XRP is navigating a critical consolidation phase, as technical momentum indicators show early stabilization, and evolving liquidity patterns are reshaping expectations for the asset’s next directional move.

At the time of writing, XRP price today is hovering near the $1.85 level, trading beneath a key resistance zone that analysts say could determine whether the market transitions from continued consolidation into a clearer trend.

XRP Chart Shows RSI Bullish Divergence Below Key Resistance

Technical analysts are closely monitoring XRP’s daily chart, where early signs of momentum divergence have emerged. ChartNerd, a technical analyst on X, highlighted that XRP is forming lower price lows while the Relative Strength Index (RSI) prints higher lows, a pattern commonly interpreted as bullish divergence.

XRP price nears $1.92 resistance as bullish RSI divergence signals potential breakout. Source: @ChartNerdTA via X

“The Daily 20 EMA at $1.92 remains the key imminent resistance for the bulls to step in and break during this bullish divergence build,” ChartNerd noted.

The $1.92 level, which aligns with the 20-day exponential moving average, has consistently capped upside attempts in recent sessions. A sustained move above this zone would likely indicate improving short-term momentum. However, XRP remains technically range-bound for now, trading below a descending trendline that continues to define the broader structure.

Historically, XRP has printed multiple bullish RSI divergences during extended consolidation phases that failed to produce sustained breakouts without accompanying volume expansion. This suggests that momentum signals alone may be insufficient without confirmation from price and liquidity.

XRP ETFs and Declining Exchange Supply

Beyond technical indicators, longer-term attention has turned to supply dynamics linked to institutional products. Some analysts suggest that XRP-linked exchange-traded products, including regional ETPs rather than U.S.-listed spot ETFs, may be contributing to reduced exchange balances.

XRP supply tightens as ETFs absorb 750M, signaling a potential 2026 breakout under Clarity Act guidance. Source: @unknowDLT via X

An analyst known as unknowDLT commented on recent supply trends: “XRP ETFs are absorbing supply fast. With only ~1.5B XRP left on exchanges and ~750M absorbed in weeks, a supply shock is likely by early 2026.”

While such claims highlight shifting liquidity conditions, publicly available data does not yet isolate ETF-driven flows from broader custody movements, including transfers to cold storage or custodial platforms. As a result, the precise impact of ETF-related demand remains difficult to quantify.

XRP Price Outlook Remains Technically Defined

From a trading perspective, analysts emphasize that XRP must reclaim nearby resistance levels before bullish scenarios gain confirmation. TradingView analyst Reazosman summarized the near-term outlook: “First needs to break 1.86–1.855… If trade above, I’m in. If not, I think it’s not ready.”

XRP is at $1.85, with momentum potentially pushing targets from $2.00 up to $3.20 by year-end. Source: Reazosman on TradingView

This perspective reflects a broader market stance. XRP remains in consolidation mode, with confirmation levels clearly defined. For short-term traders, a decisive reclaim of $1.92 would act as the primary invalidation level for bearish structure. Longer-term holders, however, may place less weight on daily RSI signals and more emphasis on sustained changes in liquidity, regulation, and real-world usage.

Final Thoughts

XRP continues to trade below a key technical ceiling, with price action shaped by a mix of short-term chart signals and evolving supply conditions. While bullish RSI divergence suggests improving momentum beneath the surface, historical context indicates that such signals require confirmation from volume and price structure to remain reliable.

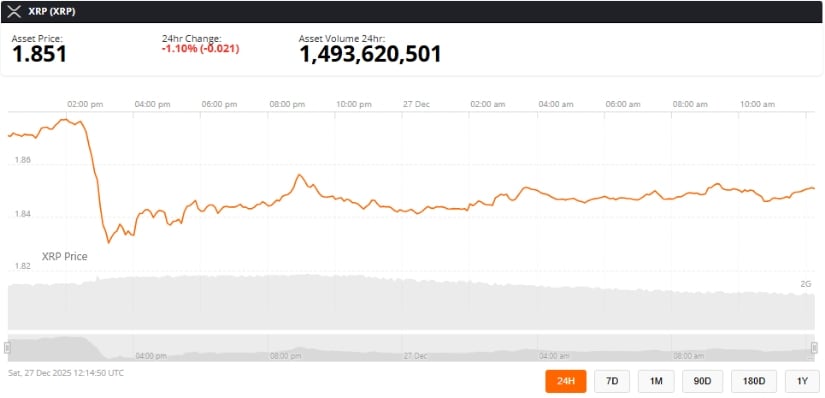

XRP was trading at around 1.85, down 1.10% in the last 24 hours at press time. Source: XRP price via Brave New Coin

At the same time, declining exchange balances and growing institutional narratives point to longer-term shifts rather than immediate catalysts. Until XRP decisively reclaims resistance, the market remains in a wait-and-see phase, with both traders and long-term observers watching closely to see whether current conditions resolve into a breakout or an extended period of consolidation.