Palantir stock has become the market’s favorite kind of story: one where the numbers force investors to change their mind. The PLTR stock price is around $194 today, and it is still trading close to its $207.52 52-week high after a year that rewrote expectations.

When a stock runs like this, the question shifts from “what do they do?” to “what is the market pricing next?” For PLTR stock, the answer sits at the intersection of surging US commercial demand, expanding government programs, rising guidance, and a valuation that now assumes the good news keeps coming.

Key takeaways for PLTR stock price

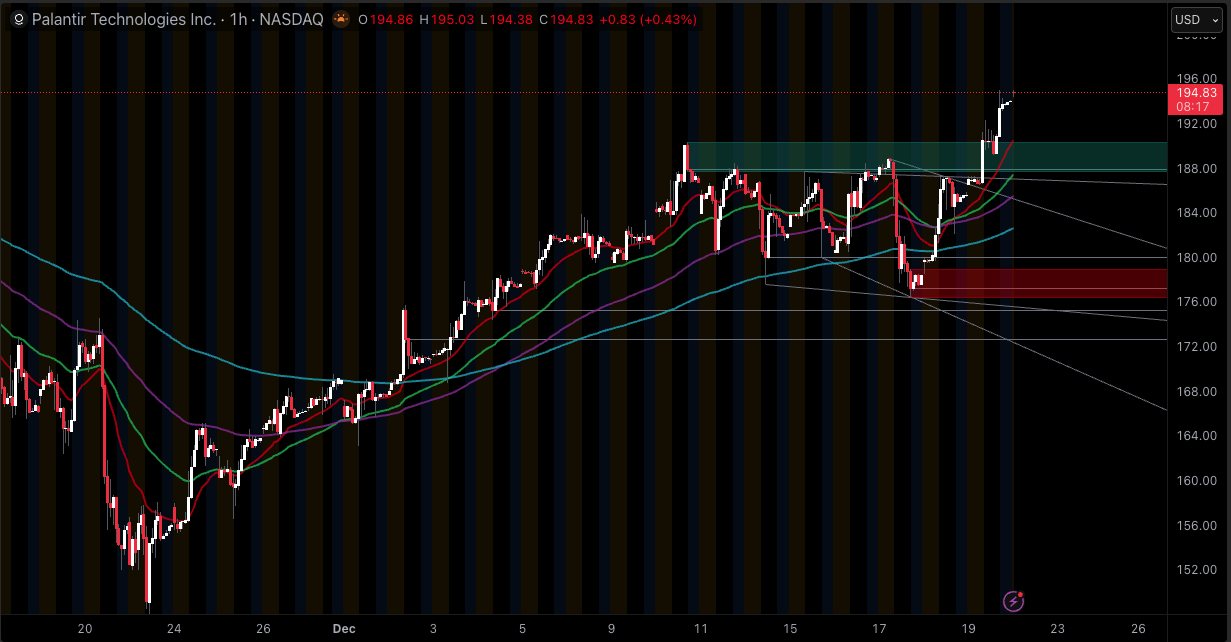

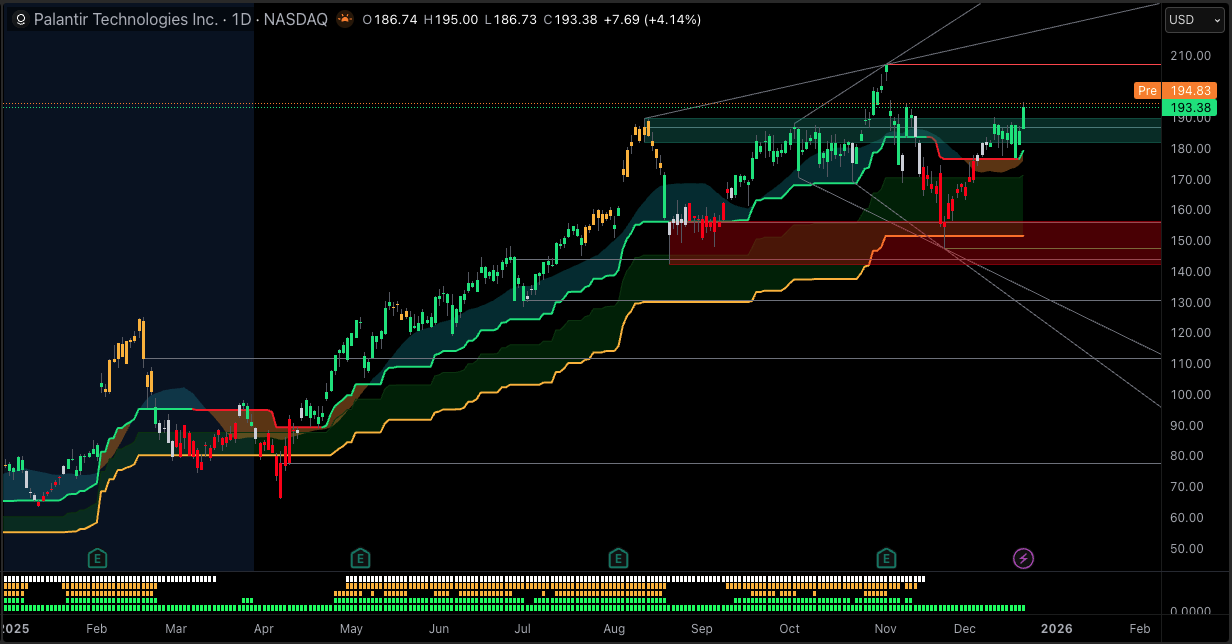

Overall technical bias: Bullish while price holds above the $180 area and stays well above the 200-day trend.

