Meme coins remain one of the most sensitive categories in crypto right now. Liquidity is thin (courtesy year-end), and even small shifts in supply or treasury activity are starting to move prices faster than usual. If you are looking for meme coins to watch in January 2026, three names stand out for very different reasons

One is facing rising sell pressure, one is holding strength despite volatility, and one shows early signs of a possible turnaround.

Pump.fun (PUMP)

Pump is one of the first meme coins to watch in January 2026 because of a major on-chain red flag. Recent data shows the team has transferred another $50 million from ICO proceeds to Kraken.

Since mid-November, over $600 million has been transferred to the exchange.

This appears to be treasury extraction rather than simple treasury management, and it raises concerns that liquidity may be drying up.

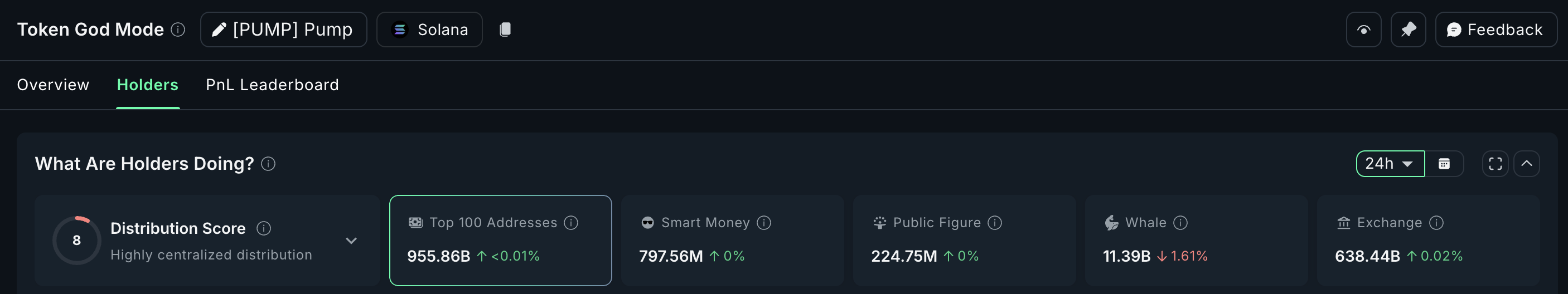

This selling pressure is visible on-chain. Over the past 24 hours, whales have reduced holdings by 1.61%, which confirms that large buyers are not supporting the price during this period.

The distribution score also indicates a high concentration among top holders, which can increase volatility if further selling continues.

PUMP Whale Analysis: Nansen

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The price chart adds to the caution. PUMP is trading near $0.00188 and sits inside a possible bear flag.

PUMP Price Chart: TradingView

A break under $0.00179 could trigger a deeper move toward $0.00146, then $0.00100, and possibly $0.00088 if momentum collapses. Upside invalidation sits at $0.00247, with bullish confirmation only above $0.00339.

PUMP Price Analysis: TradingView

For now, PUMP is a meme coin to watch, not necessarily a buy. The next trend depends on whether buyers can stop the selling pressure and reclaim $0.00203 with strength (the first key resistance).

Pippin (PIPPIN)

PIPPIN is one of the few meme coins holding ground while the broader market stays range-bound. It is down about 7% today, but it is still up around 4.6% over the past seven days. That makes PIPPIN one of the few meme coins to watch in 2026 because the short-term weakness has not broken the weekly structure.

On the daily chart, PIPPIN has flipped $0.46 from support to resistance and is currently trading near $0.43. If PIPPIN reclaims $0.46, it can attempt a move toward $0.55.

A clean break above $0.55 strengthens the setup and opens a path toward $0.71, which was the previous local high. That would also place PIPPIN near short-term price discovery, at least for the January range.

PIPPIN Price Analysis: TradingView

The CMF (Chaikin Money Flow), which tracks whether big money is flowing in or out, has turned positive for the first time since November 30. When CMF last crossed zero on November 30, PIPPIN rallied almost 880%. CMF climbing above zero again suggests inflows and early strength, even while price tests resistance.

This creates a simple narrative for January. If PIPPIN holds above $0.43 and reclaims $0.46, momentum builds toward $0.55 and possibly $0.71. If it fails, the bias returns to neutral. The PIPPIN price action turns bearish if it falls below $0.30.

Dogecoin (DOGE)

Dogecoin is down about 18% over the past 30 days, making it one of the weakest large meme coins in the market. Despite the drawdown, it still ranks as a key pick in meme coins to watch in January 2026, as on-chain behavior and price structure hint at a possible change.

