The AERO crypto price has remained under pressure in the past few weeks, moving from the August high of $1.600 to the current $0.6857. This retreat occurred as the volume on its platform slipped following the merger with Velodrome and a DNS hack.

Aerodrome Finance Volume Has Slipped

The AERO crypto price has come under intense pressure in the past few weeks. One reason for the drop is that it has mirrored the performance of Bitcoin and other cryptocurrencies, which have slumped in the past few months.

Meanwhile, its fundamentals have deteriorated a bit, with the DEX volume on its platform dropping. The network processed transactions worth over $16 billion in November, down from over $24 billion the month before. This decline happened because November was a difficult month for the industry, with Bitcoin and most altcoins being in the red.

READ MORE: Top Catalysts that May Boost the Pi Network Price in December

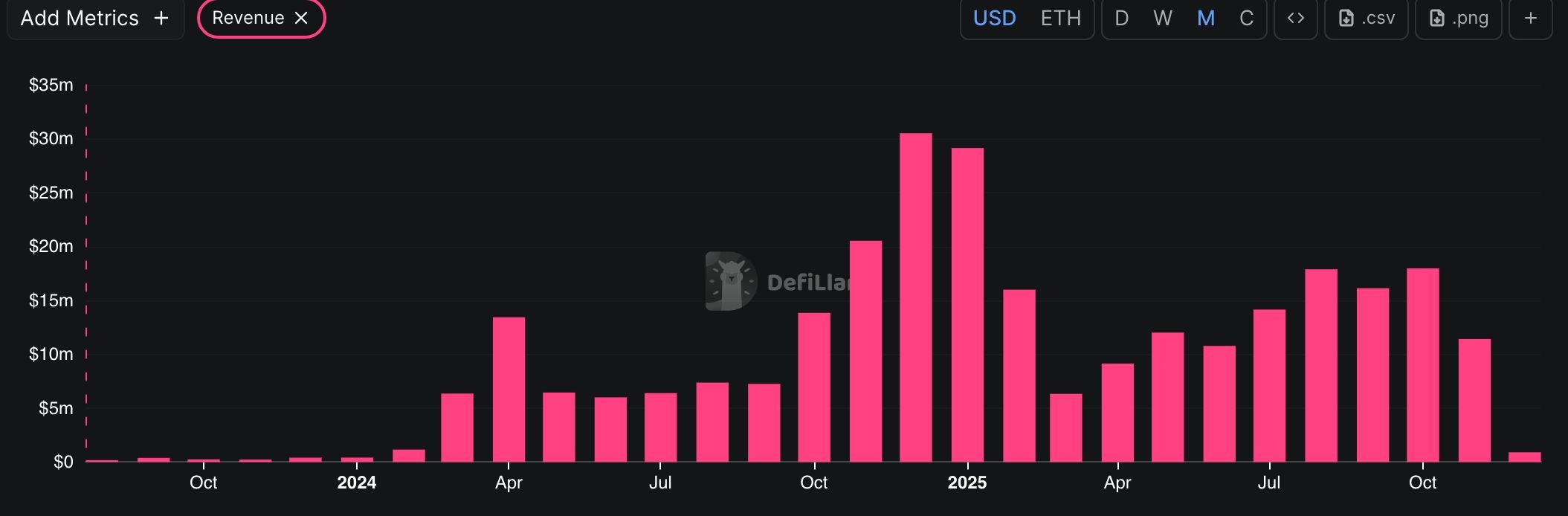

Consequently, Aerodrome fees dropped in November, bucking a trend that had been growing since March. It made $11.2 million in fees in November, down from $17.9 million in the previous month. Its annualized revenue exceeds $136 million.

This volume and fees may soon increase after the recent launch of a Base-Solana bridge. As a result, any Solana token can be deployed and traded on Aerodrome seamlessly.

The AERO price also retreated after the recent merger announcement between Aerodrome Finance and Velodrome, the top DEX platform on Optimism.

This deal, which will close in 2026, will see 5.55% of the tokens go to VELO holders and the remaining 94.5% to AERO holders. The network will also expand to other chains, such as Ethereum and the upcoming Arc from Circle.

AERO Crypto Price Technical Analysis

The daily chart shows that the AERO price has come under pressure in the past few months. It has sunk from a high of $1.60 in August to the current $0.6890.

Consequently, the token has moved below the 50-day Exponential Moving Average (EMA). It also formed a descending channel and is now at its lower side. The token remains below the Supertrend indicator.

On the positive side, it has now formed a bullish flag pattern, a common bullish continuation sign. Therefore, the most likely AERO price forecast is bullish, with the initial target at the psychological $1 level. A move above that level will signal further gains to $1.2.

On the other hand, a drop below this week’s low of $0.5800 will invalidate the bullish outlook.