Aave protocol, the most liquid lending hub in decentralized finance, is on the verge of a contentious vote. The voting period, ending December 26, will determine the ownership of the protocol’s brand, as well as the manner of fee distribution.

Aave may affect decentralized finance in 2026, as a key vote may change its ownership model. Aave is currently poised to shift ownership of its brands to a single entity, to be defined later. The proposal suggests that the Aave brand resources should belong to AAVE token holders.

The Aave vote puts three sides in conflict. On the one hand, Aave Labs has guided the protocol progress. Aave DAO, on the other hand, is trying to recoup access to trading fees. The third side of the conflict are side contributors, which sometimes use the Aave brand to promote and give legitimacy to their DeFi products.

Aave locks in more than $33B, and is one of the key hubs for liquidity, as well as third-party builders based on Aave V3 technology. The resolution on the ownership of the protocol brand may affect the protocol’s reputation and the willingness of contributors to build side products. The conflict of Aave ecosystem stakeholders may hurt the protocol’s influence in 2026, just as DeFi had recovered to a relatively sustainable level.

Is Aave moving toward the interest of AAVE token holders?

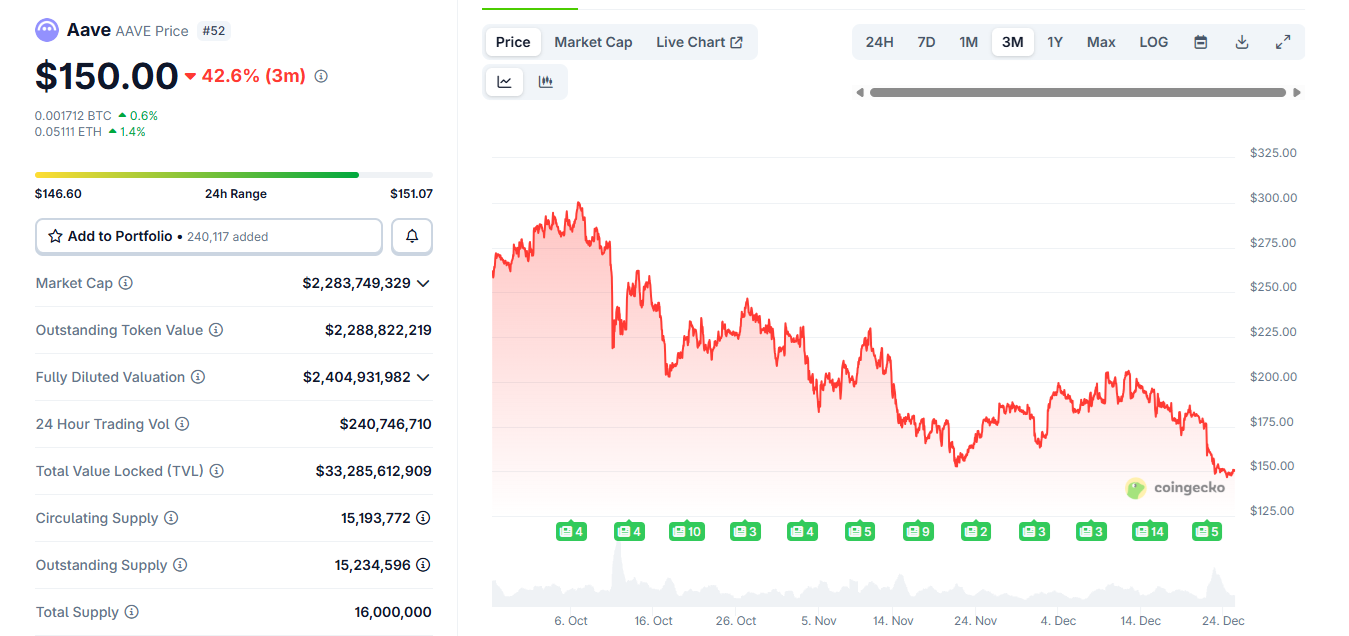

The one problem with the proposal is that it may run counter to the interests of AAVE token holders. Right after the proposal, AAVE tokens sank to a three-month low, trading as low as $146. Later, AAVE stabilized again above $150.

The other problem is that big AAVE holders are pushing the vote away from retail owners. Just around the time of the vote, the protocol’s founder Stani Kulechov bought more AAVE on some of his known wallets. The current trend of the vote toward a ‘No’ suggests token holders will not benefit from the project’s future growth, while Aave Labs may retain outsized control on the brand and storefront assets. The proposal aims to be neutral, and only discuss brand ownership structure.

As a result, Kulechov is one of the most influential voters, supporting the full transfer of brands to a new entity. However, the proposal is not directed at Aave Labs explicitly, but at all contributors and entities that have attempted to use the brand, or abstained from calling themselves a part of Aave.

As of December 25, the proposal was 18 hours from ending, with 52% of votes against the transfer of brand ownership, 43% abstaining, and only 4% in favor. The overall consensus was that the vote was rushed, and should have gone through a temp check process first.

Who owns the Aave assets?

Aave DAO holders have relied on the implicit split and good faith in the ownership of Aave assets. Currently, the assets, brand, landing pages, and GitHub resources are split between Aave Labs, as well as external contributors like BG Labs. However, at any moment, brand ownership may be revoked or challenged, curbing contributors and token owners from self-representation.

The proposal raises the issue of this implicit ownership, and asks for explicit transfer of all assets. The circle of Aave contributors is also growing, meaning some entities and app builders have been using the brand for self-promotion and monetization. As a result, the proposal asked to define the ownership more clearly:

“Private entities clearly separated from the DAO should not be allowed to unilaterally attribute to themselves, implicitly or explicitly, the name “Aave” or the status of “being Aave”. With a plural organization like the DAO and the lack of a direct mechanism of self-representation, another entity doing so outside a service agreement or other model (e.g., franchising) weakens the DAO’s ability to control its own representation.”

The DAO also claims that failing to resolve the issue may be a threat to the decentralized model. The biggest problem is the idealistic view of third-party service providers, who are contributing to Aave DAO and expect compensation.

The proposal’s main point is that the token owners should have explicit control over all brand assets, controlling them through a governance process.

The decision, however, is at a gridlock, given the ability of whales to oppose the brand transfer. For now, Aave remains in its usual uncertain state, allowing Aave Labs to still claim ownership of brand assets.

If you're reading this, you’re already ahead. Stay there with our newsletter.