Ethereum price has struggled to regain momentum, hovering near the $3,000 level over recent sessions. This prolonged consolidation has weighed on sentiment and weakened short-term confidence among ETH holders.

Still, shifting on-chain signals and historical price behavior suggest conditions may be forming for a potential rebound.

Ethereum ETFs Continue To Lose Money

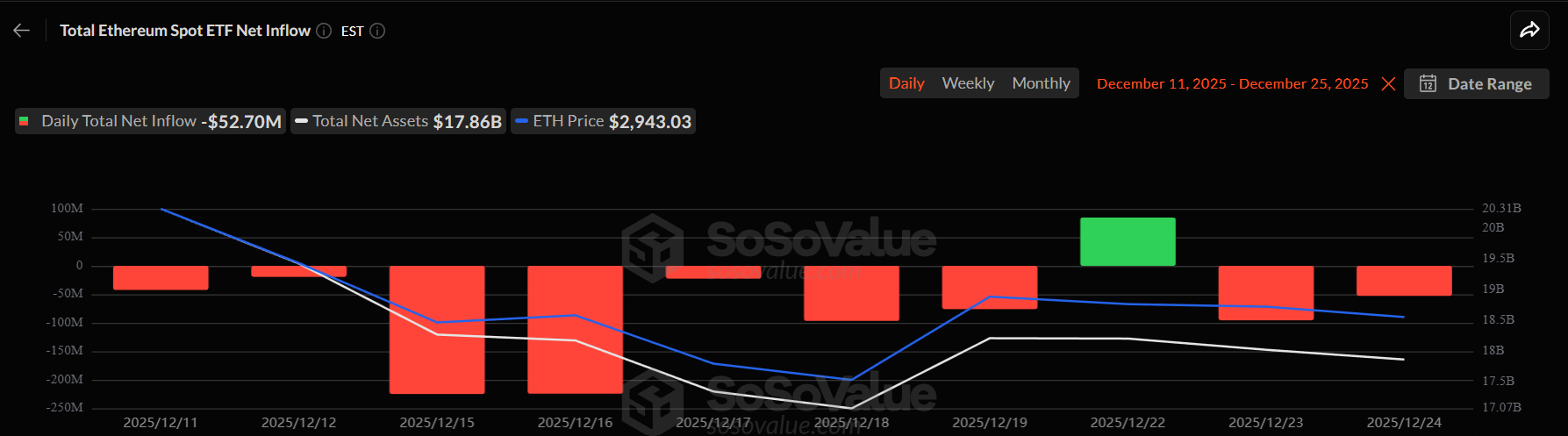

Ethereum ETFs have faced sustained pressure over the past two weeks. During this period, only one trading day recorded net inflows, largely driven by Grayscale activity. Outside that session, investors consistently pulled capital from ETH ETFs, signaling caution across traditional finance channels.

This pullback appears cyclical rather than structural. If Ethereum retests the $2,798 support level, buyers could reenter. A successful bounce and reclamation of that zone may reset market expectations and restore the upward price trajectory.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum ETF Netflows. Source: SoSoValue

