Since the short squeeze in mid-December, Bitcoin has yet to make any significant price gain, facing multiple rejections at the $90,000 price zone. The maiden cryptocurrency is presently consolidating within the $87,000, while investors patiently anticipate a clear market direction. According to pseudonymous analyst Sunny Mom, recent on-chain analysis suggests that bearish sentiment will remain dominant in the coming months following the initial extended correction in October and November.

Why Rising Short-Term Bitcoin Supply Is Flashing A Rare Bearish Signal

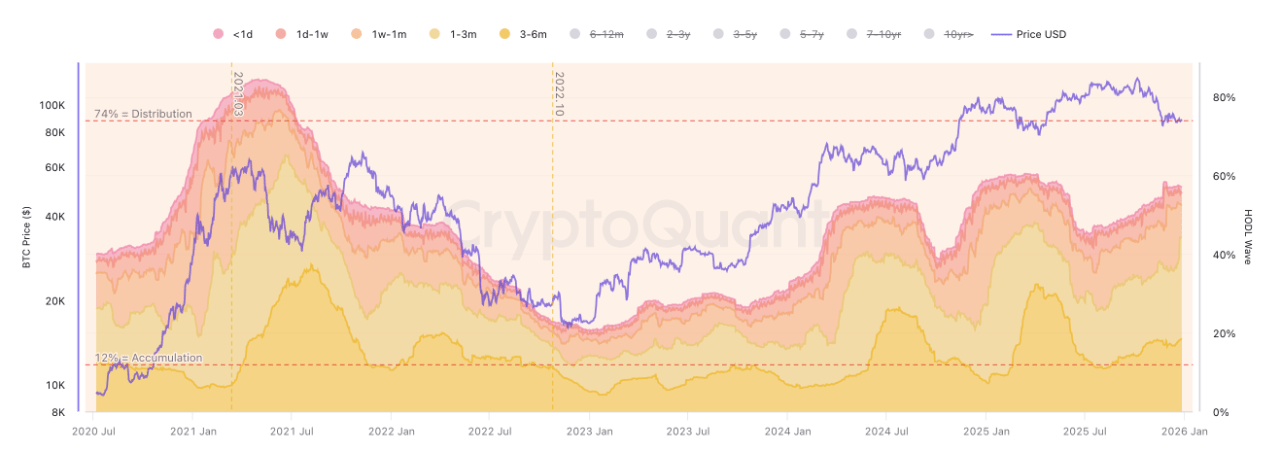

In a QuickTake post on December 27, Sunny Mom draws attention to the BTC HODL waves, which show the rising share of short-term holders coinciding with falling prices, flipping a metric that typically supports bullish narratives. Historically, an increase in short-term holder (STH) supply, coins held for less than 155 days, suggests fresh capital is entering the market ahead of sustained rallies. However, the analyst described the current move as “passive bag-holding” rather than signaling “new blood.”

This is because investors who bought during the $120,000 rally in October, driven by FOMO, alongside dip buyers in November, now sit on unrealized losses, thereby creating a price setup that alters market behavior. Sunny Mom explains that each relief rally is met with selling pressure as these holders attempt to exit at breakeven, effectively turning the expanding STH cohort into a ceiling rather than a floor. Therefore, price rebounds struggle to gain traction.

The renowned analyst explains that the market is witnessing an emotional toll that is growing visibly on-chain. Notably, there have been repeated spikes in Net Realized Loss (NRL) since October liquidations, suggesting that capitulation is underway, with investors locking in losses after months of endurance. Sunny Mom describes the process as a “dull knife” finally cutting deep, an indication that weaker hands are being forced out, not through a single crash, but through prolonged exhaustion.

Bitcoin In Demand Vacuum As Likely Fall Below $80,000 Remains Active

In further analysis, Mom attributes the current bearish setup to a demand vacuum. The market expert explains that exchange reserves are sitting near multi-year lows, signaling limited immediate sell-side liquidity. At the same time, long-term holders (LTHs) show little interest in distributing coins, reinforcing the view that conviction capital remains intact.

Therefore, the problem lies on the demand side. With macro uncertainty still elevated, new buyers appear hesitant to step in, creating a demand vacuum. This also creates thin order books, meaning even modest sell pressure can push prices sharply lower.

While some market watchers target a potential recovery in Q1 2026, citing expectations of rate cuts and improved global liquidity. Mom predicts Bitcoin may need a “final shakeout” to resolve the imbalance and reset the market for a bullish breakout. The analyst points to a potential move below $80,000 as a liquidity hunt that could flush remaining weak hands and allow larger holders to reaccumulate.