Hedera Price is trading around the $0.11 area, and tightening ranges, equal momentum, and stabilizing participation is indicating that the market is about to make its next big move after a long period of consolidation.

HBAR Volatility Eases as Price Settles Into Range Formation

Analysis of the token on the 1-hour time frame indicates that HBAR/USD is shifting to a period of sharp volatility to a recognized consolidation structure.

After a rather original drop, price rebound and headed towards the territory between the $0.115-$0.116 mark, at which point sellers’ pressure appeared. This zone was some sort of temporary resistance, and the rejection resulted in sideways movement.

Source: Open Interest

The coin has since then built higher lows and has not been able to build sustained higher highs with price stabilizing at around $0.112. The market structure has not yet gone out of the range between the support of the market at $0.108 and its resistance at $0.115.

HBAR Holds Between $0.108 and $0.113 as Buyers Defend Key Levels

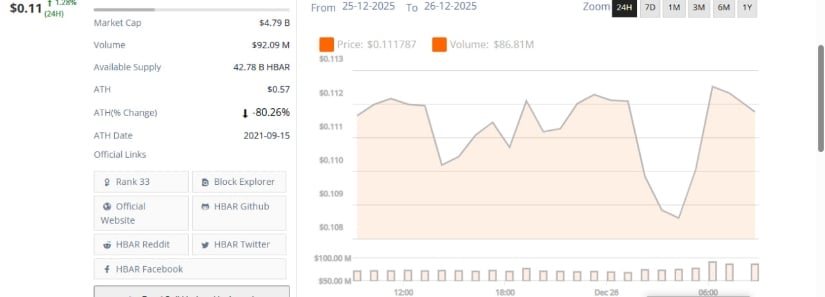

According to Hedera Price, the 24 hour chart shows that the day was relatively stable and there was moderate intraday volatility.The token was seen trading mostly in the range of $0.108-$0.113, which supports the general trend of consolidation. The initial gains were met by a regulated backlash which probed the lower limit of the range at about $0.109.

Source: BraveNewCoin

The buyer reaction was successful at this level and a recovery was initiated towards the high zone of around $0.112-$113. The volume trends were maintained all through the session to a significant degree, and a significant increase was observed in the rebound period. This implies strategic purchasing interest and not panic buying.

The market capitalization is close to $4.79 billion meaning no drastic capital changes. Although it is trading over 80% below all-time high, recent price action indicates stabilization and not increased downside activity.

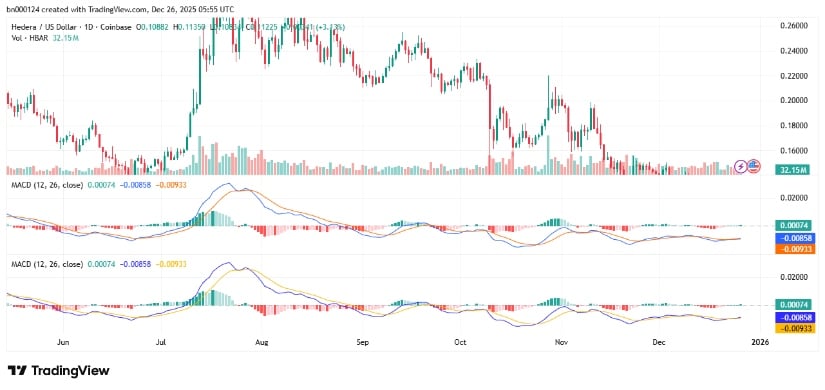

HBAR Trades Below $0.26 as Daily Downtrend Shows Signs of Stabilization

The token in the context of a daily time frame, is still set in a larger bearish context, with HBAR/USD trading under the previous distribution highs at around the $0.25-$0.26 range.

Price action has been characterizing lower highs and lows since August, which validates the persistence of downside force and minimal follow-throughs by the bulls.

Source: TradingView

The recent consolidation at the $0.15-$0.16 level indicates that the pace of the bearish momentum is starting to decelerate.

Reduced volume represents the decreasing participation and increasing indecision, whereas MACD is lower than the zero line and the histogram is flattening, which shows the deteriorating selling force.

The main resistance lies between $0.18 and $0.20 and $0.15 remains a powerful structural support of the token models.