Zcash price is up about 15% over the weekend, pushing toward its next key resistance. The move has sparked discussion about whether the next leg higher is already forming or if a short-term cooldown might occur first.

Two momentum signals and recent whale positioning hint that a pullback could come before any breakout attempt.

Momentum Signals Hint at Cooling Before a Breakout

On the 12-hour chart, ZEC made a lower high between November 16 and November 27, while the RSI (Relative Strength Index) pushed slightly higher. The RSI measures momentum, and this mismatch is a hidden bearish divergence. It often appears before short-term pullbacks.

It tells you buyers pushed momentum up, but sellers kept price capped, so demand isn’t strong enough yet to confirm the move.

RSI Divergence Could Cause A Pullback: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A second signal comes from the Money Flow Index (MFI), which shows retail dip-buying strength. Between December 12 and December 28, the ZEC price increased, while the MFI trended downward.

This tells us buyers chased price, but demand did not keep up. The MFI is rising again, but it needs to clear 65 to confirm momentum is back.

ZEC Dip Buying Slows Down: TradingView

These chart signals only matter if on-chain positioning agrees, and the holder data does point in the same cautious direction.

On-Chain Positioning Shows Whales Reducing Exposure

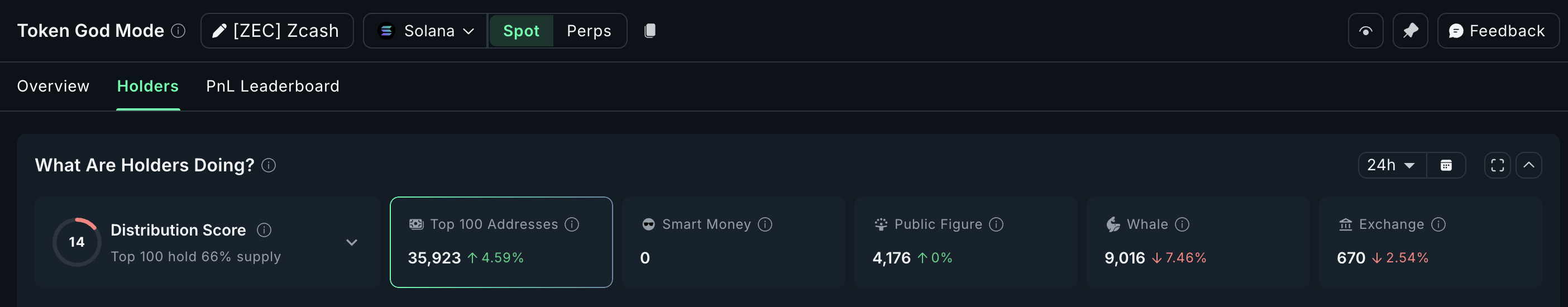

Zcash has notable holder activity on the Solana chain. That is where whale balances dropped by 7.46% over the past 24 hours.

At today’s price, near $518, that reduction signals that some larger holders may be locking in profits or waiting for lower entry points. The top 100 addresses (mega whales) still increased their holdings by 4.59%, indicating that long-term sentiment has not changed.

Zcash Whales Dump: Nansen

This mix shows a reasonable pullback setup, not a breakdown for ZEC. Whales trimming while larger vaults accumulate suggests short-term caution with longer-term confidence still intact.

$527 Remains the Key Trigger for the Next Zcash Rally

Zcash trades near $518. The next trigger sits just above at $527. A 12-hour close above that would confirm strength and could open room toward $633, which is roughly a 22% move from current prices. If buyers defend momentum past $633, $737 becomes the next high-confidence target.

The pullback map is just as clear. First support sits near $435. Losing $435 exposes $370, and failure there can extend into deeper volatility if the broader market weakens.

With year-end liquidity still thin, both sides need confirmation before traders commit.

Zcash Price Analysis: TradingView

For now, the simple line is this: $527 protects the bullish setup. $435 protects buyers from a deeper retrace.