Short-term forecast (next 1-2 weeks): Likely to keep probing $200 and then $207.52 if buyers defend pullbacks.

Medium-term forecast (next 1-3 months): Trend remains constructive, but volatility is elevated, so sharp swings are normal for PLTR.

Long-term forecast (2026): Direction depends on whether US commercial momentum stays strong and whether guidance keeps stepping higher.

Invalidation: The bullish setup weakens on a sustained break below the 50-day moving average region near $180.

Technical Dashboard: PLTR Indicators And Signal

The table below captures what the PLTR stock price is signaling right now, using widely followed daily indicators.

| Indicator / Level | Latest Value | Signal / Comment |

|---|---|---|

| 50-day moving average | $179.93 | Price above MA, short-term uptrend still intact |

| 200-day moving average | $146.93 | Long-term trend remains bullish while price stays above |

| RSI (14, daily) | 65.99 | Momentum is strong, approaching overbought territory |

| MACD (daily) | 1.89 | Positive momentum, trend remains supported |

| ATR (14-day) | 8.31 | High volatility, daily price swings can be large |

| Key support | $179–$180 | Critical area to watch for trend support (50-day MA zone) |

| Key resistance / target | $200, then $207.52 | Psychological resistance followed by the 52-week high |

Why Is The Palantir Stock Going Up?

1) US commercial demand is accelerating, and the market pays for that

The cleanest driver behind the PLTR stock rally is the US commercial business. In Q3 2025, US commercial revenue grew 121% year over year to $397M, with customer count up 65% year over year, and remaining deal value up 199% year over year.

That matters because it changes how investors model the future. Government revenue can be durable, but commercial scaling is what typically creates multi-year compounding when the product becomes embedded across an enterprise.

2) Government demand is expanding into bigger, more strategic programs

PLTR stock has always carried a government premium, but the current cycle is important because programs are getting larger and more structural.

In July 2025, the US Army awarded an Enterprise Agreement framework for future software and data needs.

In December 2025, the US Navy announced a $448M Ship OS investment tied to AI and autonomy adoption across the shipbuilding industrial base, and Palantir’s investor relations described ShipOS as authorizing up to $448M.

These are the kinds of agreements that can anchor multi-year revenue visibility and keep PLTR relevant in national security modernization budgets.

3) Profitability and cash generation are no longer “later,” they are now

A stock can rise on growth alone for a while. It rises for longer when growth comes with operating leverage and cash flow.

In Q3 2025, Palantir reported GAAP EPS of $0.18, GAAP net income of $476M, and adjusted free cash flow of $540M.

The same quarter ended with $6.4B in cash, cash equivalents, and US Treasury securities and no debt.

Those numbers help explain why the PLTR stock price is staying firm even after sharp pullbacks. More investors are willing to hold volatility when the company is producing real cash.

4) Guidance keeps moving higher, and that resets valuation anchors

Markets do not trade last quarter’s numbers. They trade the slope of expectations.

Reuters reported that Palantir guided Q4 revenue to $1.327B–$1.331B, and raised full-year revenue guidance to $4.396B–$4.400B.

That guidance momentum is a major reason PLTR stock has been able to rebound quickly after dips. The market is treating guidance upgrades as confirmation that demand is not fading.

5) Index inclusion and visibility changed the buyer base

Since 2024, PLTR has been pulled deeper into the passive ecosystem.

S&P Dow Jones Indices announced PLTR’s addition to the S&P 500 effective Sept. 23, 2024.

Nasdaq announced PLTR’s addition to the Nasdaq-100 effective prior to market open on Dec. 23, 2024.

Index membership does not guarantee higher prices, but it broadens ownership, increases structural demand through index products, and keeps the stock in front of institutions that previously could not own it.

Valuation: The Part Of The Story PLTR Stock Must Keep “Earning”

The bull case is clear. The risk case is just as clear: PLTR stock is priced for continued execution.

Yahoo’s key statistics show a forward P/E around 192 and a price-to-sales ratio above 125.

That means the market is not paying for “growth improving.” It is paying for “growth staying strong.”

A useful way to think about 2026 is this: the PLTR stock price can keep rising if the company keeps surprising to the upside. If results are merely solid, valuation can compress even if the business is healthy.

PLTR Stock Price Trend: Is The Uptrend Still Healthy?

From a technical standpoint, the uptrend is still intact because the PLTR stock price is trading above both the 50-day ($179.93) and the 200-day ($146.93) moving averages.

