BTC and ETH markets absorbed the annual options expiry on Deribit. The event closed with record $28B in notional value.

Deribit options reached the peak day of expiry, combining the monthly, quarterly, and yearly event. Historically, large-scale options repositioning has led to market volatility. Deribit is also closely watched for a hint on trader sentiment and the potential to determine the future direction of BTC.

On Friday, 267,000 BTC options expire, with a put-to-call ratio of 0.35. The notional value of yearly BTC options is a total of $23.6B, with maximum pain above current prices at $95,000.

On the Ethereum market, a total of 1.28M options expired, with a nominal value of $3.71B and maximum pain at $3,100.

Deribit marks the largest options expiry in history

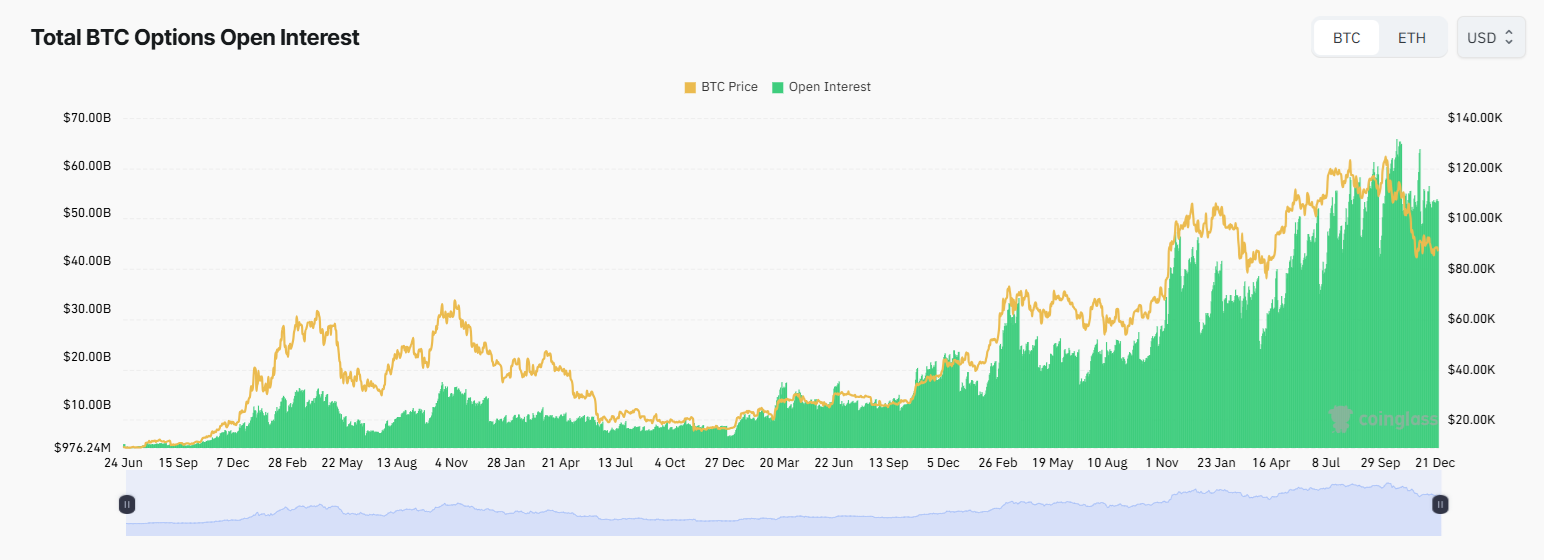

The options market in 2025 gained influence, as a way to protect from the downside to BTC trading. The yearly event with $28B in total options is the largest in trading history, reflecting the increasing scale of cryptocurrency activity and the effect of institutions and whales.

The event will affect more than half the open options positions on Deribit. Ahead of the settlement, trading volumes also rose due to repositioning. After the settlement, March options are the most influential, accumulating 30% of open interest.

The options expire at a time when the crypto fear and greed index is at 27 points, slightly up from last week’s 21 points. The options accumulation followed an increasingly volatile market for BTC and ETH.

The leading coins are also pressured by multiple factors, including slow trading during the year-end period, as well as a general loss of positive sentiment. The fourth quarter of 2025 is also one of the worst in crypto history, despite expectations for a year in the green. BTC reached new price records, but quickly broke down, following unexpected market volatility.

As a result, the options market reflected seller strategies and attempts to protect from a bear market downside.

Deribit options point to ongoing fears of BTC dip

After repositioning, Deribit options are signaling further expectations of a downside for BTC. During previous options expiry events, most Deribit traders set up put options at $85,000 to $80,000.

Currently, the most numerous options by strike price are at $75,000, with high levels still available at $80,000 and $85,000. Call options start growing above $90,000, where traders are signaling a return to a potential bull market.

BTC traded at $88,701.51, remaining in a narrow range for the past month. Despite this, any attempt to break out above $90,000 has invited more selling and long liquidations. The yearly options expiry is also expected to bring more volatility, with some price range anomalies during the low-volume trading period.

Get $50 free to trade crypto when you sign up to Bybit now