Bitcoin is holding steady within a descending range, showing little directional conviction, while several altcoins are quietly building strength. As the market consolidates, these smaller assets could hint at early upside moves before BTC breaks out.

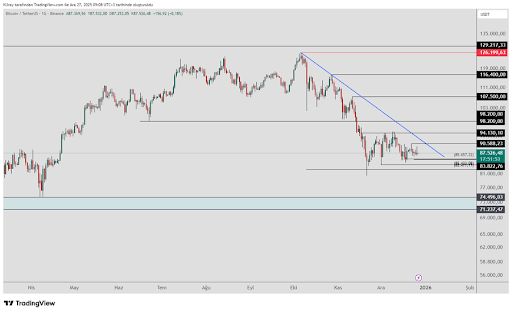

Key Resistance In Focus: $90,588 And The Descending Trendline

According to a recent update by Kamile Uray, there are no changes in the key levels being tracked on the daily chart, as the focus remains on the $90,588 level and the descending blue trendline. Unless BTC can close above these levels, the current decline may continue. Any upward moves below the blue descending trend are considered corrective rather than a trend reversal.

The first support zone to monitor during the decline is between $83,822 and $82,477. A daily close below $82,477 would signal a continuation of the downtrend and could open the door toward the $74,496–$71,237 zone, marked by the blue box. This lower zone is viewed as a strong support area where buyers may step in.

Thus, a clear reversal confirmation is key before considering any significant upward move. Once confirmed, a rally toward the blue descending trendline could follow, testing resistance levels along the way.

For the uptrend to resume decisively, BTC would need to close above $90,588 and break the descending resistance. Meanwhile, a daily close above $94,130 would confirm that the blue descending trend has been broken, potentially signaling a shift to sustained bullish momentum.

LTF Moves Show Less Impulse, But Structure Holds

Crypto analyst The Penguin noted that the lower time frame (LTF) is showing slightly less impulsive action, though the overall count remains unchanged. The recent moves on the LTF appear more like noise and do not affect the broader wave count, and confidence in a leading diagonal for wave 1 remains intact.

Putting Elliott Wave analysis aside for a moment and leaning on standard technical analysis, BTC is clearly respecting a defined range. As a result, a minor deviation toward the 0.886 level marked on the chart is being closely watched as a potential entry point.

Bullish confirmation will come if BTC manages to close and hold above $90,500, which would invalidate the current bearish scenario and signal the potential for a more sustained upward trend. Until then, the short-term fluctuations are considered normal noise, especially with the yearly open approaching.

On the altcoin side, momentum appears to be holding, suggesting potential upside. Outperformance is already visible in altcoins like XPL, indicating that while BTC consolidates, some alts are starting to push higher.