XRP price prediction analysis is once again gaining attention as the token trades at $1.87, posting a mild +0.17% gain over the last 24 hours while still struggling to recover from a sharp multi-month decline.

The recent move comes after XRP lost more than 32% over the past 90 days, a drawdown that erased much of the momentum built earlier in the year. Trading activity has increased alongside this stabilization phase, and XRP now holds a $113.46 billion market cap, maintaining its position as the fifth-largest cryptocurrency by valuation.

At the same time, capital rotation toward early-stage crypto projects such as Bitcoin Hyper is accelerating, reflecting shifting risk appetite across the market.

XRP Price Performance Shows Stabilization, Not Reversal

Despite the slight daily recovery, XRP remains under visible pressure across higher time frames. Over the last 30 days, the price has declined 14.12%, while the 60-day loss sits at 28.48%, confirming a sustained bearish structure rather than a temporary pullback.

XRP’s current trading range between $1.825 and $1.885 reflects compression rather than expansion, suggesting traders are waiting for a clearer directional signal.

From a liquidity perspective, XRP’s 24-hour trading volume of $2.01 billion, up more than 30%, indicates renewed interest, but not aggressive accumulation.

The volume-to-market-cap ratio of 1.77% supports this view, showing participation without conviction. XRP also remains far below its all-time high of $3.84, meaning the asset is still operating in recovery mode rather than a breakout phase.

XRP Price Prediction Models Favor Gradual Long-Term Growth

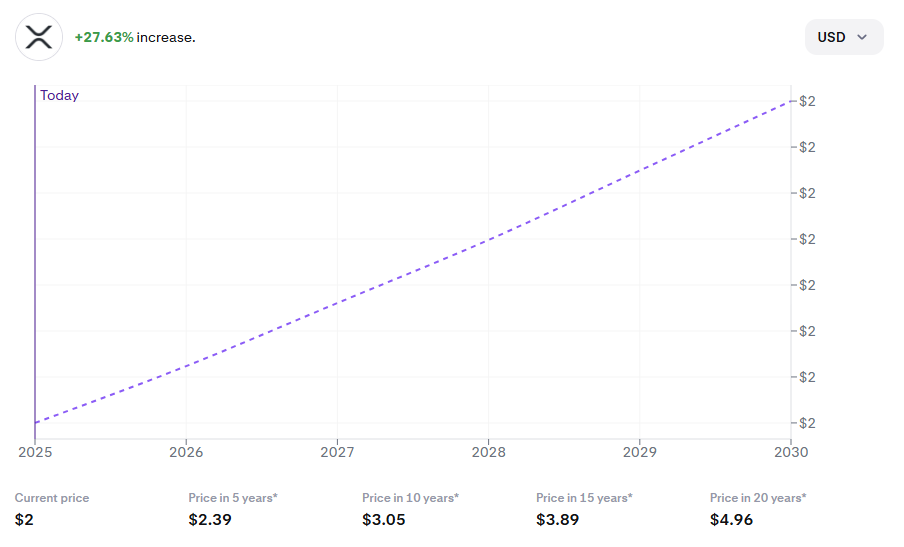

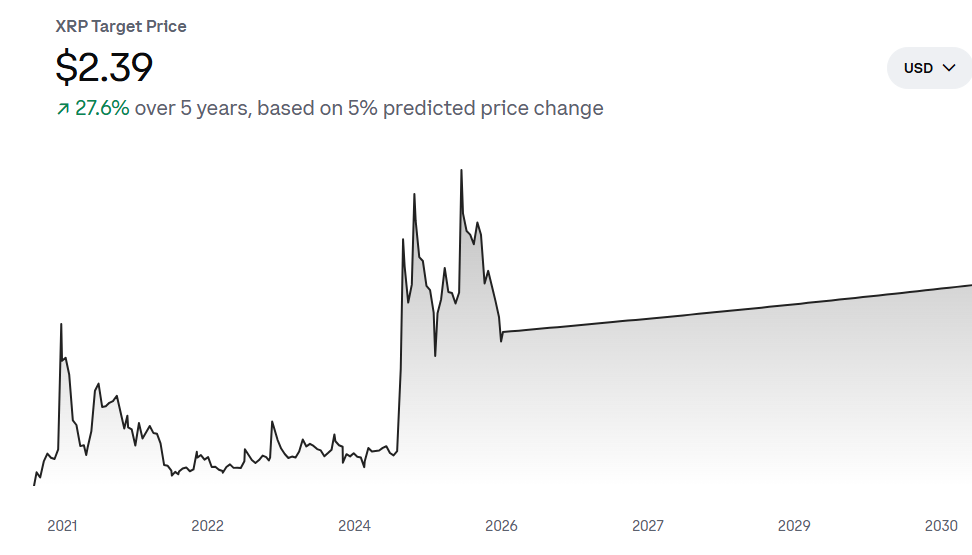

Most mainstream XRP price prediction models assume conservative growth rather than exponential appreciation. Based on long-term compounding estimates around 5% annually, projections place XRP near $1.96 in 2026 and approximately $2.39 by 2030. Further out, forecasts extend to $3.05 by 2035 and roughly $3.9 to $4.1 between 2040 and 2041.

These projections suggest XRP could more than double from current levels over a 15-year horizon, but the path would likely be slow and dependent on broader adoption trends.

Unlike earlier market cycles where speculation alone drove massive price swings, XRP’s future performance appears tied to infrastructure usage, regulatory clarity, and sustained institutional participation.

Extreme XRP Price Predictions Spark Debate Across Crypto Media

Adding fuel to the discussion, a viral analysis from Korean researcher YoungHoon Kim recently suggested XRP could reach $1,000 within the next decade under extreme macroeconomic conditions.

The claim gained traction after being shared across social platforms, largely due to Kim’s large following and the bold nature of the forecast.

From a valuation standpoint, such an XRP price prediction would require XRP’s market capitalization to rise into the tens of trillions of dollars, exceeding not only the total crypto market but also rivaling global monetary aggregates.

As a result, most analysts view the $1,000 target as a theoretical scenario rather than a realistic projection. Still, the discussion highlights how sentiment-driven narratives can briefly influence attention even when fundamentals do not support them.

Why Bitcoin Hyper Is Entering the XRP Conversation

As XRP consolidates, attention is increasingly shifting toward early-stage crypto assets with asymmetric upside. Bitcoin Hyper has emerged as one of the most closely watched presale tokens, raising nearly $30 million as it approaches its next price increase.

Unlike XRP, which already carries a nine-figure market cap, Bitcoin Hyper is still priced at $0.013485, offering significantly lower entry exposure.

The appeal lies in structural differences. Bitcoin Hyper’s presale model introduces staged pricing increases that create built-in upward pressure, while XRP’s growth depends on long-term adoption and macro conditions.

For traders who missed early XRP accumulation phases years ago, Bitcoin Hyper represents a different risk profile entirely, centered on early participation rather than recovery.