Bitcoin (BTC) faces a critical moment as it hovers near $86,700 support, showing signs of mid-range consolidation during slow holiday trading. Investors are closely monitoring the next directional move.

Despite limited price movement, market participants remain alert. Trading volumes are low, and buyer strength is muted, while sellers maintain control. Repeated intraday defenses at $86,700 suggest algorithmic support, which is often fragile during low-liquidity periods. Analysts note that BTC’s behavior reflects a broader trend of cautious sentiment, with institutional adoption providing some stability but failing to trigger a decisive rally.

Bitcoin Consolidates Amid Holiday Lull

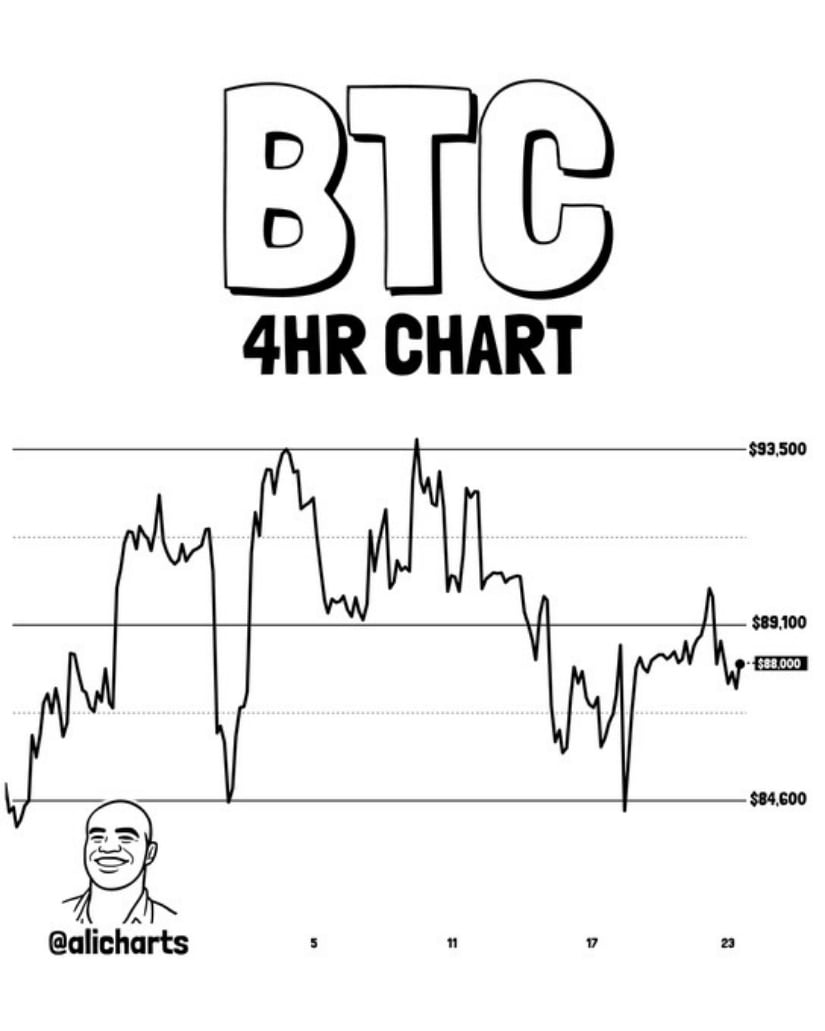

Bitcoin (BTC) is currently trading near $86,700, showing signs of mid-range consolidation as holiday trading slows down. The cryptocurrency has seen limited volatility in recent sessions, hovering between $84,000 and $93,500 over the past few days. According to Ali Charts (@alicharts), known for monitoring short-term on-chain metrics, BTC currently shows no clear directional bias, reflecting cautious market sentiment.

Bitcoin trades sideways in mid-range consolidation, showing no clear directional bias. Source: @alicharts via X

By December 24, 2025, Bitcoin dipped slightly to $86,934, down 0.5% from the prior close, aligning with the ongoing trend of stagnation in 2025 despite institutional inflows. Market participants face a tension between weak on-chain activity and ETF inflows, reflecting a cautious environment where short-term bullish signals remain limited.

BTC Technical Support at $86,700

Crypto analyst Crypto Tony (@CryptoTony), frequently cited for short-term technical levels, highlighted $86,700 as a pivotal support level. He noted, “Lose that level, and we look to short; hold this level, and expect a bounce toward $88,000.”

Bitcoin hovers at $86,700 support, with the potential to bounce toward $88,000 if the level holds. Source: @CryptoTony via X

At midday on December 24, BTC remained around $86,800, testing this critical level during low-volume holiday trading. The level is structurally significant, reinforced by repeated intraday defenses and historical volume nodes. Spot ETF inflows provide some underlying stability, but short-term sentiment leans bearish with weak retail participation.

Short-Term Market Structure: Bearish Signals Persist

TradingView analyst ecobyg1, known for technical chart analysis, provided a detailed overview of BTC, noting that the cryptocurrency is forming a lower high/lower low pattern on the 4-hour chart. This indicates a gradual corrective phase rather than a sharp drop. “Until price can hold above SMA58, we cannot call this market bullish,” ecobyg1 added.

Bitcoin ($BTC) hovers at critical short-term support near $86,800, showing bearish structure with weak buying and low volume. Source: ecobyg1 on TradingView

Key price zones

Key Resistance: $88,600–$89,200

Key Support: $86,800–$86,600 (critical short-term support)

Candlestick patterns suggest weak buyer strength, and every attempted bounce is quickly sold. The market is sliding between supports rather than building a stable base.

Final Outlook

Bitcoin’s short-term trend remains bearish, with no confirmed reversal yet. The $86,600 level represents the final short-term support before a potential breakdown. If this support holds, BTC could rebound toward $88,000; if broken, further downside toward $84,000 is possible.

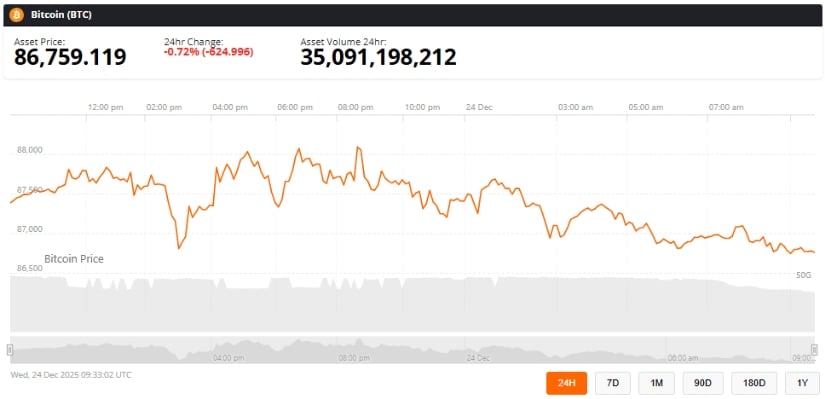

Bitcoin was trading at around 86,759, down 0.72% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Investors and traders are advised to remain patient, focus on technical confirmation, and avoid emotional positioning during this period of mid-range consolidation and low holiday liquidity.