Crucial Holders Are Showing Strength

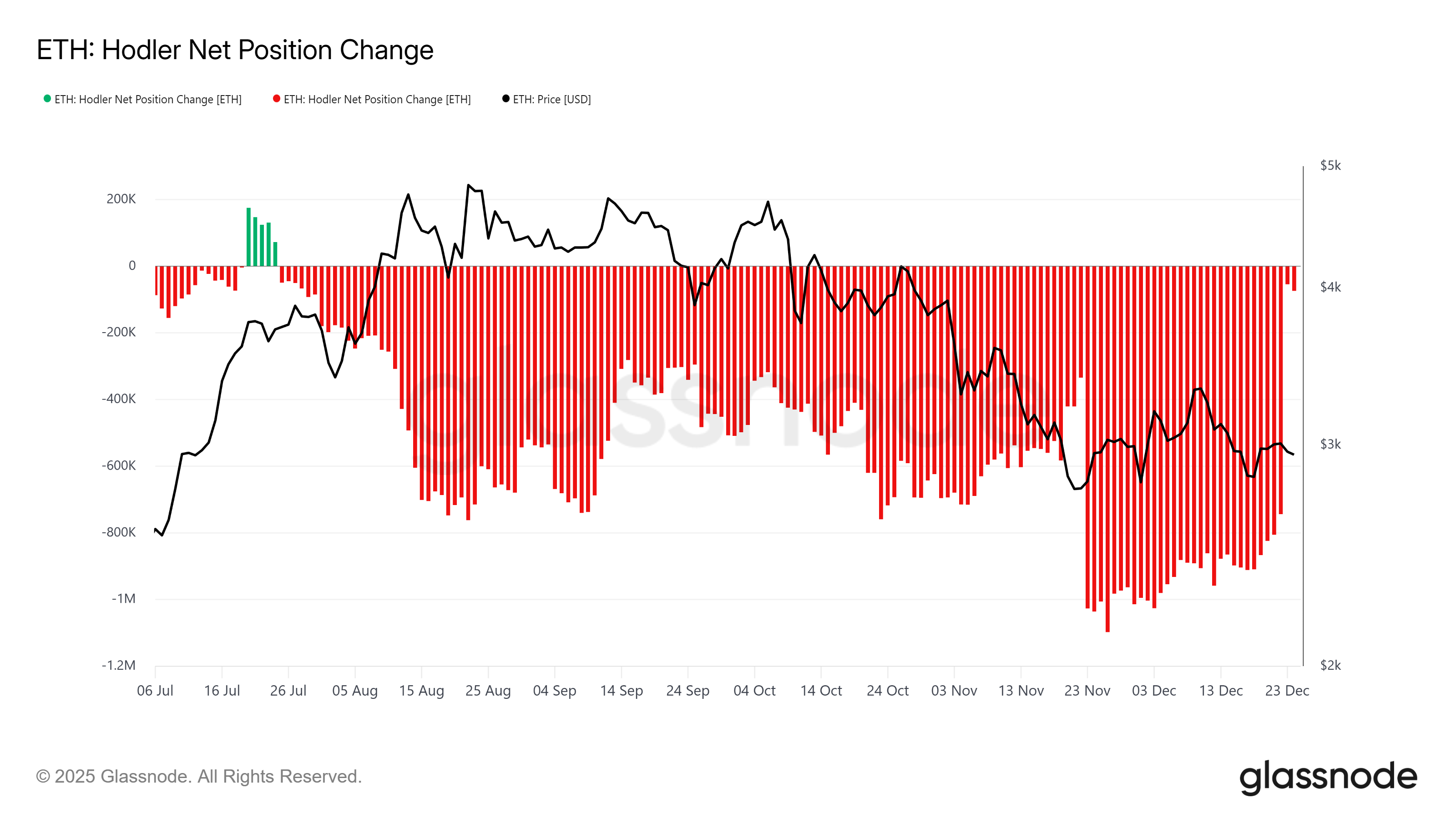

On-chain data points to improving macro momentum beneath the surface. Ethereum’s HODler Net Position Change, which tracks long-term holder behavior, has surged sharply. The indicator now sits near its largest outflow levels seen in the past five months.

This shift suggests older holders are reducing selling pressure and regaining confidence in Ethereum’s recovery potential. If the metric crosses above the zero line, it would confirm net inflows from long-term holders. Such behavior historically supports price stabilization and trend reversals.

