Banks have mostly stayed on the sidelines when it comes to holding XRP directly, even as interest in digital assets continues to increase. That hesitation has not been due to a lack of utility or demand but to strict regulatory capital rules that made holding XRP economically impractical for regulated institutions.

However, a small adjustment in how XRP is treated under global banking rules could remove that barrier and change how banks interact with the cryptocurrency.

Why Banks Can’t Hold XRP

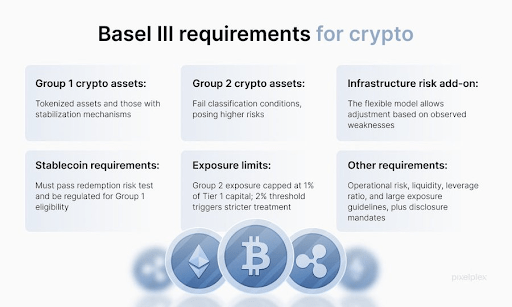

The main obstacle preventing banks from holding XRP has been its treatment under the global banking framework known as Basel III. Basel III is an international regulatory framework developed after the 2008 financial crisis that introduces higher quality and quantity of capital requirements in the international banking sector.

Right now, XRP currently falls into the Type 2 crypto exposure under Basel III, which is set up with rules for assets that pose higher risks. Under these rules, most cryptocurrencies, including XRP, fall into a high-risk category that carries a punitive capital requirement. Banks are required to apply a 1,250% risk weight to such assets, implying they must set aside far more capital than the value of the XRP itself.

This means that under the Basel III framework, for every $1 of XRP exposure, a bank must hold $12.50 in capital. This dynamic was recently explained by a crypto commentator with the name Stern Drew on the social media platform X.

In a post on X, Drew explained that this capital inefficiency alone accounts for years of institutional hesitation. The issue has not been demand nor technology, but the regulatory capital treatment that made holding XRP irrational from a balance sheet perspective.

The Regulatory Inflection Point

The conversation around XRP’s regulatory status is becoming increasingly important to its long-term outlook. Interestingly, Drew’s analysis goes further by pointing to what he describes as an inflection point that markets may be overlooking. Now that legal and regulatory clarity surrounding cryptocurrencies is improving, XRP could be reclassified into a lower-risk category under Basel III.

The endgame is that XRP is on a clear path to becoming a Tier-1 digital asset for global institutions, which is mostly for tokenized traditional assets and stablecoins with strong mechanisms. If that reclassification occurs, the economics will change immediately. XRP would become acceptable for direct balance sheet exposure, allowing banks to custody, deploy, and settle using the asset without the need of excessive capital.

This is not a discussion about short-term price movements but about capital mechanics that determine whether large pools of institutional money can participate in holding XRP at all. In this case, liquidity provisioning of XRP by banks would change from off-balance-sheet usage to direct institutional ownership.