Bitcoin hovers around $87,700 after failing to break the $90,000 resistance this week.

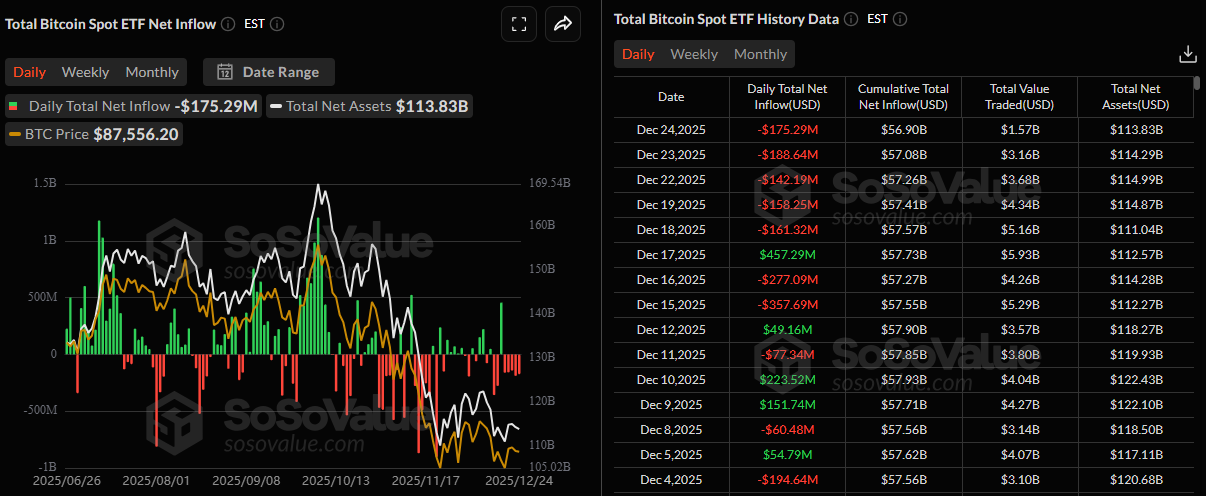

US-listed spot ETFs record an outflow of $175.29 million on Wednesday, marking the fifth consecutive day of withdrawals.