Momentum also looks firm:

RSI near 66 suggests strong demand without screaming “extreme blow-off” conditions.

Volatility is high, with 14-day ATR of 8.31, so it is normal to see wide daily ranges and fast reversals.

The bigger message: PLTR stock can stay bullish and still swing hard. That’s not a contradiction. That’s how crowded momentum stocks behave near highs.

Support, Resistance, And Key Price Zones For PLTR Stock Price

Immediate support levels

$186-$187: Recent trading lows have printed in this area, so it’s a near-term reference zone for dip buyers.

$179-$180: The 50-day moving average zone. If PLTR holds here on pullbacks, the uptrend stays structurally clean.

Resistance and upside targets

$200: Big round-number resistance that often attracts profit-taking and short-term hedging.

$207.52: The 52-week high. A clean break and hold above this level is what most trend traders want to see before talking about “price discovery.”

If PLTR stock clears $207.52 and holds, Fibonacci extension markers based on the $63.40-$207.52 52-week range sit around $247 (1.272) and $263 (1.382). Treat these as reference points, not promises.

For context, a survey of analyst estimates shows a high price target of $255, which sits in the same neighborhood as those longer-term technical projections.

Invalidation level

A sustained close below the $179-$180 region would signal the rally is losing traction and the market is shifting from “buy the dip” to “sell the rip.”

PLTR Stock Price Forecast 2026: Scenarios That Match Reality

Bullish scenario

Conditions: PLTR holds above $180, breaks above $207.52, and future quarters keep showing strong US commercial expansion and raised guidance.

What it would look like: New highs, followed by consolidation and continuation moves, with the market increasingly treating PLTR as a long-duration cash flow story rather than a tactical AI trade.

Bearish or pullback scenario

Conditions: A break below $180 with deteriorating momentum, or an earnings cycle where guidance stops improving.

What it would look like: The next major technical reference becomes the 200-day moving average near $147, which is where longer-term investors often reassess.

Sideways scenario

Conditions: Fundamentals stay solid, but valuation caps upside.

What it would look like: PLTR stock price churns in a wide band, roughly $180 to $207, while earnings catch up to the multiple.

What Moves PLTR Stock Price

| Category | Detail |

|---|---|

| What’s driving PLTR stock | U.S. commercial surge — Whether growth stays elevated; It’s the core repricing engine |

| Government durability | Large defense renewals and expansion — Stabilizes revenues through cycles |

| Profitability proof | GAAP margin discipline — Premium valuation needs margin credibility |

| Guidance momentum | Further raises vs flat guidance — The market trades the forward slope |

| Sentiment tailwinds | Analyst tone and policy headlines — Can amplify moves near highs |

Key Catalysts And Risks To Watch In 2026

Catalysts

Next earnings date: Nasdaq currently estimates an earnings report around Feb. 2, 2026, though dates can change.

Commercial conversion: Watch whether remaining deal value keeps turning into recognized revenue.

Government program wins: ShipOS and Army frameworks are big signals, and further expansions would reinforce the bull case.

Risks

Valuation sensitivity: A forward P/E near 192 leaves little room for “good but not great.”

Positioning and sentiment: Institutional ownership is around 60%, and short interest was about 47.42M shares as of late November 2025, which can add fuel to rallies but also increase volatility when narratives turn.

Frequently Asked Questions (FAQ)

1. What is the PLTR stock price today?

The latest quote shows the PLTR stock price is around $194. Prices move quickly during market hours, so check a live quote for the most current level, especially around earnings or major government contract headlines.

2. Why is Palantir stock going up right now?

PLTR stock has been supported by accelerating US commercial growth, strong cash generation, and higher revenue guidance. Recent government modernization programs have also improved sentiment around long-term contract visibility.

3. Is PLTR stock overbought?

Momentum is strong, with RSI (14) near 66, which is close to overbought territory but not an automatic reversal signal. In trending markets, RSI can stay elevated for long stretches, so price behavior around $200 and $180 often matters more.

4. Is PLTR stock overvalued?

It trades at a premium versus many large-cap peers, and multiple reports highlight elevated forward valuation metrics. A premium can be justified if growth and guidance keep surprising, but it also raises downside risk if results disappoint.

5. What are the key support and resistance levels for PLTR stock price?

Near-term support is around $186-$187, with a more important trend level near $179-$180 (the 50-day area). Resistance is typically $200, then $207.52, the 52-week high.

6. What should investors watch for Palantir stock in 2026?

Focus on whether US commercial momentum stays strong and whether management keeps raising guidance. Also track major government programs like ShipOS and Army enterprise frameworks, because they can influence multi-year revenue visibility and investor confidence.

Conclusion

Palantir stock is going up because the market is responding to measurable changes: explosive US commercial growth, expanding government programs, strong profitability and cash generation, and guidance that keeps moving higher.

For 2026, the core tension is simple. The trend is bullish, but the valuation demands continued upside surprises. If PLTR keeps delivering, the rally can stay alive. If the numbers stop improving, the stock can correct even with a healthy business underneath.