Data of the Bitcoin Fear & Greed Index suggests the average investor sentiment has now been inside the extreme fear zone for 13 straight days.

Bitcoin Fear & Greed Index Is Still Pointing At Extreme Fear

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment shared by traders in the Bitcoin and wider cryptocurrency markets. The index determines the sentiment by referring to the data of five factors: market cap dominance, trading volume, Google Trends, social sentiment, and volatility. It then represents it using a numeric scale that runs from zero to hundred.

All values above 53 indicate the presence of a greed sentiment among the investors, while those below 47 suggest the dominance of fear. Levels lying between the two thresholds correspond to a net neutral mentality.

Besides these three core regions, there are also two “extreme” zones in the Fear & Greed Index, known as the extreme fear and extreme greed. The former occurs at and below 25, while the latter occurs above 75.

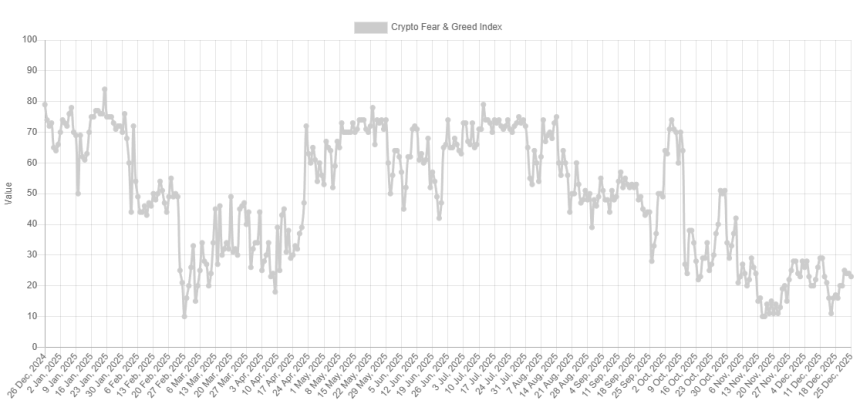

Now, here is how the sentiment among investors in the current Bitcoin market is, according to the Fear & Greed Index:

As is visible above, the majority sentiment in the cryptocurrency sector is one of extreme fear at the moment, with the indicator sitting at a value of 23. The despair among the investors isn’t new, as the index has, in fact, remained in this region for the last couple of weeks.

As displayed in the chart, the Bitcoin Fear & Greed Index has indicated extreme fear for 13 consecutive days now, underscoring the FUD that has been present in the market. If history is anything to go by, though, the extremely fearful sentiment may not actually be such a bad sign for BTC and other cryptocurrencies. Often, digital asset markets tend to move in a direction that goes contrary to the crowd’s belief.

This probability of an opposite move generally becomes the strongest inside the extreme sentiment zones, with major tops and bottoms historically forming while the index has been in the respective region.

The price low in November, which has acted as the bottom for Bitcoin so far, also occurred alongside an extended stay inside the extreme fear territory. Clearly, though, that extreme fear streak wasn’t enough to reignite sustained bullish momentum for BTC, as the asset has only consolidated since then.

As such, it only remains to be seen whether the latest stay inside extreme fear will be able to change that or if it will be a while before the bottom is reached in the current cycle.

BTC Price

At the time of writing, Bitcoin is floating around $87,500, unchanged from one week ago.