Popular market analyst KillaXBT has shared a bold prediction of a Bitcoin super cycle. After multiple failed “super cycle” calls by other market enthusiasts, the anonymous market expert argues that Bitcoin’s defining breakout has yet to begin, highlighting a key market condition.

Metal Market Downtrend, Bitcoin Supertrend

According to KillaXBT in an X post on December 27, the real super cycle will only emerge when capital decisively rotates away from precious metals and into Bitcoin, marking a generational shift rather than a typical crypto rally. Unlike past “premature” super-cycle narratives, driven more by optimism, the analyst references a budding price structure similarity that indicates a massive Bitcoin price rally ahead.

Notably, interest in precious metals is soaring after gold and silver recently reached new ATH prices of $4,500 and $77, respectively. Similar to most analysts, KillaXBT anticipates these precious metals will eventually slip into a multi-year downtrend that will force investors to explore other havens against inflation. In particular, the analyst expects older generations to remain anchored in gold, while a new cohort of capital increasingly chooses Bitcoin as its preferred store of value. As metals underperform, a scarce Bitcoin is tipped to record an unprecedented demand.

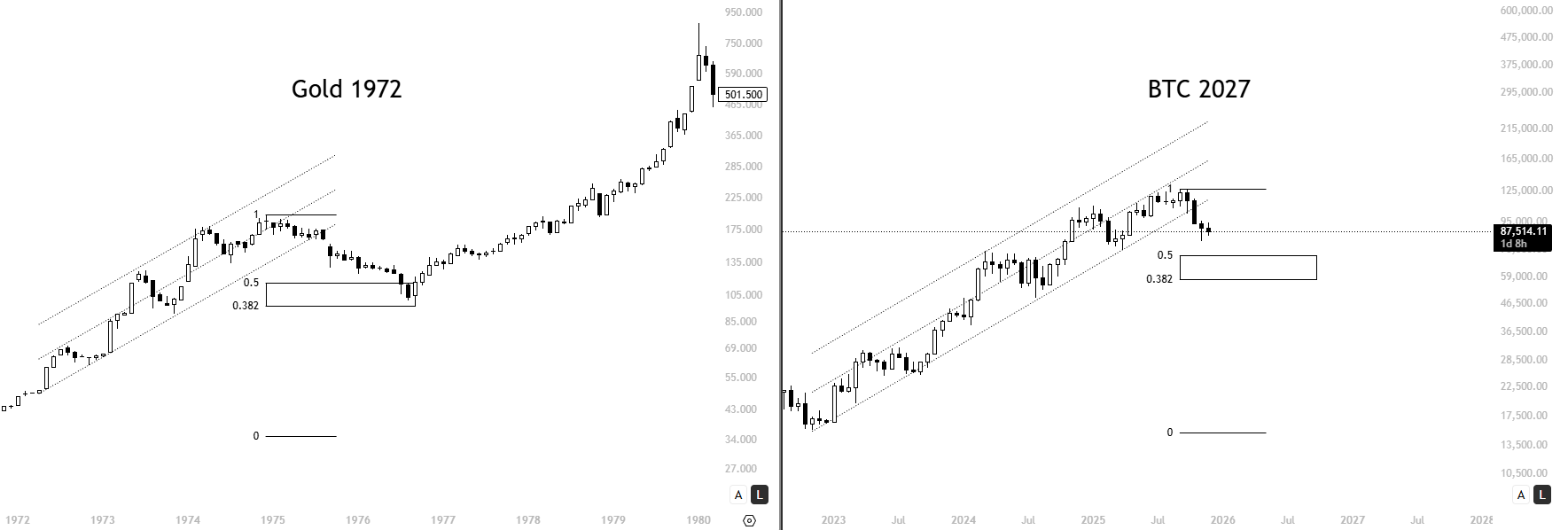

The analyst draws a historical parallel between gold in early 1972 and Bitcoin’s current position heading into 2027. In this period, Gold entered a powerful multi-year run as capital sought protection from inflation and currency debasement. KillaXBT argues Bitcoin is approaching a similar inflection point and is set to outperform every major asset class in the next cycle.

Interestingly, gold, long considered the ultimate store of value, is currently valued at an estimated $31.7 trillion in market cap value. Bitcoin, by contrast, sits near $1.83 trillion. KillaXBT explains that even at a Bitcoin price of $200,000, the network’s market cap would rise to roughly $5 trillion, still about six times smaller than gold, highlighting how early Bitcoin remains in the global asset hierarchy.

This Is The Last Sub $100,000 Bear Market – Analyst

In concluding notes, KillaXBT states that skepticism has accompanied every major Bitcoin rally, consistently peaking just before large upside moves. In past cycles, critics pointed to regulation, environmental concerns, and volatility risks. Today, the fear narrative has shifted to emerging technologies such as artificial intelligence and quantum computing.

The analyst suggests that these concerns may once again pressure investors out of the market prematurely. However, KillaXBT is taking a bullish stance as they believe the current phase could represent the final prolonged bear market in which Bitcoin trades below $100,000. However, they warn that investors should expect the supercycle boom in 2027, as 2026 is likely to be a bearish period.