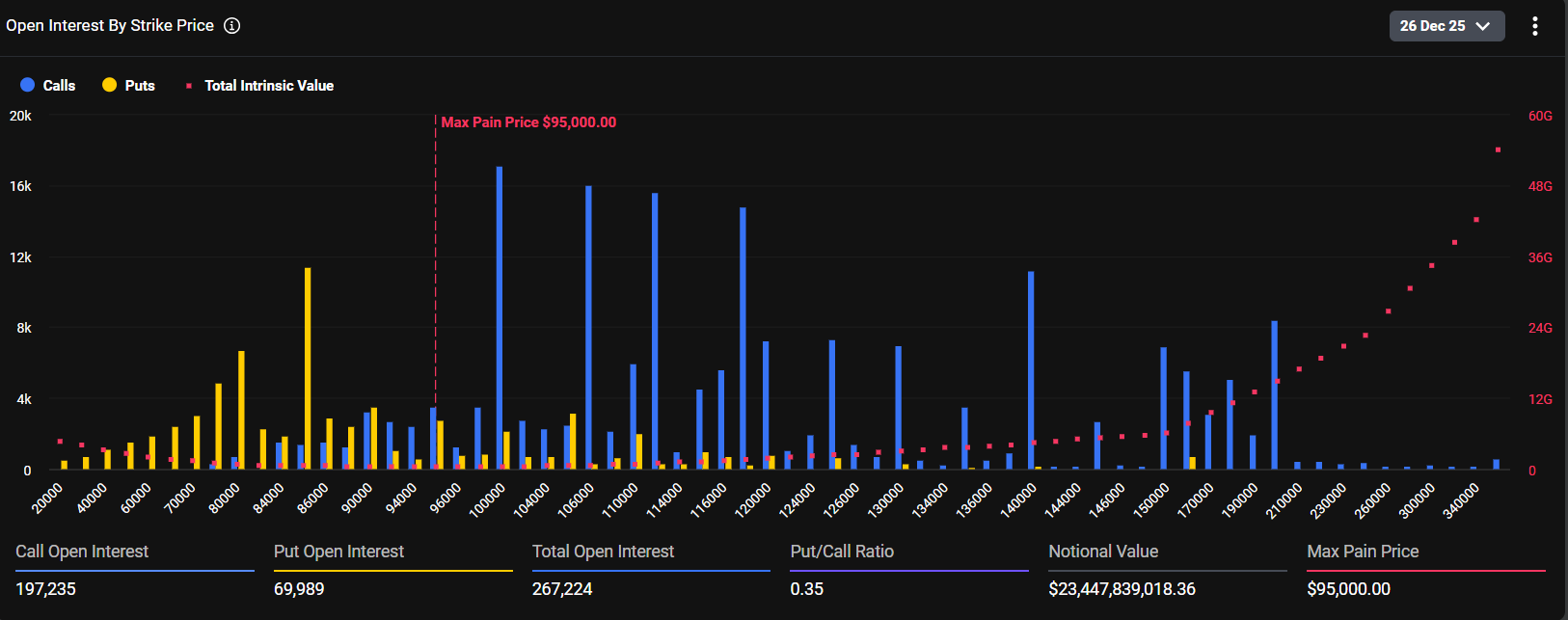

Market volatility remains high, with nearly $23.47 billion in BTC options expiring Friday, which could trigger sharp price swings.

Bitcoin (BTC) steadies around $87,700 at the time of writing on Thursday after failing to reclaim a key psychological level earlier this week. Institutional demand continues to weaken as spot Bitcoin Exchange-Traded Funds (ETFs) recorded their fifth consecutive day of withdrawals. Traders should remain cautious ahead of Friday’s large options expiry, which could bring fresh volatility and direction to the largest cryptocurrency by market capitalization.

Bitcoin’s institutional demand continues to fade

Institutional demand has continued to weaken so far this week. SoSoValue data show that Spot Bitcoin ETFs recorded an outflow of $175.29 million on Wednesday, marking the fifth consecutive day of withdrawals since December 18. If these outflows continue and intensify, the Bitcoin price could see further correction.

Calm before the storm

Derbit data shows that on Friday, $23.47 billion in BTC option contracts are set to expire. BTC derivatives traders are positioning heavily around higher strike prices, with call open interest significantly outweighing puts, as indicated by the low put/call ratio of 0.35, signalling a broadly bullish bias.

In addition, the max pain price of $95,000 suggests that option sellers would benefit most if BTC gravitates toward this level by expiry, as the most contracts would expire worthless there.

QCP Capital’s report this week highlighted that although leveraged positioning has come down, the contraction in market depth means squeeze risk in either direction remains elevated.

“Historically, BTC has tended to experience 5 to 7% swings during the Christmas period, a pattern often linked to year-end options expiries rather than fresh fundamental catalysts,” said QCP’s analyst.

Bitcoin Price Forecast: BTC steadies after rejection from key resistance

Bitcoin price was retested at the psychological $90,000 level on Monday and declined slightly the following day. On Wednesday, BTC stabilized at around $87,000. As of Thursday, BTC hovers around $87,700.

If BTC continues its correction, it could extend the decline toward the key support at $85,569.

The Relative Strength Index (RSI) is 43, below its neutral level of 50, indicating that bearish momentum is gaining traction. The Moving Average Convergence Divergence indicator showed a bullish crossover last week; however, the falling green histogram bars indicate fading bullish momentum.

On the other hand, if BTC closes above the $90,000, it could extend the recovery toward the next resistance at $94,253.