A little-known DeFi yield token stunned markets on Christmas Day after posting a triple-digit rally while most crypto assets traded quietly. Beefy Finance’s BIFI token surged more than 200% in 24 hours, briefly touching the $400 level before cooling, according to market data.

The move placed BIFI among the top gainers across the crypto market on December 25, despite no major protocol announcement or ecosystem shock.

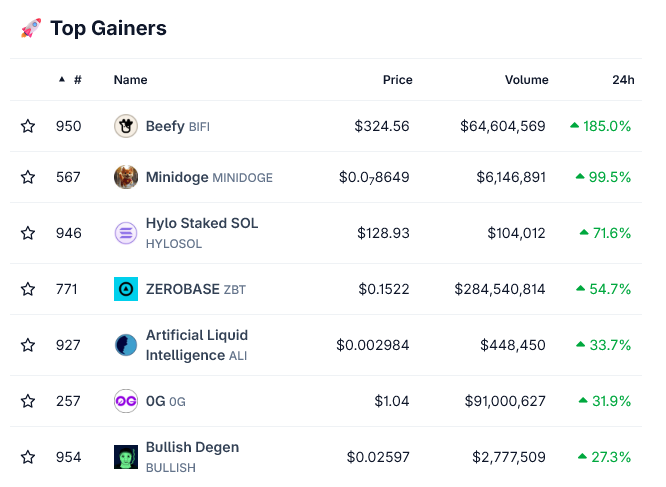

BIFI Tops the Charts on Christmas Day. Source: CoinGecko

What Is the BIFI Token?

BIFI is the governance and revenue-sharing token of Beefy Finance, one of DeFi’s longest-running yield aggregators.

Beefy operates automated “vaults” across multiple blockchains, compounding rewards from liquidity pools and staking strategies. Users retain custody of funds and can withdraw at any time.

Unlike many DeFi tokens, BIFI has a hard-capped supply of just 80,000 tokens, with no minting or burning mechanism. All tokens are already in circulation.

Holders who stake BIFI receive a share of protocol revenue generated from vault fees and can participate in DAO governance. This design makes BIFI closer to a yield-linked governance asset than a pure utility token.

BIFI Token Rallies 200% on Christmas Day 2025. Source: CoinGecko

Why BIFI Exploded on Christmas Day

The rally was driven less by new fundamentals and more by market structure.

First, BIFI’s ultra-low supply created a classic supply shock. With only 80,000 tokens outstanding, even modest buying pressure can move price aggressively.

On Christmas Day, demand overwhelmed thin order books.

Second, the token broke out after a long period of sideways trading. Once BIFI cleared key resistance levels, momentum traders and algorithmic scanners piled in, accelerating the move.

At the same time, 24-hour trading volume briefly exceeded BIFI’s market capitalization, a signal of intense short-term speculation rather than organic accumulation. That imbalance amplified volatility.

BIFI Daily Trading Volume Explodes on DEXs. Source: CoinMarketCap

Finally, the rally coincided with a rotation back into DeFi yield narratives. As meme coins cooled late in December, traders sought exposure to established revenue-generating protocols.

Beefy, with its multichain footprint and years-long operating history, fits that profile.

What the Rally Does, and Doesn’t Mean

Importantly, the Christmas surge did not reflect a sudden change in Beefy’s revenues, vault performance, or governance structure.

Instead, it highlighted how scarce DeFi governance tokens can experience extreme price swings when liquidity is thin and momentum builds.

While BIFI’s structure makes it sensitive to demand spikes, the same mechanics can work in reverse. Sharp retracements remain a clear risk once speculative flows fade.