio below 1.0 indicates undervaluation because the market cap is lower than the value of locked assets.

On Feb. 6, 2025, the Lido DAO TVL ratio was 0.059, suggesting strong undervaluation.

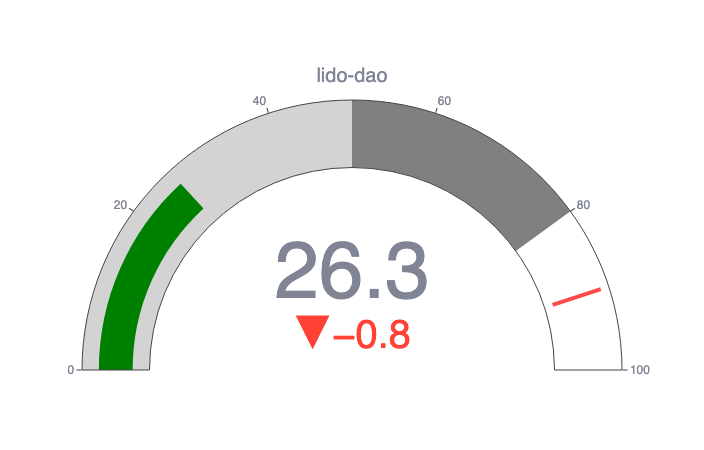

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but the score will slowly adjust back up as volatility decreases.

On Feb. 6, 2025, Lido DAO scored 26.3 on the CCN Index, suggesting weak momentum.

Lido DAO Price Performance Comparisons

| Current Price | One Year Ago | Price Change | |

| LDO | $1.80 | $2.83 | -36.3% |

| AAVE | $262.90 | $85.32 | +208% |

| BGB | $6.75 | $0.6414 | +952% |

| OP | $1.10 | $3.36 | -67.2% |

Best Days and Months to Buy Lido DAO

We looked at the Lido DAO price history and found the best times to buy LDO.

| Day of the Week | Friday |

| Week | 18 |

| Month | July |

| Quarter | Third |

LDO Price History

Now, look at some of the key dates in the LDO price history. While we take the utmost care with our price forecasts, we need to mention that price predictions, especially for something as potentially volatile as crypto, can often be wrong.

| Period | Lido DAO Price |

|---|---|

| Last week (Jan. 30, 2025) | $2.18 |

| Last month (Jan. 6, 2025) | $2.11 |

| Three months ago (Nov. 6, 2024) | $1.39 |

| One year ago (Feb. 6, 2024) | $2.83 |

| Launch price (Jan. 5, 2021) | $1.84 |

| All-time high (Nov. 16, 2021) | $18.62 |

| All-time low (June 18, 2022) | $0.406 |

Lido DAO Market Cap

The Lido DAO market capitalization, or market cap, is the sum of the total number of LDOs in circulation multiplied by their price.

On Feb. 6, 2025, Lido DAO’s market cap was $1.62 billion, making it the 55th-largest crypto by that metric.

Who Owns the Most Lido DAO (LDO) Tokens?

On Feb. 6, 2025, one wallet held more than 10% of the supply of LDO.

Lido DAO Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Total supply | 1,000,000,000 |

| Circulating supply (as of Feb. 6, 2025) | 895,936,033 (89.59% of total supply) |

| Holder distribution | Top 10 holders owned 51.22% of the total supply as of Feb. 6, 2025 |

From the Lido DAO Whitepaper

In its technical documentation or whitepaper, Lido DAO says it wants to make staking easier.

It says: “Lido liquid staking protocol is an Ethereum 2.0 liquid staking protocol solving these drawbacks. Users can deposit their ether in Lido smart contracts and receive stETH — a tokenized version of staked ether — in return. The DAO-controlled smart contracts then stake tokens with DAO-picked node operators. The DAO controls users’ deposited funds. Node operators never have direct access to the users’ assets.”

Lido DAO (LDO) Explained

Lido DAO is a platform designed to let people stake crypto without meeting minimum staking requirements. It is based on the Ethereum (ETH) blockchain and powered by the LDO token.

By staking ETH in Lido DAO, people are given a token called stETH as compensation. The value of stETH is equivalent to the amount of ETH they have deposited. It can be transferred, traded, or utilized in decentralized finance (DeFi) applications.

Initially designed to cater to ETH stakers, the system has evolved to enable participation from people staking SOL, KSM, and MATIC. Users staking these particular cryptos receive stSOL, stKSM, and stMATIC tokens, respectively. These tokens function in a similar manner to stETH, offering comparable benefits.

How Lido DAO Works

Lido DAO lets people stake less than the minimum 32 ETH required by Ethereum. This allows them to get involved and, potentially, turn a profit with less crypto.

LDO gives holders votes on changes to the network. People can also buy, sell, and trade it on exchanges.

Is Lido DAO a Good Investment?

It is hard to say at this moment. LDO’s price performance has been rather volatile recently, but it has somewhat climbed up the crypto rankings. On the other hand, it has underperformed compared to the market over the last year or so, dropping when the overall value of crypto has gone up.

As always with crypto, you should do your own research before deciding whether or not to invest in LDO.

Will Lido DAO go up or down?

No one can really tell right now. While the Lido DAO crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind that prices can and do go down and up.

Should I invest in Lido DAO?

Before you decide whether or not to invest in Lido DAO, you will have to do your own research, not only on LDO but also on other coins and tokens such as The Graph (GRT). Either way, you must also ensure you never invest more money than you can afford to lose.