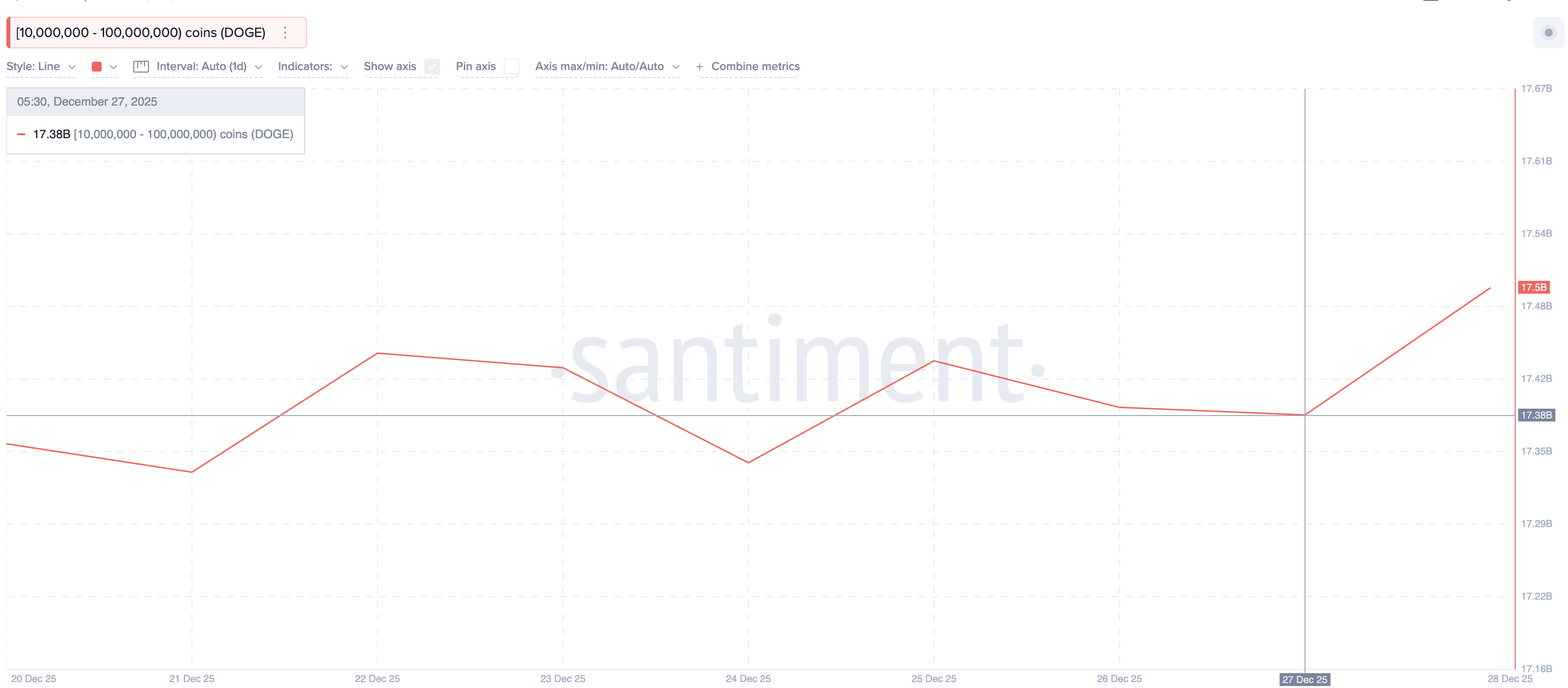

Whales holding 10 million to 100 million DOGE have started buying again. Their supply climbed from 17.38 billion to 17.50 billion on December 27.

At the current price, that is a rough addition of 14 million. That level of accumulation can matter because it indicates that large players are positioning themselves early rather than selling into weakness. If they continue to increase holdings, it can reduce selling pressure and stabilize local support.

DOGE Whale Buying Resumes: Santiment

The DOGE price chart supports that idea for now. Between November 21 and December 26, DOGE reached a lower low, while the RSI (Relative Strength Index, a momentum indicator that measures overbought and oversold conditions) reached a higher low.

This is called a bullish divergence, and it often signals a reversal when it appears on a large timeframe like the daily chart. That divergence formed exactly as DOGE tested support at $0.120 and bounced.

If $0.120 holds, the structure stays valid. The next test is $0.141. A close above that level confirms the breakout from the divergence and opens a path toward $0.154 and possibly $0.164. These are the first steps for any recovery attempt in January 2026.

DOGE Price Analysis: TradingView

The risk is simple. If $0.120 fails, whales may flip back to selling. That would weaken the bullish divergence and reset the idea that DOGE can lead any rebound. Below $0.120, the setup weakens, and meme-coin leadership rotates elsewhere until strength returns.