IOTA price has been drifting sideways after months of decline, but the latest daily chart suggests that momentum might finally be shifting. Let’s break down the technicals, uncover key levels, and calculate where IOTA price could head next .

IOTA Price Prediction: What Does The IOTA Daily Chart Reveal Right Now?

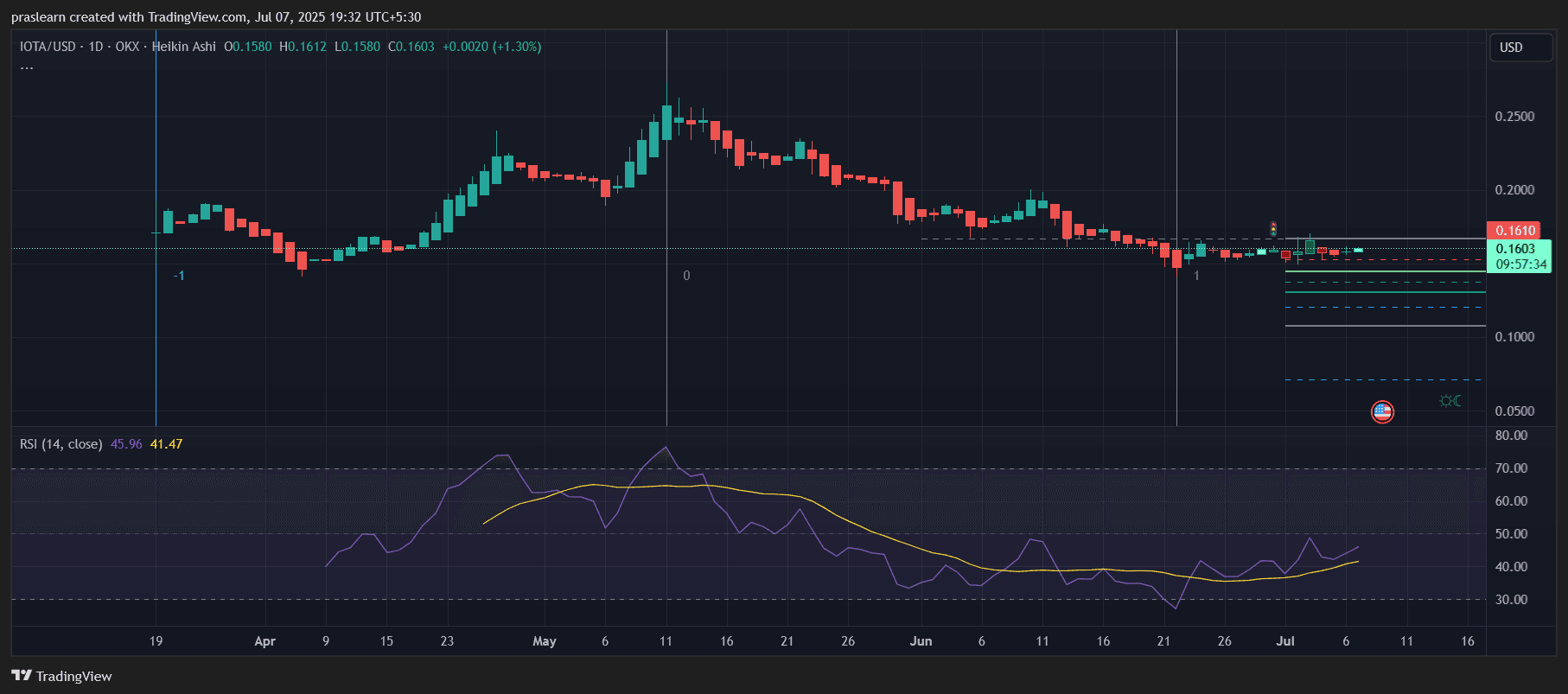

IOTA/USD Daily Chart- TradingView

The chart shows IOTA (IOTA/USD) trading at around $0.1603 , slightly above a local support base. For months, IOTA has been stuck in a steady downtrend, slipping from its May high near $0.23 to recent lows below $0.15.

However, the current candles are starting to form a base, and the Heikin Ashi candles show a tightening range, hinting at an upcoming squeeze. The presence of small-bodied candles indicates indecision, often the calm before a breakout.

Is The RSI Signaling A Reversal?

The RSI (14) is currently around 45.96, with the moving average at 41.47. This is still technically neutral, but the RSI is trending upward from sub-40 levels, showing that bearish momentum is weakening.

Historically, when IOTA’s RSI climbs from below 40 to cross 50, a short-term rally of 15–25% has followed. For instance:

In mid-April, the RSI rose from 38 to 55 → IOTA surged from $0.15 to $0.21 (+40%).

If we project a similar move now, a 20% gain would lift IOTA from $0.16 to $0.192.

Where Are The Key Support And Resistance Zones?

Support:

The immediate support is at $0.15 — a level IOTA tested multiple times in June. If this level holds, buyers may step in to defend it again.

Resistance:

On the upside, the first resistance is near $0.1610, which is exactly where the price is testing now. Breaking above this opens the path toward $0.18 and $0.20, the next horizontal resistances visible on the chart.

What Do Fibonacci Levels Suggest?

Looking at the Fibonacci retracement, if we take the May high ($0.23) and the June low ($0.145):

0.382 level is near $0.18

0.5 level is near $0.1875

0.618 level is around $0.195–$0.20

So, if IOTA can reclaim $0.18, the next Fibonacci targets are clearly visible near $0.19–$0.20.

IOTA Price Prediction: How High Can It Go This Month?

Given the sideways base, rising RSI, and current tight range, a breakout seems likely if Bitcoin and broader crypto sentiment stay neutral or bullish.

Upside scenario:

If momentum picks up and RSI crosses 50, IOTA could test $0.18 within days, then possibly $0.19–$0.20 by month-end — that’s a potential 25% upside from today’s levels.

Downside scenario:

If support at $0.15 breaks, IOTA risks sliding to the next major level near $0.13, which aligns with the extended Fibonacci support.

Should You Watch IOTA Now?

IOTA price is no longer in freefall but hasn’t yet confirmed a reversal. The tight range and improving RSI make it worth watching for a daily close above $0.1610 — this would be an early signal that a short squeeze could unfold.

If you’re bullish, keep an eye on $0.18–$0.20 as realistic short-term targets. For bears, a breakdown below $0.15 could send IOTA to test deeper lows.