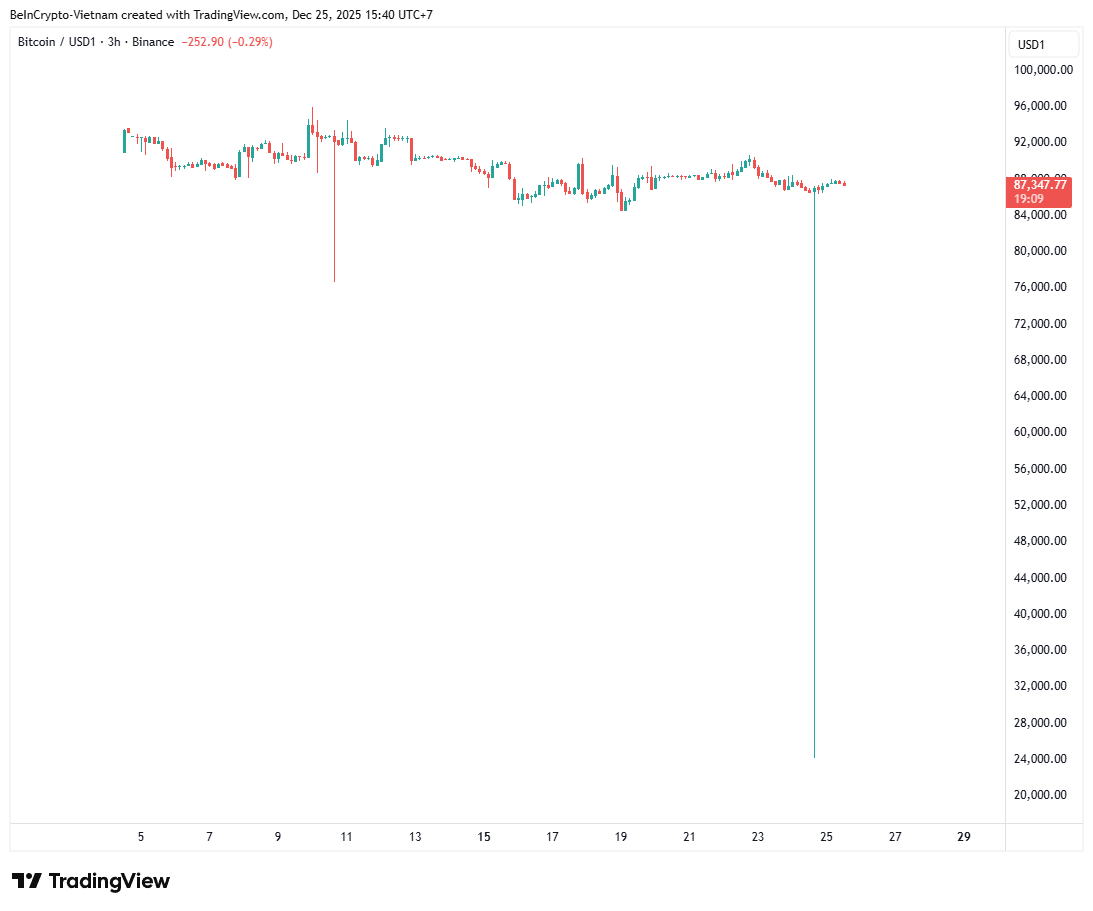

The BTC/USD1 trading pair on Binance experienced a brief flash crash. Bitcoin plunged to $24,000 before quickly recovering.

The incident did not affect Bitcoin prices on major pairs such as BTC/USDT. However, it highlighted liquidity risks in newly launched trading pairs.

BTC/USD1 crash to $24,000 exposes low-liquidity risks

According to market data from Binance, the incident lasted only a few seconds. The BTC/USD1 price later stabilized above $87,000.

USD1 is a new stablecoin issued by World Liberty Financial. The project receives backing from the family of US President Donald Trump.

Charts from Binance showed a steep wick. The move did not trigger any liquidation damage.

BTC/USD1 price performance. Source: TradingView

The incident occurred during the Christmas holiday period. Trading volumes dropped sharply at that time. Some observers speculated that the move was a liquidity test for the BTC/USD1 pair.

Joao Wedson, founder of Alphractal, explained that this phenomenon appears more often in bear markets. Capital inflows tend to weaken during those phases.

“Low liquidity in some trading pairs across multiple exchanges has been causing sharp volatility. It leads to temporary price dislocations and arbitrage issues for a few minutes. This is more common than it seems when the market is in a bearish phase,” Joao Wedson explained.

Another, more detailed explanation from the investor community linked the incident to Binance’s promotional campaign for USD1. Binance recently launched a 20% APY promotion for up to $50,000 in USD1 per user.

