Bitcoin’s long-term case against gold is increasingly being framed not as a narrative battle, but as a math problem.

A growing number of market analysts argue that the structure of Bitcoin’s supply gives it a fundamental edge over gold as a store of value, regardless of short-term price swings.

Key Takeaways

Bitcoin has a fixed supply, while gold expands as higher prices encourage more mining.

Halving cycles steadily reduce new bitcoin issuance, strengthening long-term scarcity.

Despite a weak Q4 2025, many expect Bitcoin to regain momentum in 2026 as gold and silver cool after record runs.

The comparison focuses less on sentiment and more on how each asset responds when demand increases.

How Gold Responds to Rising Demand

Gold production expands steadily over time. When prices rise, mining becomes more profitable, new deposits are developed, and total supply increases. This dynamic means higher demand for gold eventually leads to more gold entering the market, which helps cool price pressure.

While gold remains scarce and costly to extract, it is not supply-capped. Over long periods, demand tends to translate into gradual dilution.

Why Bitcoin Behaves Differently

Bitcoin operates under an entirely different system. Its supply is fixed by code and capped at 21 million coins. Rising demand cannot create new bitcoin. Instead, it increases competition among miners, pushes up energy usage, and strengthens network security, while issuance stays unchanged.

As a result, demand is reflected directly in price rather than supply expansion.

The Role of Bitcoin Halvings

Bitcoin’s halving cycle reinforces this effect. Roughly every four years, the reward for mining new blocks is cut in half. Over time, this sharply reduces the flow of new supply entering the market.

Gold has no equivalent mechanism. Its supply grows slowly but continuously, while Bitcoin’s new issuance trends toward zero.

Conservative Models Point to a Crossover

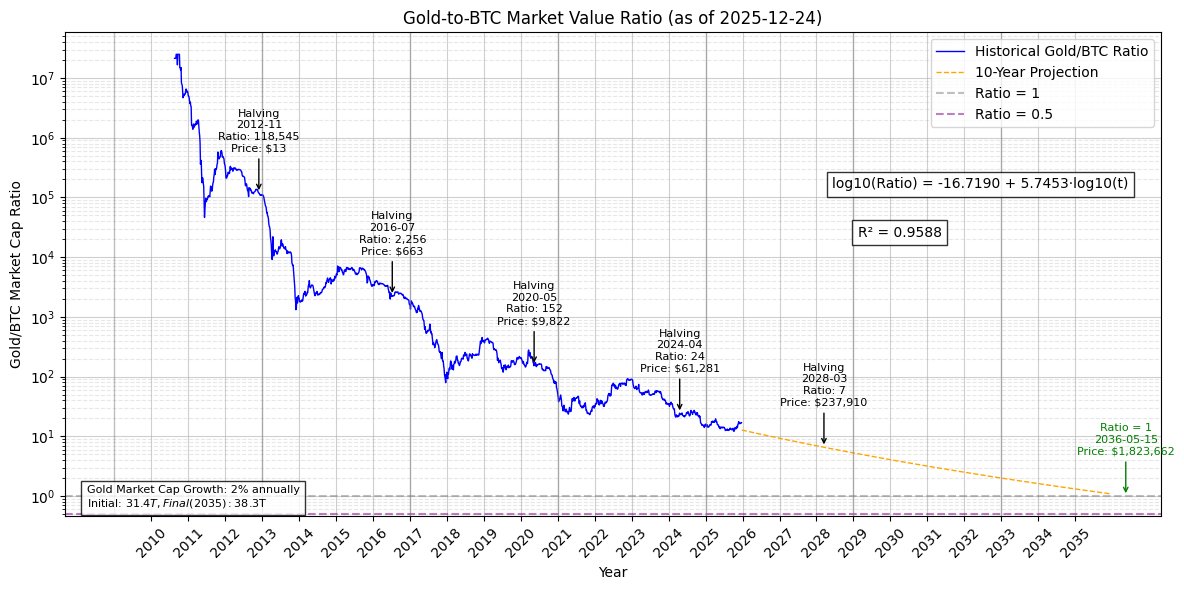

Some analysts have tested this dynamic using intentionally conservative assumptions. In one widely discussed framework, gold’s market value grows at about 2 percent per year, reflecting stable prices and gradual supply growth. Bitcoin, meanwhile, is assumed to grow far more slowly than it has historically, with its market value doubling only once every four years.

Even under these cautious assumptions, Bitcoin eventually reaches parity with gold. The models suggest this could happen within the next two decades, implying a multi-million-dollar price per coin in today’s terms.

Short-Term Weakness vs Long-Term Trends

Market timing still matters. Bitcoin struggled during the final quarter of 2025, underperforming traditional safe havens. Gold and silver, on the other hand, posted record gains earlier this year, fueled by geopolitical risk, central bank demand, and inflation concerns.

That contrast has shaped short-term sentiment, but many market observers view it as temporary.

Why Some Expect Bitcoin to Regain Momentum

A growing number of analysts expect gold and silver to lose steam after an exceptional year, opening the door for capital rotation. Despite the recent slump, many expect Bitcoin to regain momentum in 2026 as macro conditions stabilize and long-term adoption trends reassert themselves.

From this perspective, the current pause is seen less as a breakdown of Bitcoin’s thesis and more as part of a broader transition.

A Structural Debate, Not a Narrative One

Supporters of this view argue that gold responds to demand by increasing supply, while Bitcoin responds by becoming harder to acquire. Over long time horizons, they believe this structural difference is decisive.

Short-term cycles may favor one asset over the other, but over decades, supply mechanics may play the dominant role in determining which store of value ultimately prevails.

At the time of writing BTC is trading around $87,500 with no significant price swings in the past 24 hours.