Bitcoin is trading sideways near a critical inflection zone, reflecting a market caught between holiday-driven caution and expectations for renewed volatility once year-end liquidity conditions normalize.

At the time of writing, Bitcoin (BTC) has spent roughly three consecutive weeks consolidating between $85,000 and $90,000, a pattern commonly observed during late-December trading periods. Similar holiday consolidations in prior cycles, such as late 2020 and 2023, also featured compressed volume before directional expansion, often emerging in the first weeks of January. Against this backdrop, analysts are assessing whether the current range represents distribution risk or a base-building phase ahead of a post-Christmas move.

Bitcoin Price Today Chart Shows Prolonged Consolidation

The Bitcoin price today chart continues to reflect a tightly compressed range, with BTC repeatedly oscillating between $85,000 and $90,000. Buyers have consistently defended the lower boundary of this zone, preventing deeper pullbacks despite the absence of strong upside momentum. This stability has helped keep the BTC market cap relatively steady, even as broader trading activity remains subdued.

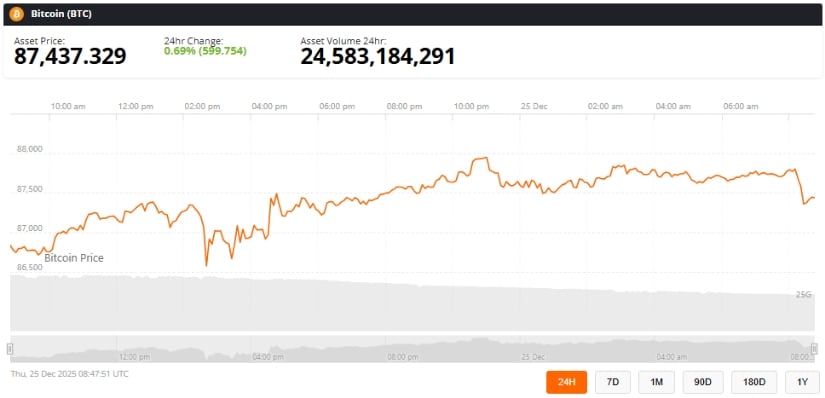

Bitcoin was trading at around 87,437, up 0.69% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Market behavior during low-liquidity periods often amplifies short-term noise. With spot volume trailing recent weekly averages, price movements have frequently resulted in failed breakouts and brief stop-driven swings. Such conditions historically favor patience over aggressive positioning, particularly as liquidity typically thins further during weekends.

Analysts Frame Bitcoin’s Pause as a Strategic Setup

Crypto analyst Michaël van de Poppe, known for tracking macro correlations between crypto, equities, and commodities, views Bitcoin’s consolidation as structurally neutral rather than bearish. In a recent post on X, he noted, “#Bitcoin currently stalls between $85–90K for multiple weeks. It’s a waiting game… it feels like we’re waiting before commodities peak and the Nasdaq breaks to a new ATH for $BTC to surge again.”

Bitcoin continues to consolidate between $85K–$90K, with analysts watching $86K support as a base for a post-holiday grind toward a potential $90K breakout. Source: @CryptoMichNL via X

Van de Poppe’s framing places Bitcoin’s near-term outlook within a broader macro context, suggesting that renewed strength in traditional risk assets could act as a catalyst. He also highlighted $86,000 as a key technical support, where price has repeatedly stabilized.

His TradingView analysis outlines a possible double-bottom retest, a pattern often interpreted as a sign of seller exhaustion. However, the reliability of such structures tends to improve when accompanied by rising spot volume, an element that remains notably absent so far. As a result, the setup continues to lean more toward potential than confirmation

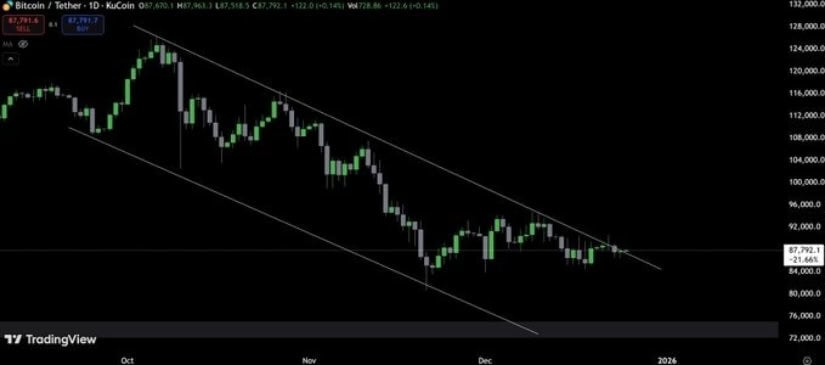

Descending Channel and Key Technical Levels

Technical analyst Alex RT₿ (@rutradebtc) has focused on Bitcoin’s interaction with a descending channel on the daily timeframe. According to his chart, BTC has trended lower since its October peak near $120,000, with recent price action pressing against the channel’s upper resistance line.

Bitcoin tests the upper boundary of a descending channel, leaving traders split between bullish breakout expectations and bearish continuation risk. Source: @rutradebtc via X

Descending channels typically reflect controlled corrective phases rather than impulsive sell-offs. A confirmed breakout above the upper boundary could indicate a shift in short-term momentum. However, without a corresponding increase in volume, such moves are historically prone to failure, an outcome that helps explain the current split in trader sentiment.

Some market participants interpret the structure as a coiling phase, while others caution that weak liquidity and limited conviction could still expose BTC to another sweep of downside liquidity.

Range Levels Define Bullish and Bearish Triggers

Providing additional structure, TradingView analyst MohammadAmin41148 emphasized that Bitcoin remains firmly range-bound, with no decisive trend change in place. He pointed to the Fear & Greed Index reading of 28, signaling persistent risk aversion among participants.

Bitcoin remains range-bound between $85K–$89K amid fear and low volume, with traders watching $88.6K for a bullish breakout and $86K as a key downside risk. Source: MohammadAmin41148 on TradingView

According to his framework:

A clean daily breakout above $88,600 would strengthen the bullish case by pushing BTC beyond the upper portion of its consolidation range.

Conversely, a sustained move below the $86,700–$86,000 zone would weaken the base-building thesis and increase the likelihood of deeper retracement.

He also warned that thin weekend liquidity raises the probability of stop hunts and misleading intraday moves, reinforcing the importance of disciplined risk management during this phase.

Final Thoughts

Bitcoin’s current price action reflects equilibrium rather than strong directional conviction. The prolonged consolidation between $85,000 and $90,000 suggests traders are waiting for clearer signals, with holiday liquidity and muted volume continuing to suppress momentum on both sides of the market.

From a broader perspective, analysts increasingly view this phase as a transitional pause rather than a breakdown. Repeated defenses of key support and a developing double-bottom structure keep the medium-term outlook cautiously constructive, though confirmation is still required. A sustained move below $85,000 would weaken the base-building thesis, while a breakout above $90,000 without volume support would warrant continued caution.