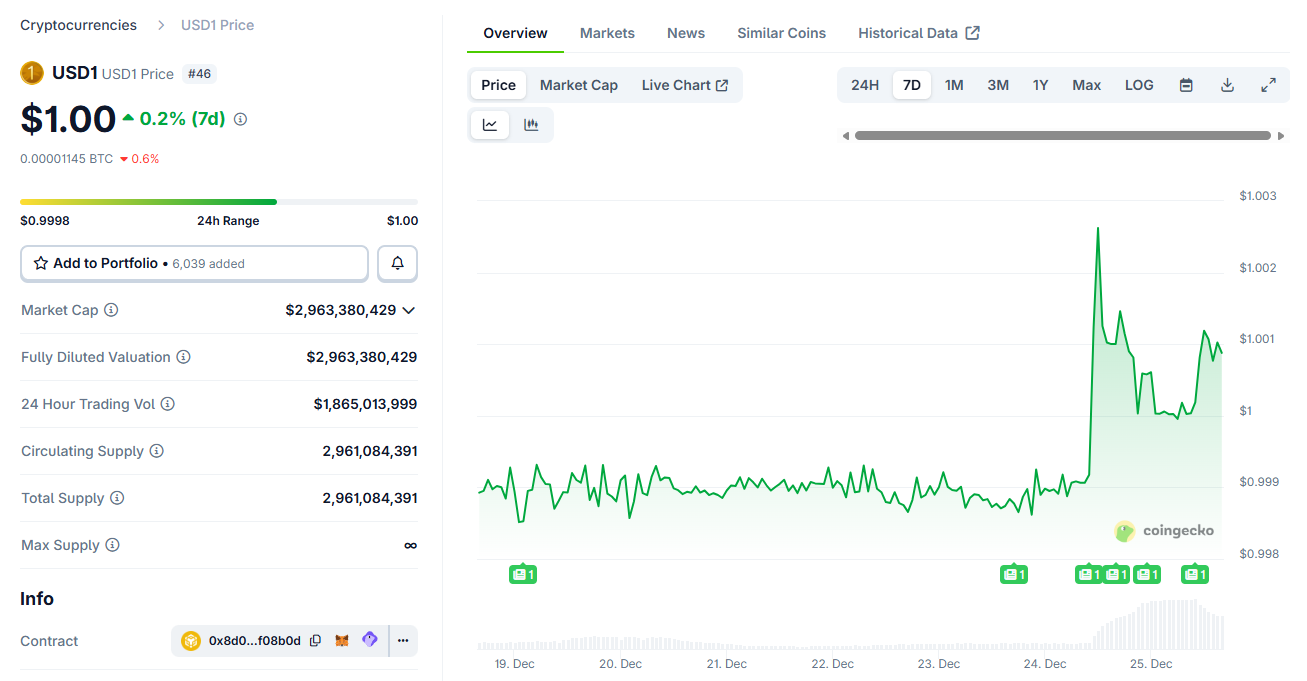

WuBlockchain, a reputable market-watching account, reported a sharp surge in USD1 supply after the launch. Supply increased by more than 45.6 million tokens within a few hours. Total market capitalization rose above $2.79 billion.

The sudden inflow of capital into USD1 pushed the stablecoin’s price up by 0.2%.

USD1 Price Performance. Source: CoinGecko

The X account Punk explained that many investors attempted arbitrage. They borrowed USD1 and gradually sold it on the spot market to participants joining the promotion.

Meanwhile, some traders chose to sell through the BTC/USD1 pair. Thin liquidity caught them off guard. Prices collapsed sharply, causing the outcome described above.

“This is just a small fluctuation in the bear market. There is no need to worry. Many similar fluctuations will appear later,” investor Punk said.

Could a similar situation happen to BTC/USDT?

A broader question now draws attention. Could a similar event occur on the BTC/USDT pair? This pair holds the highest liquidity in the market. A sudden drop there would cause massive liquidation losses.

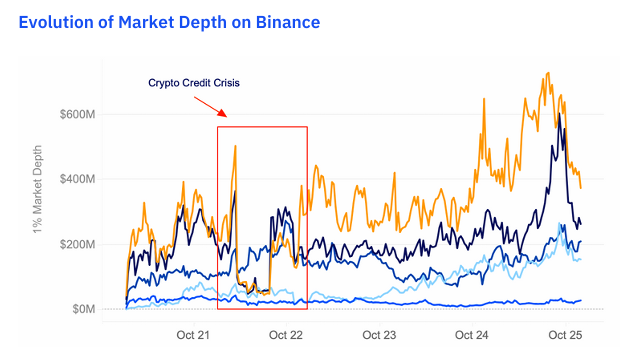

Analyst Maartunn cited Kaiko data. He noted that Bitcoin’s 1% market depth has increased significantly over the years.

“Depth didn’t just recover. It expanded. By the October 2025 highs, Binance 1% depth exceeded $600 million. That level stands above pre-2022 crash levels,” Maartunn said.

Bitcoin Market Depth on Binance. Source: Kaiko

He also emphasized that the decline in BTC/USDT prices did not erode liquidity. Over the course of more than 100 days, the BTC/USDT pair fell 21.77% (from $110,291 to $86,089). During that period, average daily spot volume reached $19.8 billion, totaling $613.5 billion.

With deeper market depth and abundant volume, a similar event on BTC/USDT remains unlikely.

However, the incident serves as a lesson for traders. Careful selection of trading pairs is essential. Low-liquidity pairs can cause severe slippage and unexpected losses.