ETH Price Could Bounce Back

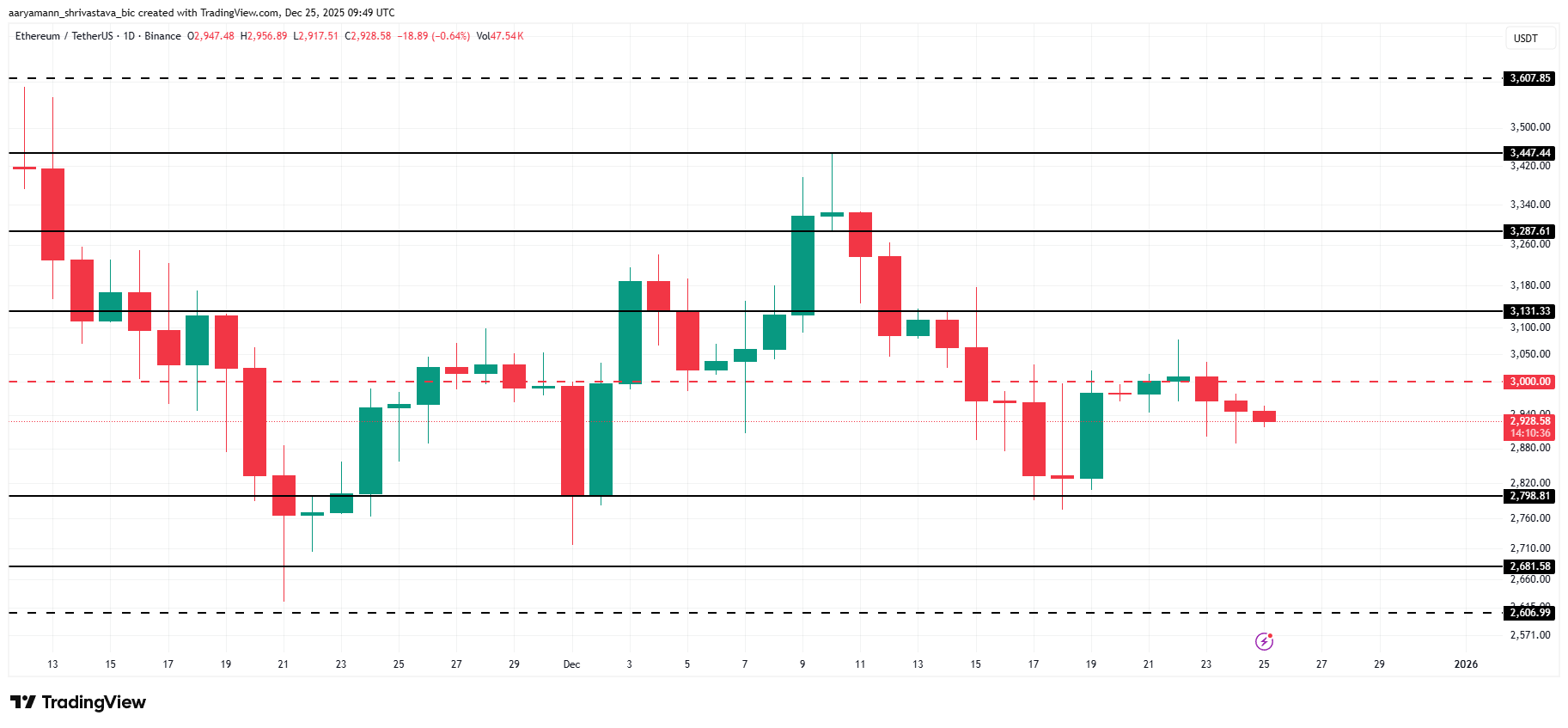

Ethereum traded near $2,978 at the time of writing, remaining capped below the psychological $3,000 barrier. This consolidation has raised concerns about whether ETH could close 2025 under that level. Persistent hesitation has kept volatility elevated and sentiment fragile.

However, ETF dynamics and long-term holder behavior point to a possible shift. A controlled pullback toward $2,798 could provide the base for a rebound. If Ethereum reclaims $3,000 as support, price action may extend toward $3,131 and beyond.

ETH Price Analysis. Source: TradingView

Downside risks remain if bullish momentum fails to develop. A breakdown below $2,798 would weaken the technical structure. In that case, Ethereum price could slide toward $2,681, invalidating the bullish outlook and reinforcing near-term bearish pressure.